DSCC reports that China’s OLED production capacity is expected have a CAGR of 8% from 2023 to 2028, while the SAGR for South Korea is 1.4%. By 2028, China’s OLED capacity is projected to exceed South Korea’s. LCDs will have a CAGR of 1%, while OLEDs CAGR will be 4.8%. This growth is expected to significantly alter the competitive landscape of the global display market, with China poised to extend its leading role in LCDs to OLEDs. China’s share of global display production capacity is expected to rise from 68% in 2023 to 76% in 2028, while the production capacities of Japan, South Korea, and Taiwan decrease in absolute terms.

BOE is expected to outpace Samsung Display in flexible OLED production capacity for foldable smartphones. DSCC stated, “Samsung Display currently leads BOE with its A2 production line for mobile and IT OLEDs,” but added, “However, by 2028, BOE is expected to surpass Samsung Display, thanks to its 8.6-generation IT OLED production line (B16).” This development underscores the rapid advancements and investments being made by Chinese firms in the display technology sector. Visionox is also expected to rank third in flexible OLED capacity with a 14% market share by 2028. This further highlights the growing dominance of Chinese companies in the OLED market, which is crucial for the development of next-generation electronic devices such as foldable smartphones.

DSCC explained, “BOE still leads significantly in LCD display production capacity, followed by China Star Optoelectronics Technology (CSOT),

the preferred bidder for the sale of LG Display’s large LCD production subsidiary in Guangzhou, acquires the factory, its market share is expected to surge further. According to DSCC analysis, “If CSOT acquires LG Display’s China LCD fab, its LCD production capacity market share is expected to surge to 23% by 2025,” adding, “BOE’s lead is expected to drop to 5 percentage points from 2025 to 2028.”

China’s government has implemented policies to support the growth of its high-tech industries, including the display sector. These policies include subsidies, investments in research and development, and support for domestic companies to expand their global market share. This strategic support has enabled Chinese firms to challenge the dominance of South Korean and Japanese companies in the display market.

Huawei and BOE Demonstrate Competitiveness in Smartphone and Foldable Panel Technology

Even more significant, in terms of the future, is that Huawei, stole the thunder from fold smartphone/tablet, which is based on a BOE OLED demonstrating at least parity with the leader SDC.

Huawei unveiled the world’s first commercial tri-fold smartphone, the Mate XT, during a new products release event on day after the Apple announcement.

Huawei’s Mate XT has a 10.2-inch screen and measures just 3.6mm thick. Claimed to be the slimmest foldable phone by Huawei, it comes with a small keyboard accessory fits right in a pocket, making it easier to carry around.

The starting price is 19,999 yuan (about $2,800) for the version with 256GB storage. Two more memory options are priced at 21,999 yuan and 23,999 yuan, placing the Mate XT at the higher price range for foldable phones. Pre-orders in China were reported to be ~3m.

The announcement comes at a time when is Apple has been losing its grip on the Chinese market dropping from third to sixth place. Huawei’s success at home has given it an even stronger advantage over other big brands like Samsung. The Mate XT has impressive technology, but it’s expensive price puts it out of reach of most buyers globally, so it won’t be a top seller. Still, the Mate XT marks Huawei’s ability to push the tech forward and stay a leader in the industry, while Apple remains stuck in trying to engineer its version of “the best foldable”. Display expert Ross Young and Apple connoisseur Ming-Chi Kuo report that Apple’s first foldable with a display from LGD (not SDC) will be released in the 2026/7 timeframe and it is likely to be a foldable version of the iPad, which exactly what Huawei’s just delivered with the Mate XT.

US sanctions forced the Huawei to come up with a competitive ecosystem by not allowing the company to use the latest Android apps. So Huawei developed the Harmony OS and the associated apps which can compete with iOS and Android. What was once a US dominant smartphone software position, now has a Chinese competitor, which could be enhanced if the CCP let it be known that all the Chinese OEMs should transition to Harmony. In 2023, Chinese OEMs had a 54%, Samsung 21% and Apple 18% share of smartphone shipments.

To demonstrate their software ambitions, Huawei showed a new edition of Aito M9 and newly released Luxeed R7, both powered by Huawei’s Harmony Intelligent Mobility Alliance (HIMA), during the event. (Xinhua/Liang Xu).

Aito M with Harmony Intelligent Mobility. (Source: Huawei)

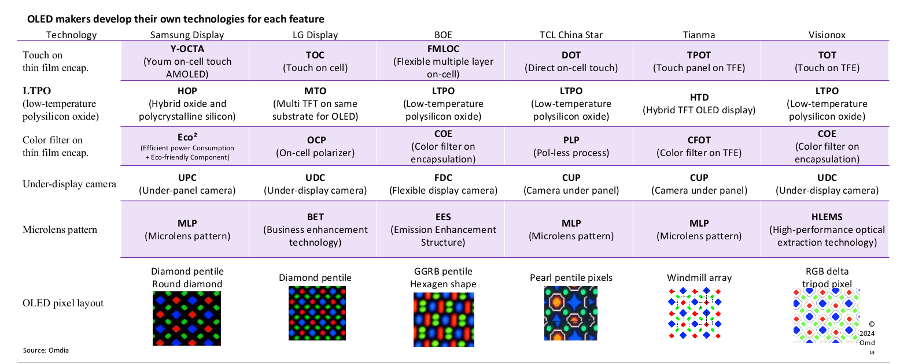

BOE, CSOT and Tianma and Visonox are all taking aim at SDC’s OLED technology leadership and are able to compete with advances originally developed by SDC, including:

- LTPO

- Integrated Touch

- Elimination of the circular Polarizer

- Under Panel Camera

- Microlens Patterning

- Pentile Pixel Layout

- Hybrid OLED with tinned substrate and tandem architecture

The state of these advances are depicted in the next table. BOE is also using thinning substrates and tandem architecture. Visionox is a leader in replacing the FMM with lithographic patterning of sub-pixels, which they calin will produce tandem architecture performance with a single emitted layer and along with JDI is working with AMAT on the deposition equipment, which is expected to be much less expensive than the Canon Tokki Gen 8.6 deposition tool.

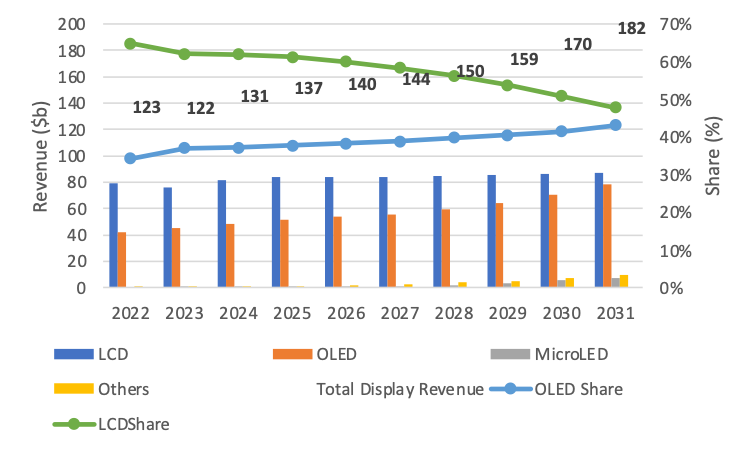

OLEDs narrow the gap with LCDs in display shipment revenues. (Source: DSCC)

DSCC and Omdia, expect OLEDs to close the gap in market share with LCD to 5% by 2030 after starting at 32% in 2020. Moreover in some of the largest (by revenue) applications, OLEDs now lead in the high priced and profitable end, i.e. smartphones, TVs, automotive, gaming monitors, and will soon lead in tablets and PCs, when the new Gen 8.6 OLED IT fabs start production in 2025/6. Moreover the threat from MicroLEDs is non-existent in the decade.

