In Part 1 of this article (DSCC Increases Display Capex Forecasts on New Fabs in China and Rising Capital Intensity (Part 1), I covered the developments in our equipment spending forecast by application. In this part, I’m looking by territory, by equipment type and by vendor.

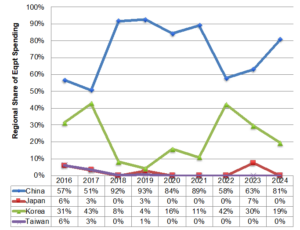

By country, China is expected to dominate spending from 2019-2024 with a 79% share, up from 75% last quarter, due to the addition of the HKC H5 and CSOT T9 fabs among others. Korea’s share should surge in 2022 and 2023 on increased OLED TV spending. Its 2019-2024 share is expected to reach 20%. In LCDs, China’s share is even more dominant at 100% from 2019 – 2022 with no spending forecasted from 2023. In OLEDs, China is expected to lead Korea with a 70% to 28% share advantage, gaining 5 points vs. last quarter on projections for increased OLED TV spending in China.

Equipment Spending by Region Source: DSCC’s Quarterly Display Capex and Equipment Market Share Report

Source: DSCC’s Quarterly Display Capex and Equipment Market Share Report

By manufacturer, BOE is expected to lead in display equipment spending from ‘19-’24 with a 24.2% share followed by China Star at 19.6%, Samsung at 15.7%, LGD at 10.8% and HKC at 10.1%. In just OLED, BOE is expected to lead with a 23% share followed by SDC at 22%, China Star at 16% and LGD at 15%. Looking just at LCDs, we now show HKC leading with a 36% share followed by China Star at 28% and BOE at 26%.

By equipment type:

- Backplane equipment – We show backplane equipment accounting for a 50% share from 2019-2024. exposure leading with a 23% share on $8.5 billion in revenues over this period followed by CVD with an 11.2% share, dry etch at 11.1%, coater/developers at 7.1% and PVD at 7.0%, Market shares by supplier are provided for 26 different backplane segments. AMAT led the backplane market in 2019 with a 14.2% share followed by Nikon at 12.2%, Canon at 8.9%, TEL at 8.7% and Invenia at 4.2%. In 2020, we show AMAT continuing to lead with a 13.7% share followed by Nikon at 11.1%, Canon at 10.1%, TEL at 7.1% and ULVAC at 3.6%.

- OLED frontplane equipment – We see $16.7 billion in OLED frontplane equipment spending from 2019 to 2024 accounting for a 23% share. FMM VTE tools are expected to lead with a 31% share followed by open mask VTE systems with a 15% share, inorganic encapsulation with an 11% share and IJP at 5%. The IJP share came down on lower prices and fewer units than expected at SDC’s QD-OLED fab. Market share is provided for 17 different segments. In 2019, LG PRI led with an 18% share followed by YAS at 16%, Tokki at 11%, Panasonic at 10% and AMAT at 4%. In 2020, Canon Tokki is expected to enjoy a dominant 36% share followed by AMAT at 13.3%, ULVAC at 4.0%, Kateeva at 3.4% and SEMES at 3.1%.

- Similar info is provided for color filter, cell and module equipment.

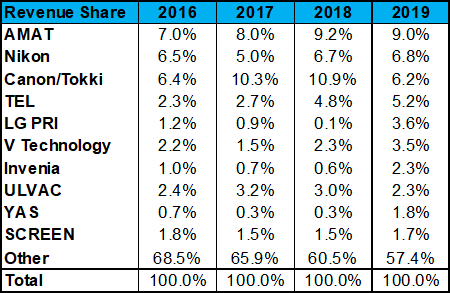

The top 10 overall suppliers for 2019 were led by AMAT with a 9.0% share on revenues of $912 million. Interestingly, if you shift their revenues by 1-quarter due to different revenue recognition approaches, DSCC’s 2016 – 2020 revenues for AMAT are within 2% of their published 2016-2020 revenues. Nikon was 2nd on its strong G10.5 litho position followed by Canon/Tokki, TEL and LG PRI. This is by far the highest LG PRI has ever been ranked and is a result of their share of the open mask evaporation tools sold to LGD. Of the top 10, only LG PRI, V Technology, Invenia and YAS enjoyed Y/Y growth.

Top 10 Display Equipment Suppliers for 2016-2019 Source: DSCC’s Quarterly Display Capex and Equipment Market Share Report

Top 10 Display Equipment Suppliers for 2016-2019 Source: DSCC’s Quarterly Display Capex and Equipment Market Share Report

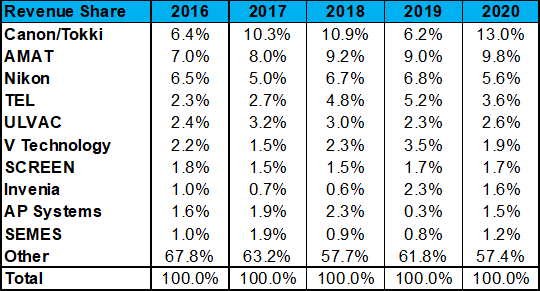

For 2020, Canon is expected to reclaim the top position on 11% growth in exposure equipment, nearly 400% growth in FMM VTE equipment and its first open mask VTE equipment sale at over $250 million. AMAT is expected to gain share with a 19% increase in revenues. Nikon is expected to lose share as their LCD business falls sharply, TEL is expected to maintain the #4 position while ULVAC jumps to #5 on an FMM VTE system sale and stable PVD revenues resulting in 24% revenue growth. Semes jumps to #10 on 71% growth thanks to IJP and organic TFE sales to SDC’s QD-OLED fab. (RY)

Top 10 Display Equipment Suppliers for 2016-2020

Source: DSCC’s Quarterly Display Capex and Equipment Market Share Report

Source: DSCC’s Quarterly Display Capex and Equipment Market Share Report

Ross Young is the founder and CEO of Display Supply Chain Consultants (DSCC), a leading display market research, consulting and events firm which he started in 2016. Ross has a long history in the display industry. Prior to DSCC, Ross was SVP of Displays, LEDs, Lighting and PV at IMS Research after the firm acquired his market research business Young Market Research (YMR). Prior to YMR, Ross was VP of New Market Creation at Samsung LCD where he reported to the CEO. From 1996 – 2008, Young started, ran and sold DisplaySearch which became the leading source of market intelligence, events and consulting to the flat panel display supply chain.