During the first quarter of 2018, Chinese suppliers outperformed Taiwan and Korean suppliers, helped by government subsidies, lower labour and fab costs, and the exclusion of interest payments in odd quarters, according to DSCC. Flexible OLED smartphone panel shipments dropped rapidly and LTPS LCD took share from OLED. Smartphone panel volumes were weak, especially at the high end, which boosted blended unit ASPs and reduced area ASPs as smartphone panels carried higher prices on an area basis. While OLED volumes fell faster than LTPS volumes, OLED margins continued to outperform LCD margins. Panel makers are optimistic about TV volumes in the rest of 2018, despite experiencing above-average channel inventories in the first quarter of 2018. LG reported a shortage of OLED TVs and revealed they may convert even more LCD capacity to OLED TV capacity.

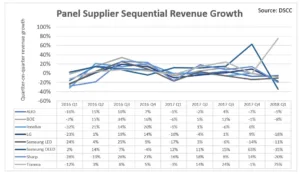

Tianma had the highest revenue growth at 75%. This was due to the company acquiring one of its subsidiaries during the quarter, Xiamen Tianma, with its 5.5G and 6G LTPS LCD fabs. This resulted in significant revenue growth, despite shipments declining quarter-on-quarter for the Tianma group overall, as Xiamen’s results were not featured in its results for the fourth quarter of 2017. Every other supplier experienced sequential revenue declines, ranging from -5% for AUO, whose unit shipments were down just 1% with area shipments down just 2%, to Samsung’s OLED business, which fell 35% on a 34% decline in flexible OLED shipments.

AUO experienced full loading in its fabs and experienced significant area growth year-on-year in small/medium displays up 26% as it added and ramped significant LTPS LCD capacity last year. AUO is also seeing strong growth in gaming monitors and has a larger commercial/industrial position than most suppliers, which has less seasonality. BOE, which saw double-digit quarter-on-quarter declines in both large-area and small/medium shipments, indicated that a driver IC shortage in the first quarter of 2018 worsened their small/medium panel business. BOE experienced gains in unit ASPs and declines in area ASPs.

Conversely, Samsung saw the worst performance in its OLED panels after experiencing the best performance a quarter earlier. This can be attributed to weakness in its flexible OLED shipments for the iPhone X. Samsung’s shipments to Apple were down 58% quarter-on-quarter to 15 million, more than offsetting a 10% increase in shipments to its own Galaxy brand. While Samsung’s OLED shipments were down 17% quarter-on-quarter, flexible OLED smartphone shipments were down 34%, with rigid OLED smartphone shipments down just 1% quarter-on-quarter. OLEDs fell from 80% of Samsung’s revenues for the fourth quarter of 2017 to 74% of its revenues in the first quarter of 2018.

DSCC expects another sequential decline in the second quarter of 2018. On the other hand, based on improvements in rigid OLED fab utilisation in April, the company predicts sequential growth for rigid OLEDs in the second quarter of 2018, but it won’t likely be enough to offset the continued weakness in flexible OLEDs. However, a resurgence is predicted during the third and fourth quarters of 2018, for iPhone and other new product launches.

