It first examines the current status of the first foldable smartphones from Royole, Samsung and Huawei. It covers what problems they have dealt with and solutions they have implemented. It also reveals cross sections of the foldable panels revealing thicknesses and suppliers for the different layers above and below the panels including hard coats, colorless polyimide, OCA, black matrix, polarizers, touch sensors, adhesive materials, cushion films, frames and more. The report reveals 360K foldable panels are expected to be shipped in 2019 with foldable devices amounting to less than 250K units. However, by 2023, foldable displays are expected to reach over 68M and generate over $8B in revenues.

The report then examines the foldable roadmaps, product plans and strategy for 11 different brands covering – Samsung, Huawei, Lenovo/Motorola, Xiaomi, Oppo, Vivo, TCL, Google, Sony, Apple and PC brands. 19 different foldable devices are shown to be launched within 2020. Perhaps the biggest surprise is the number of models coming from Samsung that use ultra-thin glass (UTG) as well as the number of clamshell models being introduced across the industry. Clamshell smartphones offer a smaller seam, smaller hinge, higher yields, reduced risk, the smallest smartphone form factor with the best portability, a lower cost and lower price. Not just Motorola, but Samsung and many other brands are expected to adopt clamshell smartphones from 2020. DSCC sees clamshells accounting for at least a 60% unit share of the foldable smartphone market from 2020-2023 even though they aren’t in the market yet. In addition, DSCC sees UTG from SCHOTT significantly penetrating the foldable market from 2020. DSCC expects Samsung to launch 2-3 products in 2020 with UTG with an aggressive folding radius while enjoying the scratch resistance and hardness of glass as well as the touch experience consumers have grown accustomed to. DSCC also expects to see products that combine clamshell form factors with UTG in 2020.

The next chapter examines all the foldable panel suppliers in terms of their foldable product plans, unyielded capacity, yielded capacity and compares and forecasts yields across the suppliers. The following suppliers are included – Samsung Display, BOE Technology, LG Display, Royole, Visionox, China Star, AUO and EDO.

The next chapter covers DSCC’s detailed cost and price forecasts. A bill of materials is provided for the following panels – 7.3” in-folding, 6.7” clamshell and 8.03” outfolding from 2019-2023. The 8.03” foldable costs are modeled based on production in China and Korea allowing users to see where China has an advantage, where Korea has an advantage, which is ultimately cheaper and what type of operating margins are likely. It also compares cover film vs. UTG costs.

The final chapter includes DSCC’s foldable unit shipment and revenue forecasts for all foldable applications. The forecasts are provided by application, form factor, brand, panel supplier and size. It also reveals 31 different product/supplier combinations that are being tracked and forecasted. Highlights of the forecast include:

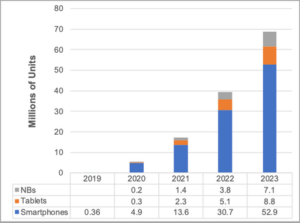

- Foldable panels for smartphones, tablets and notebooks are expected to grow at a 272% CAGR from 0.36M in 2019 to 68.8M in 2023.

- Foldable display revenues are expected to grow at a 242% CAGR from $62M in 2019 to $8.4B in 2023.

- Smartphones are expected to maintain at least a 77% share throughout the forecast on a unit basis on a 248% CAGR. Tablets are expected to grow at a 208% CAGR with NBs at 262%. On a revenue basis, the smartphone share will be 54% with notebooks overtaking tablets in 2022.

- Clamshell form factors are expected to become the leading type of foldable smartphone from 2020 followed by in-folding and then outfolding based on forecasts for each product.

- Samsung is expected to lead in foldable smartphone penetration and maintain the highest share through the forecast as it looks to establish this category and introduces the most products. An early and proprietary position in UTG may boost its position. DSCC expects Samsung’s share to fall from 70% in 2020 to 42% in 2023 with foldables accounting for an 8% share of its smartphone shipments in 2023.

- Huawei will be #2 until Apple enters the market which is forecasted to happen in 2022.

- As the reliability issues are overcome, a growing number of smartphone brands are expected to enter and increase the number of foldable products in their product line as they try to boost their blended ASPs and margins.

- Samsung Display is expected to be the dominant panel supplier given their technical and capacity leadership in a sector struggling to boost differentiation and achieve higher utilization. Samsung Display is expected to launch a number of different panels for not just the Samsung brand but other leading brands as well. BOE is expected to be #2 with a low double-digit share supplying to leading Chinese brands.

- Looking at all applications by size, the 7.x” market is expected to enjoy the highest share each year except for 2020. It is a sweet spot for clamshell, in-folding and out-folding. It will eb followed by 6.x with 13.x” #3 as it will be used in both tablets and notebooks.

DSCC’s 2019 Foldable Display Market Update and Outlook Report is available immediately and is priced from $3495. It is also available in a package with either DSCC’s 2018 Foldable Display Technology and Market Report or DSCC’s upcoming 2019 Foldable Display Technology Update.