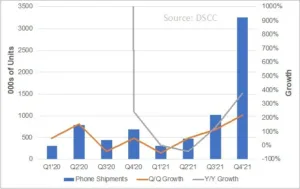

DSCC expects to see a significant surge in foldable smartphone shipments from August with record months for shipments each month from August to December. In fact, Q4’21 foldable/rollable smartphone shipments are expected to be larger than Q1’20 – Q2’21 combined. What is driving the surge?

Quarterly Rollable/Foldable Smartphone Shipments

According to DSCC CEO Ross Young, “There are a number of reasons for this. First, Samsung has delayed the launch of its 2021 foldable smartphones until Q3’21. At least three models are expected, and Samsung is positioning their Z Fold foldable line-up as their second flagship series, replacing the Note series. In addition, they are expected to introduce a more aggressively priced version of their clamshell foldable. Thus, Samsung should drive a lot of volume in 2H’21. At the same time, Samsung Display will begin selling foldable displays with Ultra-thin Glass (UTG) to other brands from 2H’21 leading to a number of new products. In fact, we expect to see at least 12 different foldable and rollable smartphones on the market from at least 8 brands and shipments of more than three million units in Q4’21. For the year, foldable/rollable volumes should reach 5.1M units, up 128%, with revenues up 137% to $8.6B.”

In Q4’20, foldable smartphone shipments were up 54% Q/Q and 242% Y/Y. However, in Q1’21, foldable smartphone shipments are expected to rise just 1% Y/Y with a 40% Y/Y decline expected in Q2’21 on the lack of new products. However, Q3’21 and Q4’21 should each be up well over 100% Y/Y.

In Q4’20, Samsung was the dominant foldable brand with a 91.5% share on a unit basis. For all of 2020, Samsung led with an 87% share on a unit basis. The 2020 foldable market was 2.2M units, up nearly 1000% vs. 2019. The Z Flip was the #1 model with nearly a 50% share followed by the Z Fold 2. Korea was the leading region for foldable smartphone shipments in 2020 due to the success of the Z Flip and Z Flip 5G in that region as Korea accounted for more than 50% share of demand for Samsung’s clamshell models in 2020.

In 2021, DSCC expects Samsung to continue to dominate the foldable/rollable market with an 81% unit share and 76% revenue share. Samsung Display is expected to be even more dominant as it begins selling to other brands in 2H’21. Samsung Display’s share of foldable/rollable panels is expected to grow from 83.5% in 2020 to 87% in 2021 on a unit basis.

One important trend is the significant growth in in-folding or book-type foldables like the Z Fold 2 which are expected to account for 49% of foldable/rollable phone revenues in 2021, up from 39% in 2020, as new entrants (Google, Oppo, Vivo and Xiaomi) choose this form factor. According to DSCC’s Young, “We are seeing the new entrants opt for in-folding devices as small as 7.1” and as large as 8.2” which will give consumers a nice choice along with sub-7” clamshells.”

