Display panel and component suppliers showcased next generation product innovations for MicroLED, MiniLED, OLED, Quantum Dot and LTPS LCD at DisplayWeek 2019 at San Jose in May. As application market growth-rates are slowing down suppliers are rushing to find the ‘next big thing’ that will drive demand growth. Generally, technology prototypes take years to be commercialized and reach mass production.

MicroLED: Shifting from concepts to prototypes

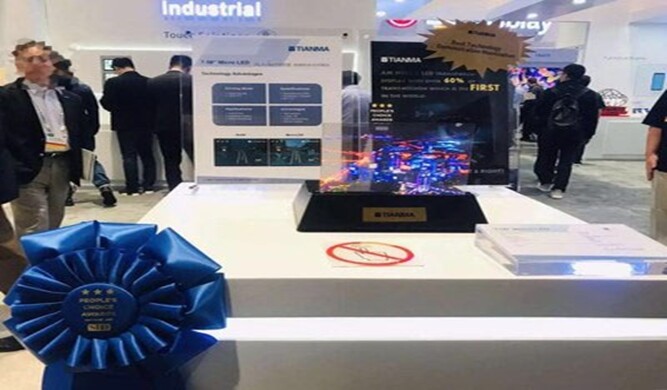

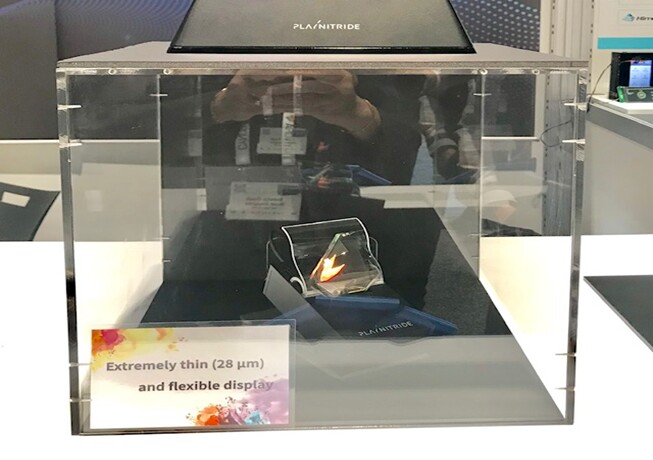

PlayNitride showcased 7.5-inch RGB full color, transparent MicroLED display with LTPS TFT backplane, 720x 480 resolution, 114 PPI pixel density, >600 nits brightness, >60% transparency and <0.7mm border width (developed in collaboration with Tianma). Both Tianma and PlayNitride received SID award for this very impressive product. This product is geared for applications such as automotive, industrial control and home furnishing. PlayNitride also showed an extremely thin (28um) flexible MicroLED display and a 1.25-inch 458dpi MicroLED wearable display. PlayNitride expects mass production at the end of 2019. Glo demonstrated their InGaN based 1.8-inch LTPS based color RGB MicroLED display in partnership with Kyocera. Company is focusing on smart watch products and expects mass production in 2020.

Tianma/PlayNitride – Transparent MicroLED

Tianma/PlayNitride – Transparent MicroLED

PlayNitride (Flexible MicroLED)

PlayNitride (Flexible MicroLED)

Plessey showed GaN-on-Silicon monolithic MicroLED technology (DisplayWeek award) that can enable brighter, smaller, and higher performing solutions for AR/MR headsets, smart glass, pico-projectors and HUDs. Plessey has been working with Jasper Display Corp’s silicon backplane and Aixtron’s MOCVD reactor as well as Nanoco’s QD technology.

MicroLED technology has the advantage of a simple structure, very low power, higher resolutions, high brightness, high stability, longer life, high transparency and narrow borders. This technology still has many challenges especially manufacturing yield issues. Even though many industry observers are concerned about the long path from prototypes to commercial mass production, suppliers are still optimistic and expect many products to come to market in the next few years.

MiniLED: New products emerging with cost challenges

Tianma received best new display component award for LTPS miniLED HDR LCD smartphone display, that features local dimming (with up to 4600 partitions), >1,00,000:1 contrast ratio, >1,000nit brightness, high color gamut, (DCI-P3) and wide viewing angles. CSOT showed a 5.99inch LTPS display (1080×2160), 500nits, >1,00,000:1 contrast ratio with miniLED backlight. For smartphones, MiniLED backlight can empower LTPS LCD by offering higher contrast, higher brightness, faster response time and increase in color gamut. In spite of display performance advantages, MiniLED based products still face cost challenges to make them competitive in the smartphone market. In the near term, suppliers are focusing more on value-based applications such as gaming, automotive and VR.

CSOT showcased ultra slim MiniLED 15.6-inch notebook based on LTPS TFT, 3840×2160 resolution, 1000 nits brightness, 20000:1 contrast ratio and NTSC 100% color gamut. AUO showed a 17.3-inch UHD 4K HDR LTPS LCD with MiniLED backlight, >1000nits brightness, >1,000,000:1 contrast ratio, for gaming and professional notebook PCs. BOE exhibited HDR notebook featuring 15.6-inch oxide display and MiniLED backlight with very high refresh rate of 240Hz.

CSOT also showed 12.3-inch automotive narrow border MiniLED display based on LTPS TFT, 2880×1080 resolutions, 650nits brightness, and >200,00:1 contrast ratio. AUO showed 12.3-inch curved cluster auto display with MiniLED backlights. The company also showcased 2.9-inch LTPS TFT LCD, ultra high resolution (3456×3456), 1688PPI, >1,000,000:1 contrast ratio with MiniLED backlights (2304 zones) for virtual reality application. TCL/CSOT showed a 65-inch RGB AM MiniLED BLU TV with 3840×2160 resolutions, 2000 nits brightness, 1,000,000:1 contrast ratio, BT2020: 90%, DCI-P3 100% color gamut, with >5000 backlight zones.

