Emerging trends for next generation OLED displays were showcased and discussed at DisplayWeek 2023 through exhibitions, seminars, symposium and the Business Conference. It was absolutely great to be back in person to meet, connect, discuss, listen and learn. With more than 5000 attendees it felt like a reunion after the Covid years.

What a difference a year make! The display industry has shifted from record growth and very high revenue in 2021 to a declined market in 2022. In times like these, innovations and developments in display materials, process, products and technology can help to recover and drive demand in future.

Display Market in Decline

According to DSCC Ross Young’s keynote presentation at the Business Conference,

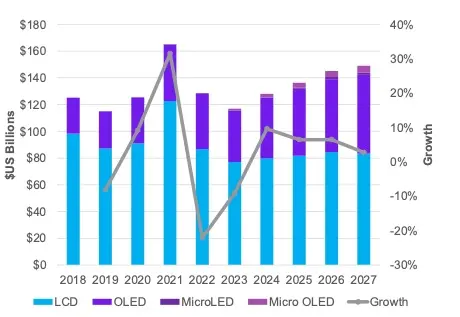

- Display revenues peaked in 2021 on strong COVID demand and tight supply leading to a dramatic increase in panel prices. The 2021 display market grew 31% to a record $165B.

- 2022 revenue fell 22% to $128B with LCDs down 29% and OLEDs down 1% as prices collapsed and fell below cash costs.

- 2023 revenue is expected to fall 10% to $116B as demand remains soft and prices remain low, LCDs down 11%, OLEDs down 8%.

The display industry is in a tough place post COVID with demand down and supply up. Demand is proving to be inelastic, resulting in losses for both panel suppliers and TV brands. According to DSCC forecasts, market will recover starting from 2024.

- Slower supply growth and return of demand growth will enable the market to rebound to $148B in 2027, a 2.9% CAGR from ‘22 to ‘27.

- MicroLEDs and Micro OLEDs to grow at triple digit CAGRs with OLEDs growing at a 7% CAGR and LCDs falling at a 0.8% CAGR.

As Ross presented, OLED performance is getting better through tandem stacks, phosphorescent blue emitters, CoE, MLA, eLEAP/ViP, etc. OLED suppliers are targeting their G8.7 IGZO based RGB OLED fabs to address larger panel sizes and reduce costs.

Technology Development can Drive Display Demand

Looking at the history of display market, we see that technology shift has helped to drive demand and gain higher adoption rates. Shift from CRTs to flat panel display LCD, shift from CCFL backlight of LCD to LED, shift to larger sizes and higher resolutions, all helped to generate consumer product replacement demand. Flexible AMOLEDs continue to gain significant shares in the smartphone market. Large size OLED has also achieved strong position on premium TV market.

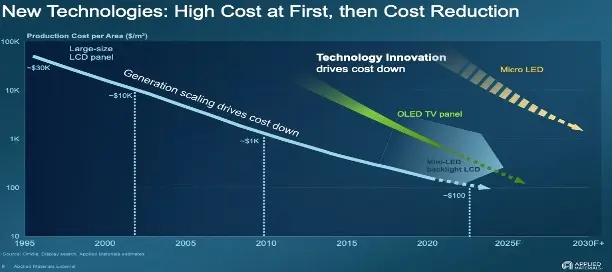

Max McDaniel from Applied Materials said in his Business Conference keynote presentation, “Inflection waves drive display industry. New technologies are high cost at first, then cost reductions. Technology innovation drives cost down”. He stated, “New momentum in OLED IT with RGB OLED scale-up. Litho based solutions are emerging and may dramatically improve scalability and cost of large-area RGB OLED manufacturing”. OLED display technology with new form factors (foldable, rollable, stretchable) combined with better materials, process and designs will create new usability of products in future, opening up new application opportunities.

Higher Brightness and Better Color to Drive OLED TV Demand

Bob O’Brien from DSCC said in his presentation, “In the premium TV market, we see a three-way battle between MiniLED LCD, White OLED and QD-OLED”. LCD dominates the mainstream TV market. According to DSCC data presented by Bob:

- TV dominates display area, with 70% of flat panel display area in 2022.

- 78% of display area growth will come from TV; area share will increase to 72% by 2027.

Chirag Shah from Samsung Display presented that, “QD-OLED display with blue self-emitting pixels, top emission and quantum dot color conversion can provide superior color performance as it doesn’t rely on color filters like white OLED or LCD”. For 2023 Samsung Display introduced QD OLED with hyper efficient EL material, advanced optimization algorithm InteliSense AI, graphite heat sink and advanced Cd Free quantum conversion material. HyperEfficient EL could achieve 33% more color and brightness reaching >2000 nits. Chirag said the real feel for color can be measured by Experienced Color Range (XCR). As per SDC measurement:

- Perceived brightness(Q)= Achromatic Luminance(white)+ Chromatic Luminance (color vividness)

- QD OLED looks brighter under same luminance or QD OLED needs less luminance for same visual brightness

Jeff Yurek from Nanosys presented that, “Quantum Dots deliver brighter, faster color for premium TV.”

