According to Sigmaintell Research, 418 million smartphone panels were shipped globally during the first quarter of 2018, a decrease of 11% compared to the same period last year. The weakness of global smartphone sales directly reduced the demand for smartphone panels.

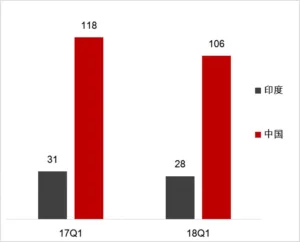

Although smartphone sales in Eastern Europe, the Middle East and Africa still maintained a relatively high growth rate in the first quarter, sales in the Asia/Pacific region — especially in China — were dismal. Sales in India also dropped sharply in the first quarter.

The poor performance of the two countries is a drag on global shipments of smartphones and panels, which have seen varying degrees of decline in the first quarter.

Smartphone Shipments in China and India in 2017 Q1/2018 Q1 (in millions)

Source: Sigmaintell Research

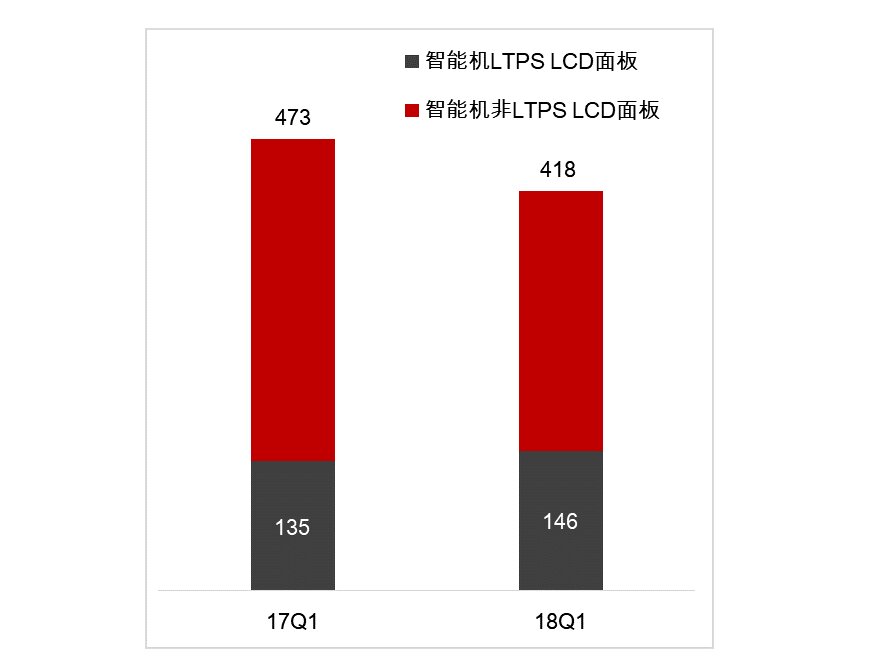

In the first quarter of 2018, the penetration rate of full-screen products exceeded 40%. With the enlargement of display sizes and the trend of resolution enhancement, the demand for LTPS LCD is also increasing. In the future, the trend of differently-shaped screens will further strengthen demand. On the other hand, LTPS LCD’s relatively abundant supply also kept its price down, which narrowed the gap with a-Si LCD and enhanced competitiveness.

Analysts say 146 million LTPS LCD smartphone panels were shipped globally in the first quarter of 2018. In a sluggish market environment and with a year-on-year decline of 12% in overall smartphone panel shipments, it has achieved 8% growth.

Global Smartphone Panel Shipments in 2017 Q1/2018 Q1 (in millions)

Global Smartphone Panel Shipments in 2017 Q1/2018 Q1 (in millions)