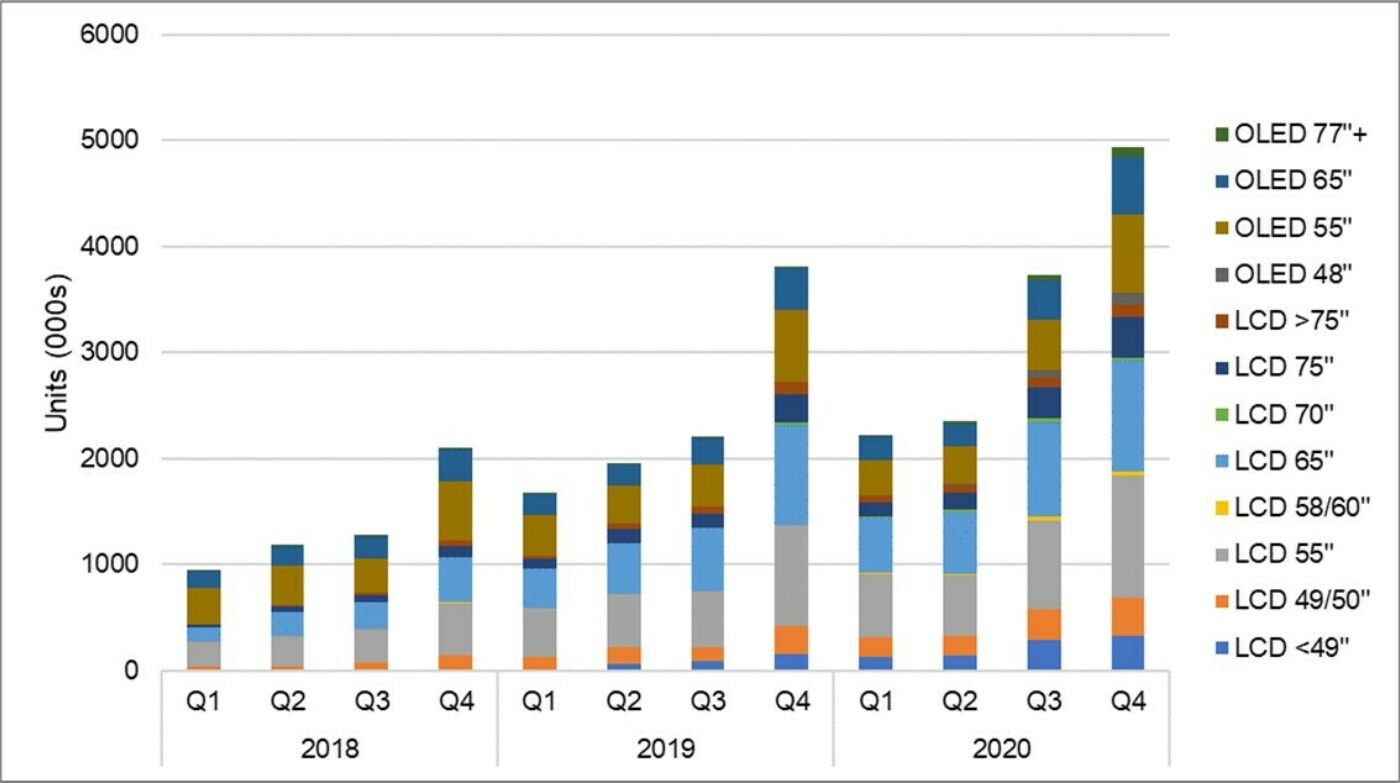

DSCC tracks and forecasts the supply chain for foldable/rollable smartphones on a panel shipment, device production and device shipment timeline in units and revenues. The 2019-2021 results for all three parameters are shown below. The biggest differences between these values are related to the time lags between them which are more pronounced when products are introduced late in the year like we are seeing in 2021. DSCC has brought down its numbers for 2021 due to the lack of an UTG supply chain besides what exists at Samsung Display as well as driver IC shortages which will delay and downsize some programs in 2021. Rapid growth is expected to continue into 2022 as the products introduced in late 2021 ramp, other companies complete their UTG supply chains and companies expand their offerings.

2019-2021 Foldable/Rollable Panel Shipments, Phone Production and Phone Shipments

DSCC’s Quarterly Foldable/Rollable Display Shipment and Technology Report now tracks and forecasts shipments on a model by model basis for every application using foldable or rollable displays which includes smartphones, notebook PCs, tablets and TVs. Panel shipments, device production and device shipments are provided on a monthly basis through the end of 2021 with a long term forecast through 2025. It also includes roadmaps, design wins, detailed product specifications, cost analysis, technology advancements and more.

About DSCC

Display Supply Chain Consultants (DSCC) was formed by experienced display market analysts from throughout the display supply chain and delivers valuable insights through consulting, syndicated reports and events. The company has offices in the US, Europe, Japan, Korea and China.