DSCC has launched its latest quarterly smartphone display cost report, covering the most critical variables in smartphone panel cost including screen size, resolution and substrate type. Discussing the report, co-founder and president Bob O’Brien commented:

“Smartphones have driven many of the leading-edge innovations in the display industry and as OLED smartphones capture an increasing share of the overall phone market, an understanding of the structure of smartphone costs is essential for a thorough knowledge of the display industry”.

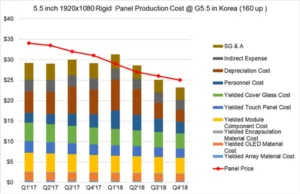

A sample chart from the report is shown below, demonstrating the impact of low OLED fab utilisation driving fixed costs higher in the first half of 2018, against the overall trend of declining costs driven by lower material costs and improving yield.

The chart also shows the detailed breakdown of the cost elements available in the report, including yielded materials costs for array materials, OLED materials, encapsulation, module components, touch panel and cover glass. Furthermore, by including the panel price for both history and DSCC’s forecast, the operating margin related to each product can be seen.

Source: DSCC Quarterly Smartphone Display Cost and Forecast Report

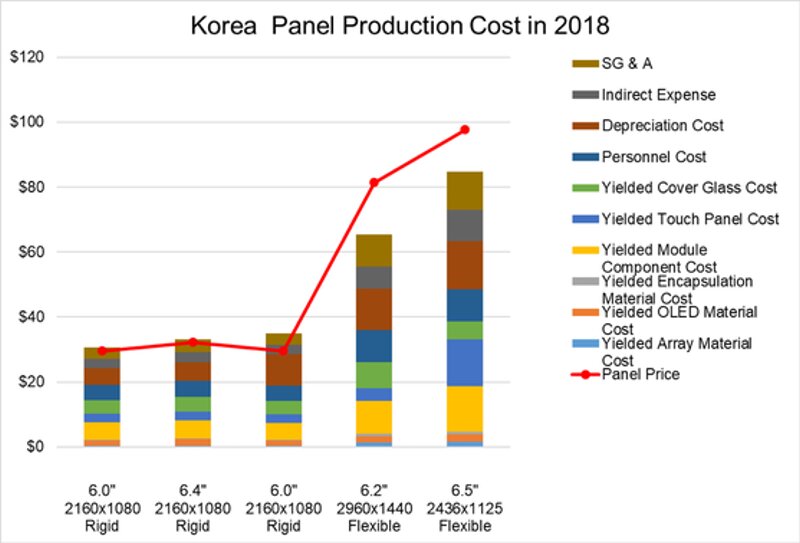

Another sample graph shows an abbreviated chart of cost by product for Korea production in 2018, with some representative products. Costs for flexible displays are substantially higher than rigid displays and a prominent driver of this higher cost is the lower yield for flexible panels in several process steps which, combined with higher capital costs, pushes depreciation costs higher.

Source: DSCC Quarterly Smartphone Display Cost and Forecast Report

Source: DSCC Quarterly Smartphone Display Cost and Forecast Report