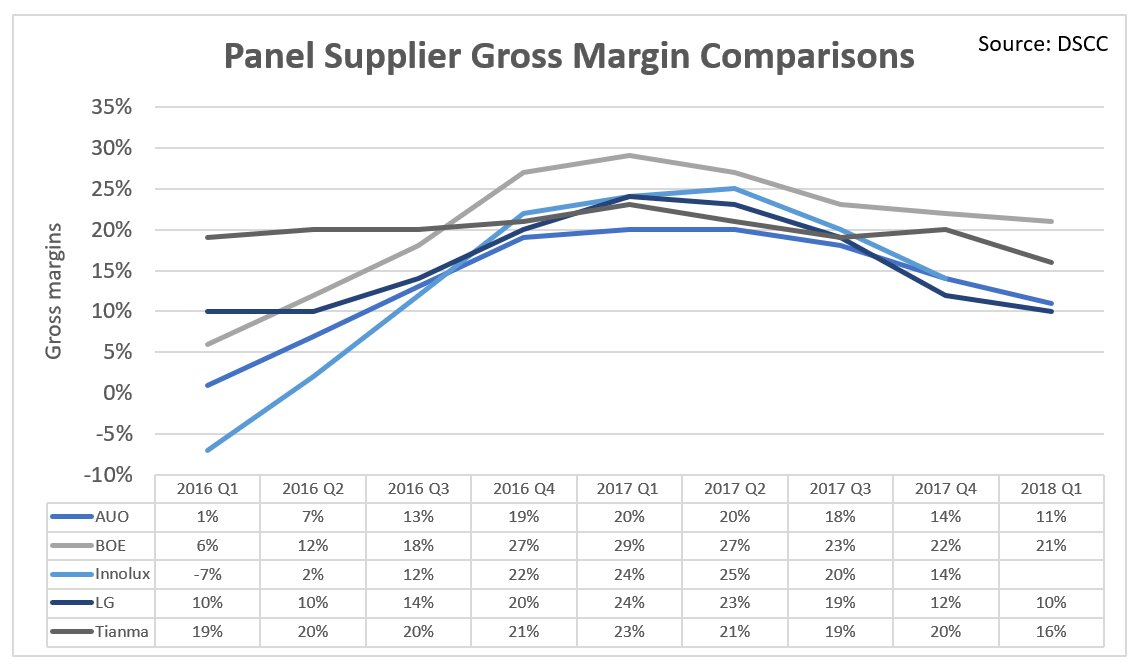

BOE maintained the highest margins of these companies for the sixth consecutive quarter at 21%. Tianma Micro, also a Chinese supplier, had the second-highest gross margins at 16%, while LG had the lowest at 10%. LG experienced a 35% sequential decline in mobile revenues which significantly impacted the quarter and weighed on their blended ASPs, which fell 11% quarter-on-quarter. Area shipments were down 9%, with capacity down 5% as the company took capacity down for maintenance and R&D.

LG expects capacity to rebound by a similar percentage and also indicated it expected ASPs to stabilise in the second quarter of 2018. TV panel prices are not going to stabilize in the second quarter, relative to the first, but could stabilise in July relative to June, if demand picks up to erase existing channel inventories in TVs which are currently at above-market averages.

