So I was wrong… we have not seen the endgame, yet. The AMLCD industry has not been roiled by mergers and acquisitions as I thought possible back in 2001. At the time, I was deep in long-term strategy for the Philips-LG joint venture we now call LG Display. Studies on industry endgames were being published, most notably by AT Kearney, and I postulated ways display makers might shake themselves out.

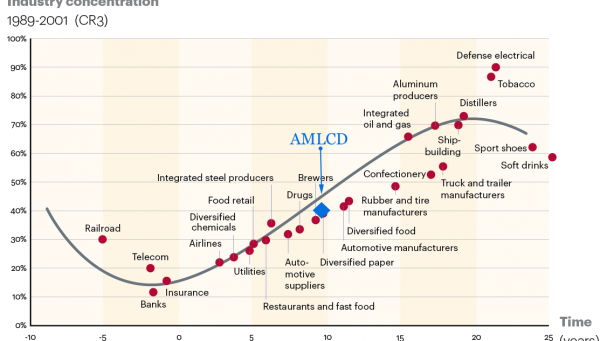

The following chart adds my old assessment of the AMLCD industry’s position along the CR3 curve (concentration ratio or share of the top-three companies) in 2001. Sharp demonstrated the first wall-hanging LCD TV in 1991, so that seemed to be a good starting point. Ten years later, the top-three makers had a combined capacity share of 40%. That put the AMLCD industry in an endgame position similar to beer makers, which seemed good to me… big fab bets and big steins of beer went well together. It seemed reasonable to think that we would see AMLCD consolidation similar to the brewer mergers in the press today.

Merger Endgame – Click for higher quality image

Merger Endgame – Click for higher quality image

But, we haven’t… it seemed likely from 2001 to 2011, however. The AMLCD concentration ratio reached 64% at the 20-year point, but that placed panel makers below the hypothetical endgame curve. Since then, the top-three share has declined to 57% and Charles Annis of IHS predicts a CR3 of 51% in 2018. If we look back in eight-year increments, We can see that Korean makers LG Display (formerly LG.Philips LCD) and Samsung in various entities remain leaders with the #3 spot shifting from Taiwan to China.

| 2002 | 2010 | 2018 | |||

|---|---|---|---|---|---|

| Maker | Share | Maker | Share | Maker | Share |

| LGD | 14% | Samsung | 24% | Samsung | 19% |

| Samsung | 14% | LGD | 22% | LGD | 18% |

| AUO | 10% | Innolux | 17% | BOE | 14% |

| CR3 | 39% | CR3 | 63% | CR3 | 51% |

Such historical reviews lead me to revise my mental model… perhaps there will be a shake-out without an endgame merger frenzy. While we see some companies capitulate during crystal cycle busts (asset impairments/sales by CPT is a recent example) we have not seen mergers on the scale of AUO buying Innolux or AB InBev buying SAB Miller.

Lack of scale economies is one reason for this, perhaps. As I have presented at SID conferences, adding AMLCD area capacity does not seem to reduce AMLCD area cost. A big merger might lead to a swanky party but the hangover would certainly lead to a long-term headache trying to load the increased capacity with profitable product.

If there is no advantage to consolidation, we may see the AMLCD industry continue to evolve along national lines of interest. China is doing what it did in LED and PV industries and it hopes to do in the IC industry: cultivate national champions and capture global share. If this is the future, what can we do but give display makers a hand?

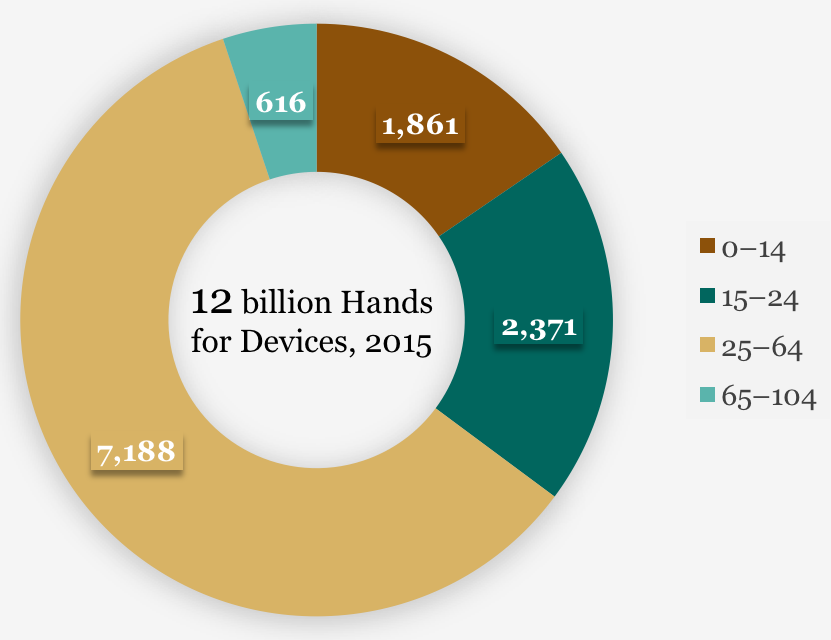

Potential hands to hold mobile devices by age range in millions, 2015

Potential hands to hold mobile devices by age range in millions, 2015

Well, hands, really. It takes lots of hands to hold all the mobile display products the industry can make with all the fabs coming on-line. The good news is that the world population exceeds seven billion people this year, according to the CIA fact Book. If I divide this up by age group and assume Students, Young Adults and Working-age Adults want a device in each hand (say a tablet and a phone) while Children and Seniors will get by with one-handed media consumption, then global demand could be 12 billion devices! Oh, and that could grow 11% a decade… seems like there’s plenty of demand for plenty of device makers, which is good because most of the makers want to keep making panels without making money.

So won’t you give your favorite display maker a hand and replace your phone today?

David Barnes

—————

AT Kearney links

The Merger Endgame Revisited

https://www.atkearney.com/documents/10192/2088020/The+Merger+Endgame+Revisited.pdf/3b8c5602-317f-48a1-ae49-354d4a3e8737

https://www.atkearney.com/paper/-/asset_publisher/dVxv4Hz2h8bS/content/the-merger-endgame-revisited/10192