Source: Sigmaintell Research

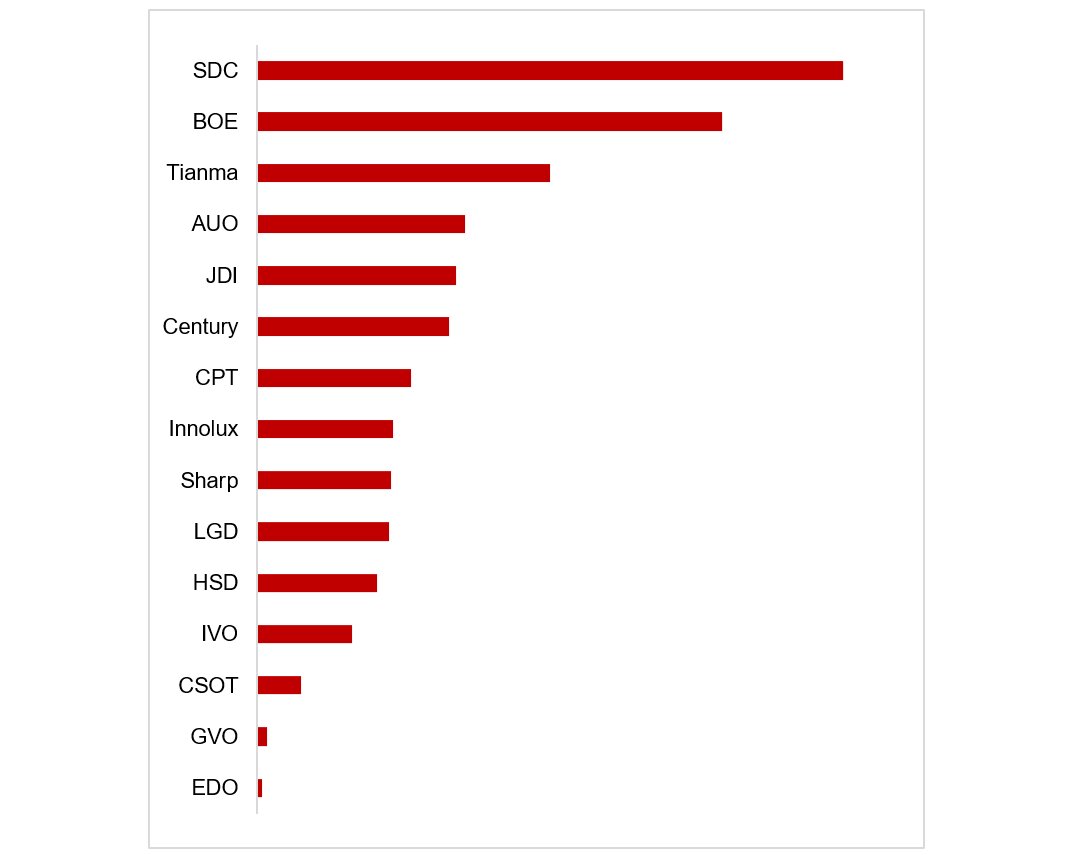

Smartphone panel vendor performance is quite different, due to their different customers and products. On the whole, the dominant panel factories for LTPS LCD products have all achieved good results in the first quarter.

Global Smartphone Panel Shipping Ranking in 2018 Q1. Source: Sigmaintell Research

Global Smartphone Panel Shipping Ranking in 2018 Q1. Source: Sigmaintell Research

Samsung still ranks first in the smartphone panel market. Mature AMOLED technology and sufficient capacity have given the company an advantage but at the present stage, development at Samsung also faces many problems.

For example, the space for future growth of Samsung mobile phones is limited. Additionally, iPhone X sales did not reach expectations and the performance of Oppo, Vivo and Gionee — Chinese brands which contribute much to Samsung’s panel business — was unsatisfactory in the first quarter, according to Sigmaintell.

In the future, Samsung will accelerate the penetration speed of OLED displays in the mid-range market. Apple will also release two new OLED display phones in 2018

Samsung’s shipments in the first quarter showed a sharp decline, decreasing by 14% compared to the same period last year. However, the company’s co-operation with Xiaomi has helped Samsung achieve new breakthroughs in China.

BOE‘s shipments fell 12% year-on-year in the first quarter of 2018, mainly due to reduced demand for a-Si LCD. However, the company still remains in first place for smartphone LCD panel shipments and this year, it will continue to exert strength in LTPS LCD products.

In the first quarter, BOE’s LTPS LCD panel shipments increased by 46% over the same period a year earlier. The output of this type of panel will continue to increase in the coming quarters.