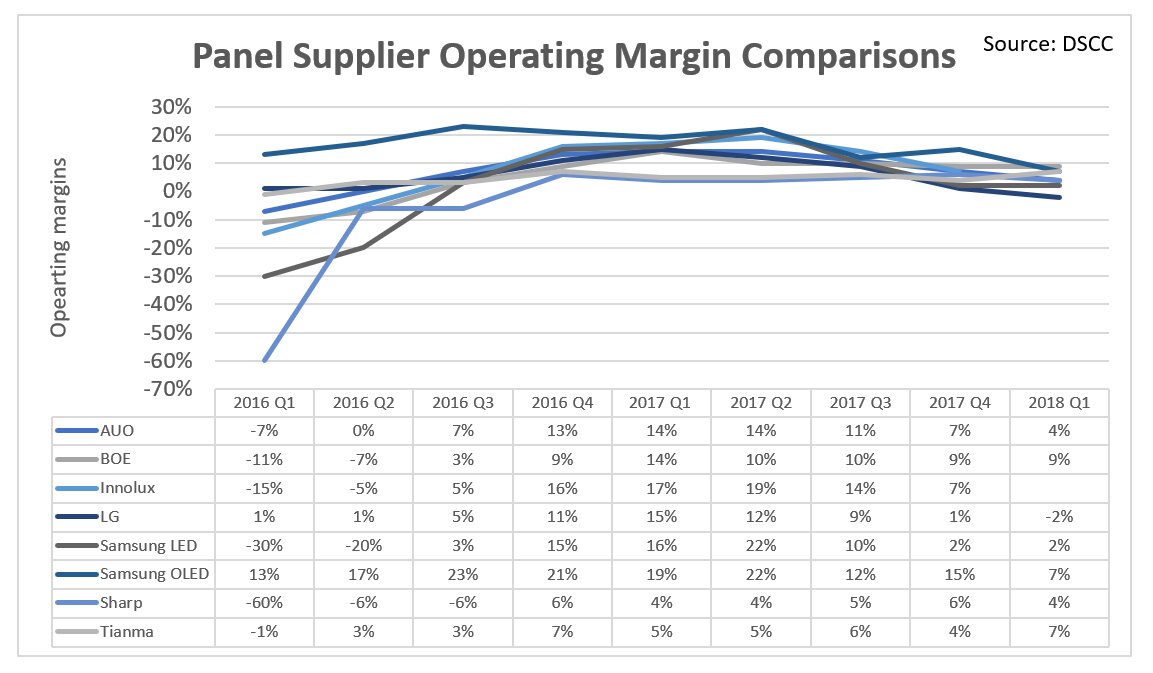

As indicated, operating margins ranged from -2% to LG to 9% for BOE. DSCC believes that China’s local and national government subsidies are reflected on BOE’s income statement in three ways – Other Income, Asset Allowance and R&D Allowance. While Other Income is not reflected in Operating Income, it is likely that R&D Allowance is included. In any case, BOE had the highest operating margins in the first quarter of 2018. Its significant scale, subsidised fabs and lower cost labour boosted its financial performance relative to its competition. BOE did indicate that its small/medium business was somewhat limited by a driver IC shortage.

Samsung’s OLED operating margins fell to 7%, its lowest OLED operating margin since the second quarter of 2015. With flexible OLED fab utilisation down significantly, revenues fell and costs rose. Its OLED operating income was down 72% quarter-on-quarter, to $342 million. Its LCD operating income of just $38 million was the lowest since the second quarter of 2016. As a result, OLED’s contribution to its operating income fell from a 96% share in the fourth quarter of 2017 to a 90% share in the first quarter of 2018.

LG experienced its first operating loss in over five years. It pointed to growing price competition from Chinese suppliers in large-area markets, weakness in mobile markets and continued losses in OLED TV panels due to their limited scale. It pledged to reduce its costs and implement a flexible capex strategy to be more responsive to market demand and technical readiness, which translates to flexible OLED fab delays and uncertainty regarding its 10.5G plans. LG wisely intends to remain conservative regarding flexible OLED capex due to the high capital intensity along with demand volatility as we have seen this year with Apple and Samsung. However, it acknowledges that growth in flexible OLED supply and demand is inevitable due to both the smartphone and automotive markets moving towards OLEDs, as well as demand for foldable displays from its customers.