MiniLED backlight can enhance luminance and HDR in a LCD TV by increasing the number of LEDs and improving the picture performance. A higher number of MiniLED chips can enable better picture quality but may lead to higher costs. MiniLED TV is expected to come in 2019, but it may be 2020 or even later before significant cost reductions can be achieved. If customers can see a substantial difference in picture quality, MiniLED can drive replacement demand.

Tianma LTPS MiniLCD

Tianma LTPS MiniLCD

Flexible Display (AMOLED, OTFT LCD, Reflective): Differentiation through design innovations

BOE and Visionox showcased many innovative designs for flexible AMOLED displays including automotive (transparent pillars, rearview mirrors), smartspeakers, smart lamps, smart monitors and art frames as well as foldable phones. CSOT showed a demo of a 7.2-inch AMOLED foldable display with static & dynamic in-folding and out-folding. BOE showed a 7.7-inch foldable OLED display – QXGA 2480 x 2160, 1,00,000:1 contrast ratio, which can bend 100K times. It also showed a 12.3-inch FHD rollable AMOLED display with bending radius of <R5, thickness <1mm, contrast ratio 1,00,000:1 with 100K times bending capability, which can be rolled out and rolled back.

Photo-4

Factors that can enable the success of foldable phones are durability/reliability, mechanical performance, adhesion, sensitivity, thickness, quality, visibility of creases, and the user’s experience. Foldable display creates new challenges in reliability, manufacturing and yield. The cover window needs both hardness and flexibility, a tricky combination. There have been discussions about plastic vs. glass for foldable applications. Schott, Corning and AGC are all working on developing ultrathin high strength bendable cover glass for foldable phones that can improve durability, optical clarity and scratch resistance compared to plastic. But plastic can provide a better bending radius and higher flexibility.

Foldable can be considered as the starting point for many other new form factors such as rollable, stretchable and others. Foldable can be applicable to other applications beyond smartphones such as notebooks.

BenQ Materials showcased an impressive advanced color shift solution for foldable AMOLED displays. It also showed an automotive display solution to improve visibility including anti-reflective solutions and efficient light control.

LG Display showed its 65-inch rollable OLED TV and a very impressive 88-inch 8K OLED TV (People Choice award), which offers fine details, an immersive experience and depth due to the deep black color. LGD also showed a 6-inch, light field OLED display which creates a volume image by using light fields, high angular resolutions, and a perfect black creating floating effect.

LG Display, BOE and others showed many different options for automotive applications with a focus on design flexibility, a curved form factor and transparent display. LGD showed a more than 12.3-inch size automotive POLED for cluster and CID.

JOLED showed 21.6-inch 4K flexible printed OLED with plastic substrate and LTPS backplane. The company has constructed a production line for printed OLED with target for mass production in 2020.

FlexEnable showed a larger than 8-inch flexible organic TFT LCD plastic display that is conformable, free form, lightweight and enables new product designs in smart home, automotive, signage and other applications.

E Ink showcased full color reflective (e-paper) display in 26-inch and 13.3-inch with less than 3 second update time for new color image. Both displays are in production. It also showed a 32-inch foldable display targeted for architecture and construction, featuring a-Si TFT on PI.

Quantum Dot: Offering multiple solutions

Nanosys received a DisplayWeek People’s Choice award for showcasing varieties of QD displays including a Hisense ULED XD TV (using a dual cell LCD panel and Nanosys QD technology). The product is expected to be available in 2020. BOE and CSOT both also showed dual cell LCD panel technology where a monochrome LCD is placed directly behind a color LCD resulting in larger number of dimming zones and higher contrast. Nanosys showed a Vizio P series Quantum X, 3000 nits TV, Samsung 82-inch QLED 8K QD TV, BOE’s QD notebook and HP’s QD gaming monitors. The company is working with highly efficient InP QDs in collaboration with LG Display to develop emissive QD display and presented a paper at the conference.

CSOT showed an LCD display with a ‘QD polarizer’ (although I struggled to find out exactly what that was – Man. Ed.), a 65-inch Q-cell and with a quantum dot display with high efficiency QD polarizer, which provides ultra wide viewing angle. NanoPhotonica presented its emissive EL-QLED technology at the investor conference.

BOE-Rollable AMOLED

LTPS LCD: Pushing the technology to new limits

While next generation technology such as MicroLED, OLED and QD are bringing new innovations, LTPS LCD is still pushing the technology for new features and capabilities. AUO showed a 6-inch full screen in-cell fingerprint LTPS LCD prototype at the conference. AUO and others also showed hole in-cell touch capability for LTPS LCD to compete with OLED in the smartphone market.

LTPS LCD is also expanding its presence in automotive, notebook and other medium size display market. The automotive market is moving towards electric, connected and autonomous vehicles where the display requirements are shifting towards high resolutions, low power, higher performance and design flexibility (example: ultra wide pillar-to-pillar display, reconfigurable dashboard). JDI has been designing and producing concave-curved 12.3 (R1500mm) 1920 x 720 and 15-inch (R3000mm) 1920 x 720, LTPS TFT LCD modules for which it has received the Display Application of the Year award from the SID.

The DisplayWeek 2019 conference covered an extensive array of new prototypes including many different products in 8K ranging in sizes from <5-inch to above 100-inch. BOE showcased series of 8K products (3.5-inch, 13.3-inch notebook, 27-inch monitor and 50-100-inch TVs. In recent years, application markets such as smartphones, notebook, monitor and TVs having seen growth rates slowing down considerably. Next generation technology innovations are essential to drive replacement demand and create new markets. (SD)

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insight.com