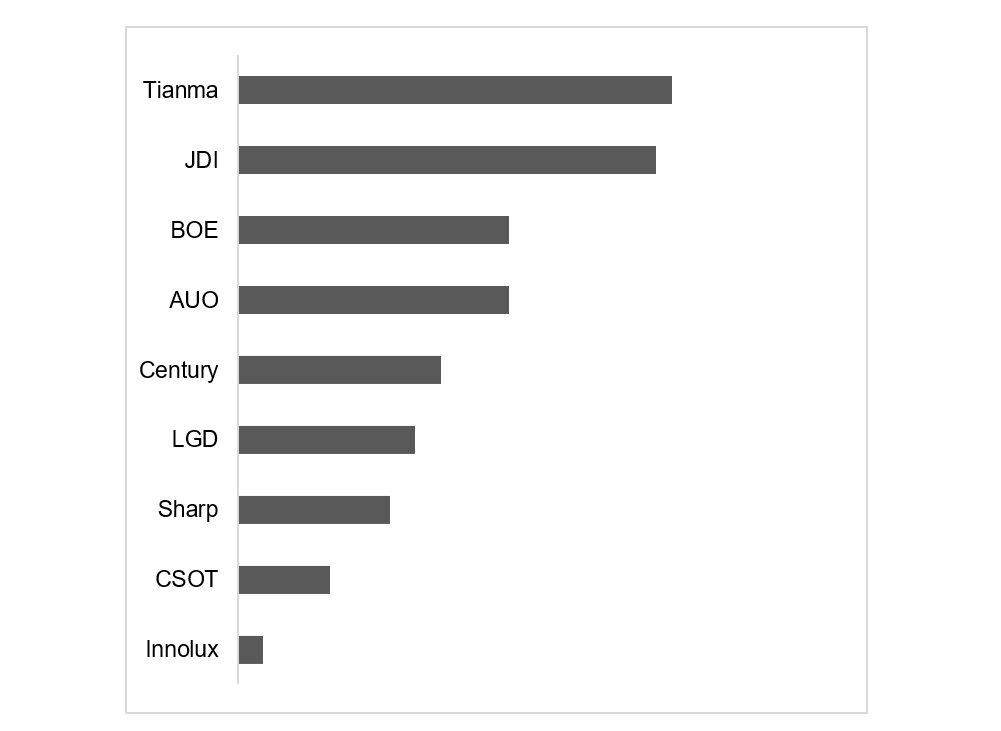

Tianma‘s performance in the first quarter was excellent, according to the research. Its smartphone display panels shipped 27% more than they did in the first quarter of 2017, with more than 44 million shipments.

It is worth mentioning that in the first quarter, the company’s LTPS LCD panels shipped more than 31 million, with an increase of nearly 100% over the same period a year before, defeating JDI and becoming number one for shipments of LTPS LCD products.

The penetration rate of LTPS LCD in Tianma’s smartphone panel shipments has reached 70%. In addition, the company’s customer structure is also reasonable, so it occupies a more important position in the supply chain of the four major mobile phone brands in China.

Analysts predict that, with so many brands moving towards full and differently-shaped screens and LTPS LCD, Tianma’s revenue will continue to increase. The company will soon commence operations at its OLED production line in Wuhan, China, which will further enrich its high-end product line.

Global Smartphone LTPS LCD Panel Shipping Ranking in 2018 Q1.

Global Smartphone LTPS LCD Panel Shipping Ranking in 2018 Q1.

Source: Sigmaintell Research

AUO has also improved its competitiveness by tilting its middle and high-end product lines, with LTPS LCD as its main technology, and by exploiting productivity advantages.

With the continuous increase of the utilisation rate of its LTPS LCD production line in Kunshan, China, LTPS LCD accounted for more than 60% of AUO’s smartphone panel shipments in the first quarter of 2018. The shipment of LTPS LCD panels increased by 127% over the same period last year but so far, AUO has not yet forged relationships with all the main brands in China, so there is still room for expansion in the future.

The situation at JDI is still not optimistic. The rise of LTPS LCD products in panel factories has resulted in JDI losing a large number of middle-end product orders. The company is now more heavily dependent on Apple. In the first quarter, Apple products accounted for 65% of its total shipment volume.

Even if the new LCD phone released by Apple in the second half of 2018 increases the volume of JDI’s shipments, in the long run, the defects in its customer structure will impede its sustainable development in the future, Sigmaintell believes.

Foxconn firms are facing different situations. Innolux‘s own a-Si-dominated product structure has seriously hampered its development, causing it to shed many important brand customer orders. In the first quarter, its smartphone panel shipments dropped 34% year-on-year.

The performance of Century was remarkable, according to Sigmaintell’s research. Through close cooperation with Xiaomi, shipments of LTPS LCD panels out of Taiwan have risen sharply. In the first quarter, the company’s shipments increased by 47% over the same period in 2017.

Sharp, though it has mature LTPS LCD technology, relies too much on Apple orders. On the whole, the total shipment volume of Foxconn’s three panel factories ranked third but there are still customer structure and technology issues that the company needs to face.

The global and Chinese smartphone and panel markets will remain in slow recovery in 2018 but the influence of international trade relations, exchange rates and tariff fluctuations won’t be ideal. As a traditional off-season, the first quarter’s weak market performance is reasonable.

However, in an environment of overall market decline, some panel factories can still go against the trend. In particular, manufacturers with LTPS LCD technology strength and superior customer bases can still achieve higher growth.

Sigmaintell maintains that, in the long run, AMOLED will become a mainstay of the smartphone market but in the short term, LCD will still occupy an important position and there is a promising future for LTPS LCD technology.