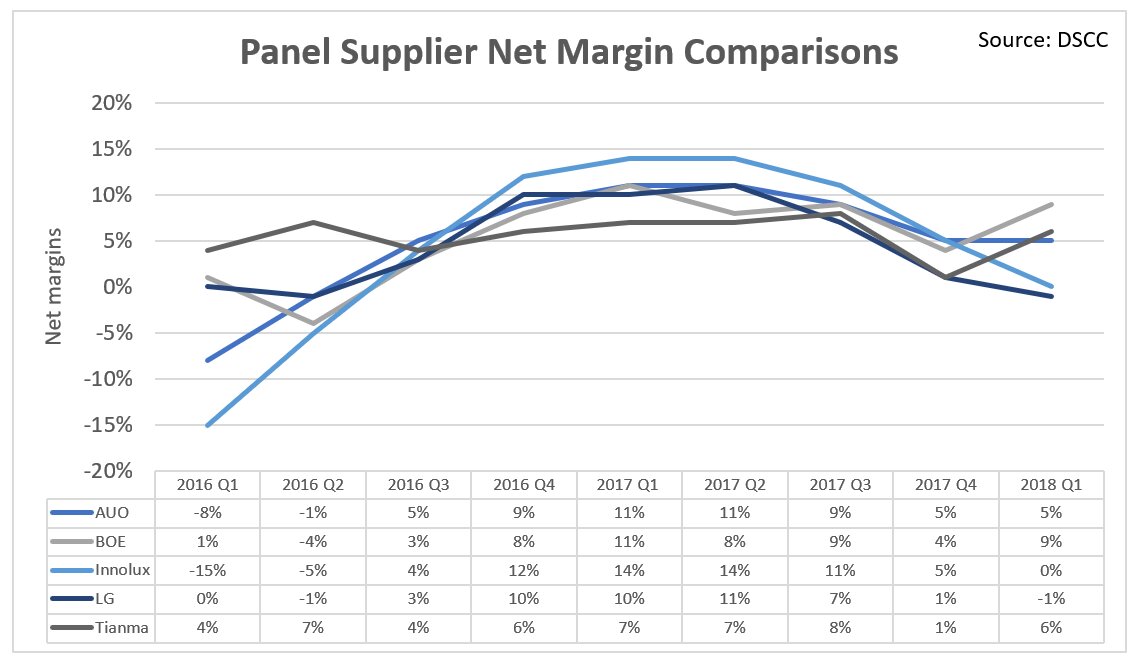

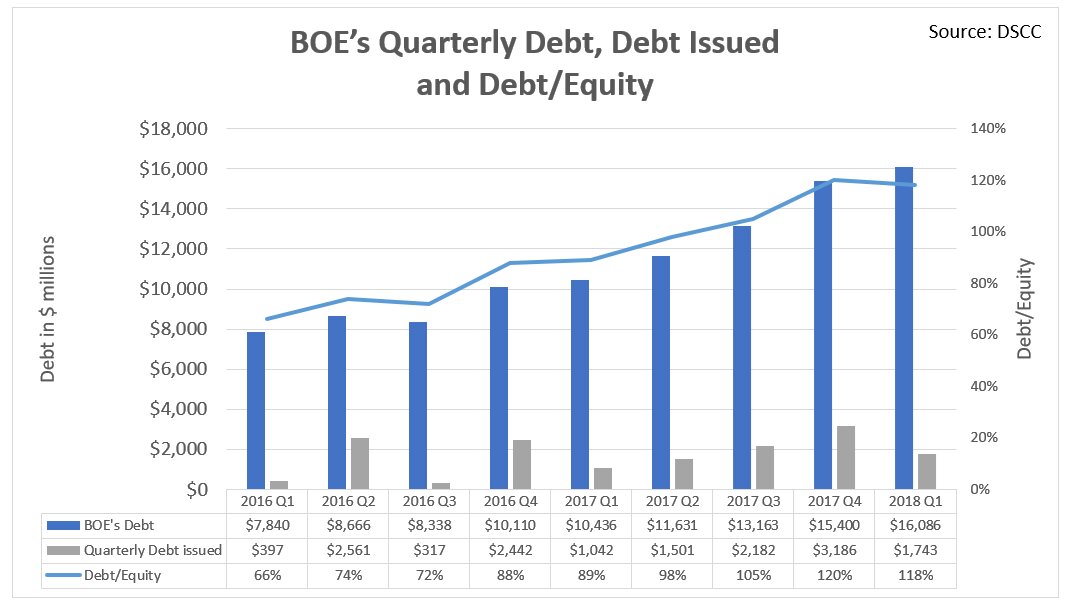

BOE’s net profit was above its operating profit as it enjoyed $77 million in Other Income in the first quarter of 2018. It also recognised Asset Allowance and R&D Allowance of $115 million. Another benefit is that it only recognises Interest Expenses twice a year, so it avoided an approximate $195 million expense in the first quarter of 2018. The company’s debt has grown to $16 billion, with its debt/equity over 100% for the third straight quarter, at 118%. However, with significant government support, customers and suppliers do not seem concerned.

Based on the six suppliers reporting so far, capex is down 20% quarter-on-quarter for the first quarter of 2018, with BOE holding a slight edge over LG. The largest spender of 2017, Samsung, saw its capex fall 61% quarter-on-quarter and 80% year-on-year to $746 million in the first quarter of 2018, the lowest value since the first quarter of 2015. Samsung’s capex has declined for three consecutive quarters and will likely continue to fall throughout 2018.