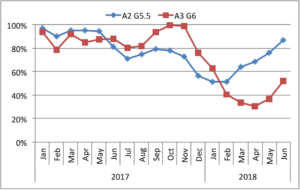

DSCC said in a blog post that it expects Samsung Displays’ fab utilization rate will continue to improve as it builds up volumes to meet the demands for flexible OLEDs for Apple, Samsung and other brands. The rate in its rigid displays (mainly from the A2 fab which inputs 175K substrates per month) should get to over 80% in June, up from 76% in May and that improvement has been caused by the reducing price gap between OLED and LTPS LCDs.

DSCC said that Samsung’s rigid OLED utilization gets above 80% in June

This change means that Samsung is likely to boost rigid OLED capacity, rather than flexible displays. The utilization has gone from 31% in April, to 37% in May, as production started on the next iPhone and to 52% in June as production started for the new 6.46” iPhone X Plus.

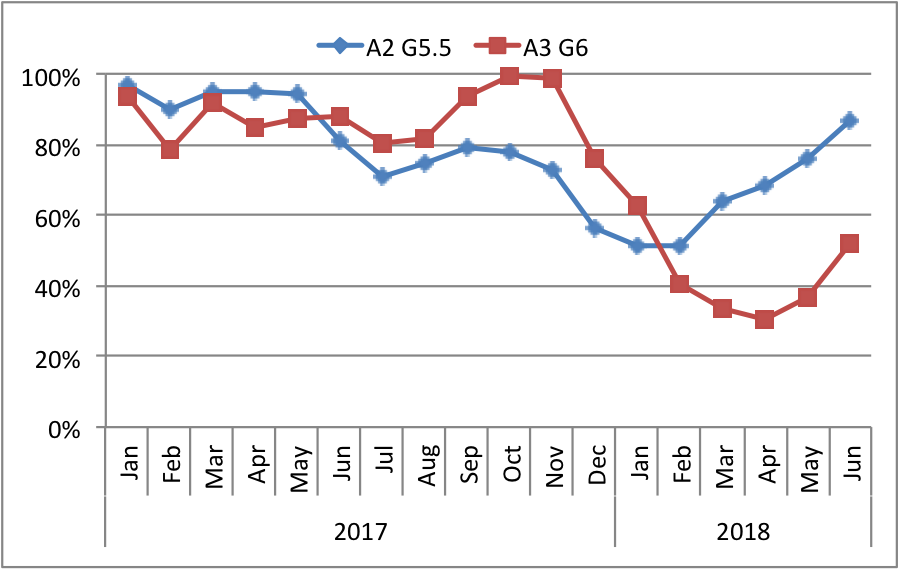

DSCC said that an important question for Samsung’s flexible fabs is how much does utilization decline in Q1’19 after the initial build for the next iPhones and do they have to idle any capacity in 1H’19 as they did in Q1 and Q2 2018? A lower price gap with rigid OLEDs and LTPS LCDs and form factors that take advantage of their flexible capability such as curved, foldable or rollable will certainly help to boost demand and prevent future idling of capacity. OLED penetration into less seasonal markets will also help, the firm believes.

As a result of these changes, Samsung’s revenues are forecast to bottom out in Q2 2018.

Samsung’s revenues should bottom out in Q2. Image:DSCC

Samsung’s revenues should bottom out in Q2. Image:DSCC