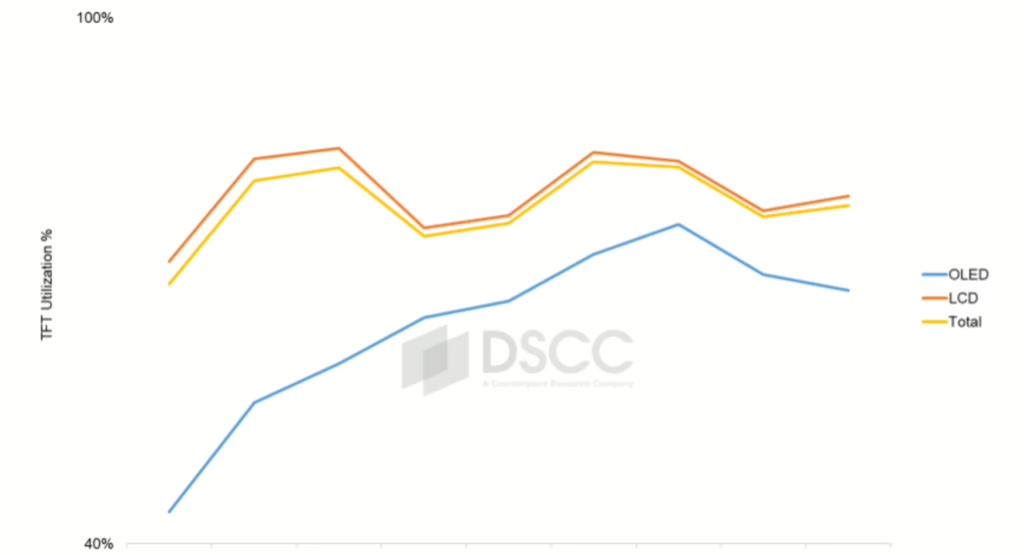

In a recent report by DSCC, the flat panel display industry shows signs of carefully managing production capacity in the latter half of 2024. After a modest recovery in the second quarter driven by anticipated events like the Euro Cup and Paris Olympics, along with a PC market refresh cycle supported by AI-powered computers, display manufacturers have since moderated their factory utilization rates.

While overall worldwide fab utilization experienced a slight QoQ decline in the third quarter, regional variations emerged. Korea and Taiwan saw sequential increases in utilization, contrasting with a more pronounced slowdown in Chinese manufacturing.

The OLED display segment showed resilience. Mobile display utilization for rigid OLED panels reached around 80% since the second quarter, fueled by growing demand in notebook PCs and smartphone markets. Flexible OLED panels continue to follow a predictable seasonal pattern, typically seeing higher utilization in the second half of the year due to Apple’s product cycles and holiday sales. However, new OLED lines intended to supply panels for the OLED iPad Pro experienced a sharp decline in utilization during the fourth quarter, attributed to weaker-than-anticipated demand.

The LCD segment has been more significantly impacted, with utilization rates showing more pronounced declines. This is particularly evident in China, where manufacturers took extended shutdown periods around the National Day holiday, a departure from previous years’ practices.

Total display capacity continues to substantially exceed current market demands. To prevent inventory buildup and maintain market stability, manufacturers are strategically restraining production. The approach appears to have achieved a soft landing, with panel prices stabilizing in the fourth quarter of 2024.