Display Supply Chain Consultants (DSCC) has released the first issue of its Quarterly OLED Shipment and Fab Utilization Report

Display Supply Chain Consultants (DSCC) has released the first issue of its Quarterly OLED Shipment and Fab Utilization Report

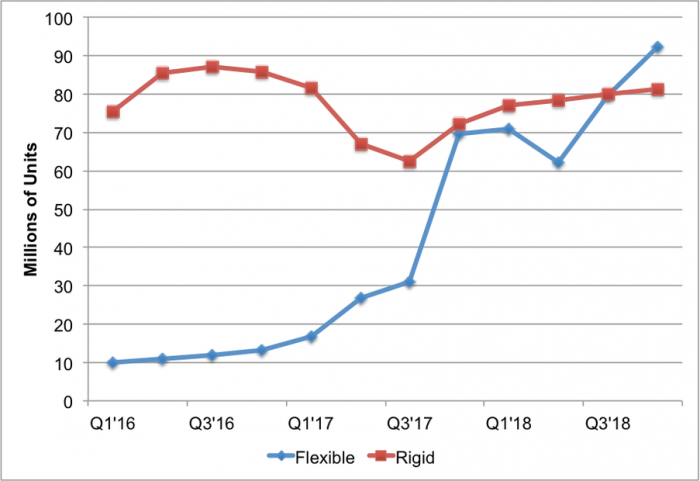

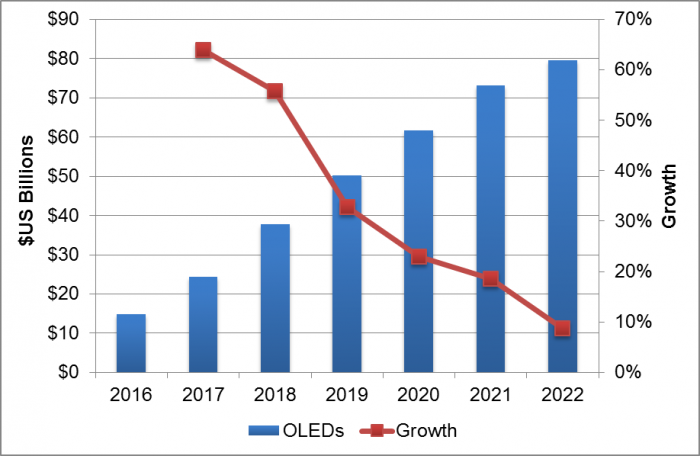

- Quarterly OLED revenues exceeded $5 billion for the first time in Q3 17 and are expected to rise 88% Q/Q and 153% Y/Y in Q4 17 to $10.0 billion as shown in Figure 1. Flexible smartphone OLEDs are driving the revenue growth on pent-up demand for the iPhone X. Flexible OLED display revenues rose 37% Q/Q in Q3 17 and are expected to grow 140% Q/Q in Q4 17. The flexible OLED unit share of the OLED smartphone market rose from 29% in Q2’17 to 33% in Q3 17 and is expected to reach 49% in Q4 17 with units shown in Figure 2 with the revenue share rising from 56% in Q2’17 to 66% in Q3 17 and a projected 80% share in Q4 17 on significantly higher prices.

- Samsung was the top OLED panel supplier in Q3 17 with a 91% share, which is expected to rise to 93% in Q4 17 on higher flexible OLED output. Samsung was also the #1 customer of OLED panels in Q3 17 with a 42% share. However, in Q4 17, strong iPhone X as well as Touch Bar and Smart Watch shipments will enable Apple to overtake Samsung with a 57% to 26% advantage.

- For 2017, OLED revenues are expected to rise 64% to $24.3B.

- After the spike in demand in Q4 17, OLED revenues are expected to decline 11% in Q1’18 and 10% in Q2’18 on seasonal weakness and high flexible OLED smartphone prices limiting demand in China. Double-digit sequential growth is expected in seasonally strong Q3’18 and Q4’18 as both rigid and flexible OLED smartphones proliferate and OLED TV capacity grows. For 2018, OLED revenues are expected to rise 56% to $37.7B.

Figure 1: Quarterly OLED Revenues and Growth

Source: DSCC’s Quarterly OLED Shipment and Fab Utilization Report

Figure 2: Quarterly OLED Smartphone Unit Shipments  Source: DSCC’s Quarterly OLED Shipment and Fab Utilization Report

Source: DSCC’s Quarterly OLED Shipment and Fab Utilization Report

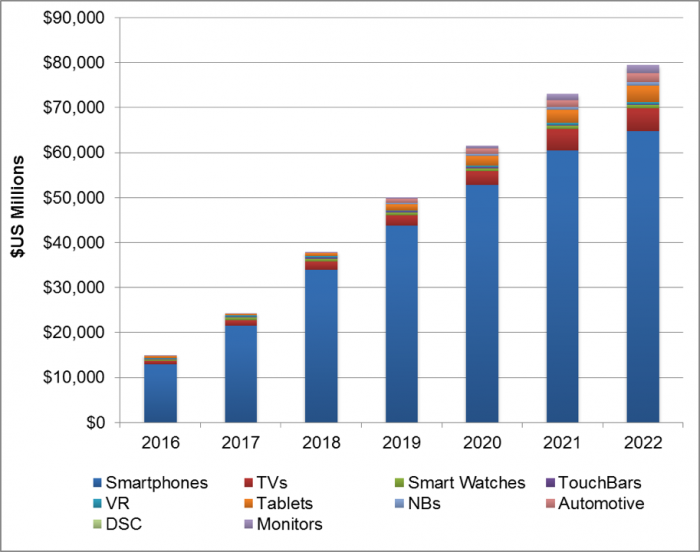

- Through 2022, OLED revenues are expected to continue to surge as OLEDs increasingly penetrate more applications and capacity continues to surge. OLED revenues are expected to grow at a 32% CAGR from 2016 to 2022 to $79.5B as shown in Figures 3 and 4 with TVs rising at a 34% CAGR, smartphones rising at 31% and a host of other applications grow at faster rates including tablets, notebooks, monitors and automotive.

- Samsung is expected to remain the dominant OLED panel supplier in 2018 with an 87% share, down from 92% in 2017, which includes TVs.

- In the TV market, LG is expected to dominate both in panels and TV sets. The OLED TV panel market is expected to grow at a 48% CAGR from 2016 to 2022 to 9.5 million units. The report reveals the share of OLED TV panels purchased by TV brand with LG and Sony leading in 2017 with a combined 84% share.

- OLED fab utilization fell from 82% in Q2’17 to 72% in Q3 17 and is expected to be 85% in Q4 17.

Figure 3: OLED Revenue Forecast and Growth: 2016 – 2022

Source: DSCC’s Quarterly OLED Shipment and Fab Utilization Report

Source: DSCC’s Quarterly OLED Shipment and Fab Utilization Report

Figure 4: OLED Revenue Forecast by Application: 2016 – 2022