- With pure color (narrow and tunable emission properties)

- Luminance for HDR (excellent operational stability at high luminance)

- Chromatic Response time (fast response time in nano sec means display without ghosting)

Jeff quoted OMDIA data to show QD technologies are growth drivers in premium TV segment with combined QD MiniLED and QDOLED:

- >50% share in 2023

- >70% by 2026

At the exhibition, Samsung Display showcased their 77-inch QDOLED TV. LG Display showcased their 77-inch 8K and 65-inch 4K WOLED TV based on their Meta Technology. META Technology comprises a ‘Micro Lens Array’ that maximizes light emission from the OLED panel and ‘META Booster,’ a brightness-enhancing algorithm. According to LGD based on META technology, their latest OLED displays can achieve 60% brighter images and 30% wider viewing angles than conventional OLED displays. Using Meta technology TV can have 2100nits peak brightness. MiniLED based on QD starting to challenge OLED in TV market. It grew rapidly in last few years but continued to be outsold by OLED.

Gen 8.7 Fabs and IGZO Backplane to Drive OLED IT Demand

Samsung Display, LG Display and BOE are bringing Gen 8.7 fabs (in 2025 and beyond) to address larger OLED panels for tablets and IT markets and are trying to reduce cost using FMM VTE tools. As Ross presented, for ½ Gen 8.7 FMM VTE tools, glass area is 116% higher than (½ Gen 6) and has 2 times more transfer chambers per tool. Tandem tool capacity at 7.5K/m need two tools for 15K/m fab capacity which can be extremely high cost and with technical challenges it can create constraint for Gen 8.7 fabs. Samsung Display and LG Display are planning high mobility IGZO backplane with low mask count to improve cost. Higher cost saving is also expected by shifting to rigid +TFE substrate that will have lower capex compared to flexible OLEDs. All three suppliers are planning to use Tandem structures with Gen 6 Fabs in 2024 for higher brightness, higher life time and also to reduce power consumption (20% to 30%) especially for IT market.

As per Ross’s presentation Visionox and JDI are considering an alternate approach eLEAP, eliminating FMM patterning step with lithography step. It can be a lower cost solution, and can also target all sizes on a single G8.7 line while boosting OLED brightness and lifetime with larger aperture targeting IT application. Mike Hack from Universal Display presented the update for Blue Phosphorescent OLED (PHOLED) emitter which will enable all Phosphorescent RGB OLED increasing brightness plus lifetime while reducing power consumptions. Blue PHOLED is expected to be commercialized by 2025.

IT market is declining after strong growth during Covid due to WFH and LFH. As per DSCC’s David Naranjo presentation for IT market,

- 2023 – Double Digit Y/Y Growth Expected for OLEDs

- MiniLED notebook PCs are expected to decrease 10% Y/Y while OLED notebook PCs increase 20% Y/Y.

- MiniLED tablets are expected to decline 7% Y/Y while OLED tablets increase 18% Y/Y.

Apple is expected to shift from miniLED IGZO based LCD to OLED for iPad Pro model in 2024. The company is expected to introduce OLED Macbook Pro and OLED foldable notebook in 2026. Many suppliers were showing prototypes of OLED foldable notebooks at DisplayWeek 2023.

- LG17-inch foldable crease free display that can be used as tablet, laptops or portables

- Samsung Display Flex Note 17.3-inch foldable laptop, unfolded to larger screen monitor

- BOE showcased 17-inch bendable laptop display

- TCL CSOT 17-inch IGZO Ink Jet printed OLED foldable display

High Resolution MicroOLED (OLEDoS) to Drive AR/VR Demand

Apple introduced Apple Vision Pro its first AR/VR headset in June 5th at WWDC 2023. Apple calls it a spatial computer because of its ability to blend digital content with physical world. It will be available in early 2024 for $3499. According to DSCC’s Guillaume Chansin’s blog, Apple Vison Pro has 3 display panels. The two primary displays in the Apple headset are based on OLED-on-Silicon (MicroOLED). Apple is not the first company to adopt OLEDoS, but their displays are larger with higher resolutions. The third display is a flexible OLED panel on the front of the headset. Sony is supposed to be supplier for MicroOLED while LGD suppling flexible OLED.

For VR (and pass-through AR) most displays are based on TFT LCD and AMOLED. VR needs high pixel density to reduce or eliminate the screen door effect, as optical lenses magnify the image. It requires high refresh rates and a short duty cycle to reduce motion sickness. There is a need for smaller lighter headsets. For see-through AR, all headsets are currently based on microdisplays (DLP, Micro-LCD, LCoS, Micro OLED) or laser beam scanner (LBS). They need very high brightness displays to match the ambient light; display needs to be small and power efficient to make headsets thinner and light-weight. According to DSCC Guillaume Chansin’s presentation at Business Conference

- VR is expected to dominate the AR/VR market and Micro OLED is expected to capture the largest $US share from 2024.

- VR (including passthrough AR) will dominate in the consumer space. See-through AR mostly for professionals.

- Increasing interest in Micro OLED as it offers high resolution in a compact size.

OLED display is continuously innovating and developing new materials, manufacturing process, and new form factors to drive future demand.

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected].