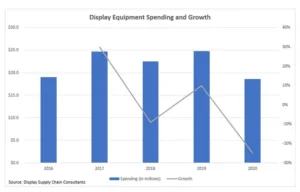

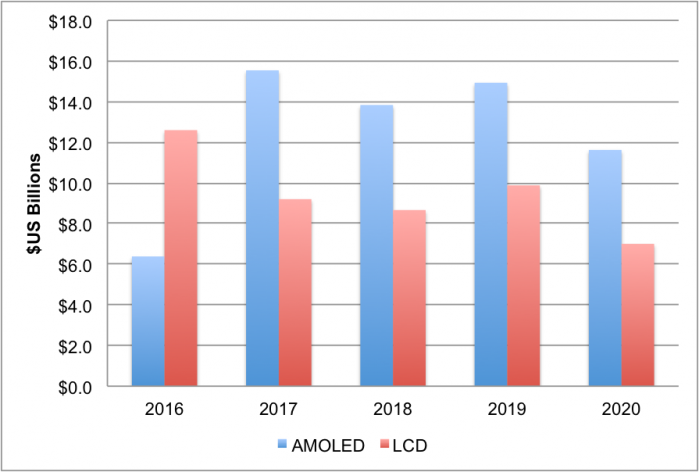

2017 was a record year for the display equipment market, according to Display Supply Chain Consultants, with revenues up 30% to a record high $24.7 billion. Capital-intensive OLED fabs drove spending up 143% to a record $15.5 billion, or 63% of display equipment spending, up from 34%. LCD fab spending was down 27% to $9.2 billion and a 37% share, down from 66%.

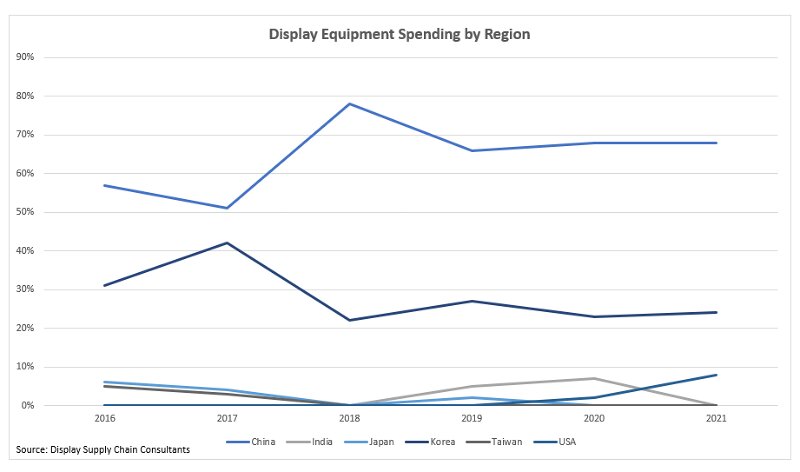

Samsung Display was the largest customer with 54% growth to over $7.5 billion, or a 31% share of display equipment spending. Samsung’s share of OLED equipment spending was 48%. BOE was the second-largest display equipment customer, with a 229% growth to $6 billion and a 24% share. China was the number-one region in 2017 with a 51% share of spending, compared with Korea at 42%. 6G was the dominant glass size with a 55% share, up from 52%.

In 2018, display equipment spending is expected to fall 9% to $22.5 billion, although equipment bookings are expected to rise 5% to a record $24.8 billion, as 2019 spending is expected to rise year-on-year. OLED spending is expected to fall 11% in 2018, with LCD spending down 6%. Driving the decline in OLEDs is slower-than-expected capacity growth at Samsung’s next fab, with the company’s equipment spending expected to drop by 64% in 2018. BOE is expected to replace Samsung as the number one display equipment customer in 2018, with its spending rising 12% to nearly $6.7 billion and its share reaching 30%.

LG Display is expected to be the number two customer in 2018, with a 15% share. The LCD share of spending will rise slightly from 37% to 39% as the 10.5G share of equipment spending rises to 22%. China’s share of 2018 display equipment spending is expected to reach 78% in 2018, thanks to a 37% increase in spending, fuelled by government subsidies to support LCD TV and OLED smartphone manufacturing goals. 2018 is expected to be the first year where China leads in OLED spending, with a 64% to 36% advantage over Korea.

2019 looks to be a record year with BOE, China Star, LG Display and Samsung all spending at least $3.6 billion on display equipment. Equipment revenues are expected to rise 10% to a record $24.8 billion, with OLED spending up 8% and LCD spending up 14%. 2019 is expected to be a record year for display equipment spending, targeting both smartphones and TVs, with LG Display projected to lead in spending.

China’s share is expected to fall to 66%, with Korea’s share rising to 27%. China will continue to lead in OLED spending with a 64% to 33% advantage over Korea. However, Samsung will return to the top position in OLED equipment spending, with a 24% share, compared to BOE at 17% and LG Display at 16%. According to DSCC Founder and CEO Ross Young:

“2017 to 2019 represents an unprecedented $72 billion of equipment spending on display capacity, fuelled by capital-intensive OLED fabs targeting smartphones and TVs and 10.5G LCD fabs targeting the 65” and larger TV market.

This level of spending would not have been possible without Chinese government subsidies, enabling their suppliers to compete more aggressively on cost and scale with Korean suppliers Samsung and LG. Consumers will benefit from all of this capacity, which will drive down costs and prices”.

OLED vs. LCD Equipment Spending