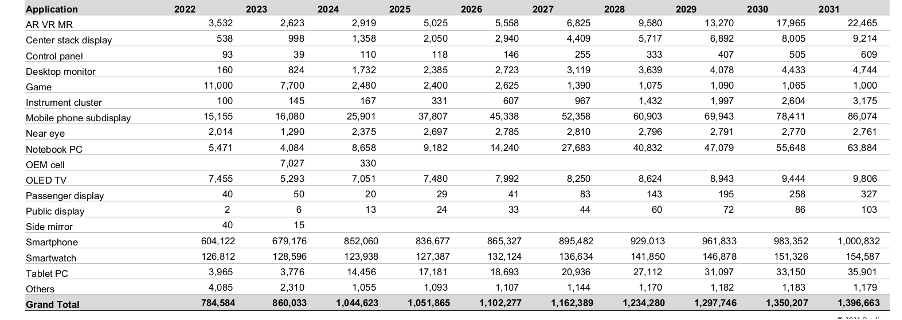

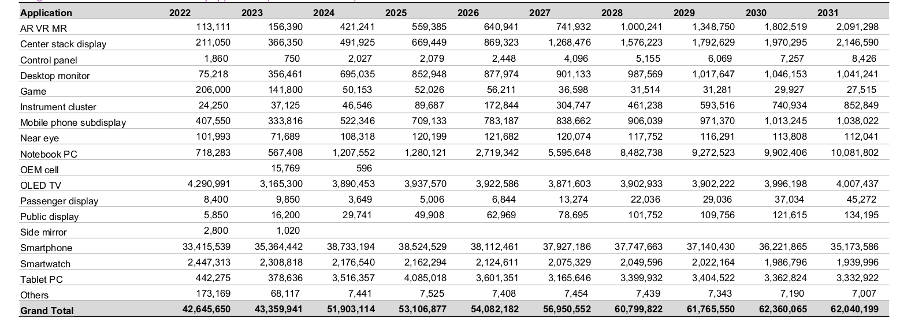

The next 2 tables show Omdia’s OLED display unit and revenue forecast thru 2031, by application.

Samsung Wants Over $700m for Leak of IP to Chinese

With Samsung losing the technology and funding battle, they have shifted to what appears to be a last gap by suing the Chinese for infringing on their IP. Samsung has upped the damages claim against Toptec to such a great extent. It either signals to the market and its Chinese competitors that Samsung is very serious about protecting itself or it lays the groundwork for any potential hits the company may be taking from the competition. It is easier to blame any shortcomings on unfair practices by the competition, particularly if you have a court case that backs up your claims, than it is to feel overwhelmed by the extent of competition. TCL and Hisense are flexing a lot of muscle in Europe and IFA 2024 is a turning out to be a showcase of their growing power in the region. That has got to hurt.

Ultimately, there are few possible answers for Korea’s display industry. The Koreans are unhappy with the level of state support for Chinese manufacturers, and want the Korean government to do more. It is almost a desperate plea right now. The more esoteric technology questions like QD or not QD, or PenTile vs. GGRB may just pass over most consumers heads and not make any dent in actual sales. It’s hard to see how Samsung or LG can slow down the increasing encroachment by TCL and Hisense, and other Chinese competitors. At IFA, these companies are showing products that suggest they are not just budget product makers, that they have the means to compete in the premium segment of the market.

For example, TCL has its 115-inch QD-MiniLED TVs, AI-powered smart home energy systems, and paper-like smartphone displays, positioning itself as a leader in the large-screen TV market. Hisense is promoting its 163-inch MicroLED TV, smart home appliances, and gaming-focused TVs with enhanced features, such as high refresh rates, and getting noticed for it. There’s also Honor, which introduced its foldable smartphone, the Magic V3, directly challenging Samsung’s foldable series, taking a bold marketing approach by mocking Samsung’s chunkier design.

From the outside, it looks like the Chinese companies are holding their own, or even surpassing, their Korean rivals on technology. For their part, Korean companies like Samsung are looking to debunk those claims in hopes of maintaining their perceived advantage. It looks like the gap is closing and it may not matter how you fight it on the details, it won’t make much difference if your market share continues to get eroded. It might be interesting to see how this all pans out for the suppliers of materials, and equipment to companies in Korea and China, mostly out of Japan and the West. They might end up getting caught in the middle having to support their customers on both sides, assuring everyone else that they are all equally capable. What else can they do? That’s a bind as accusations fly and sides have to be taken.

About a year ago, Samsung Display claimed 3.6 billion won in damages against Toptec over an alleged OLED technology leak. Now, the company is significantly increasing the claim to 73 billion won (approximately $730 million), a move that Toptec has criticized as an excessive and one-sided demand that does not align with legal standards, according to The Elec.

This case dates back to 2018 when the Suwon District Prosecutor’s Office indicted a Toptec business executive, accusing the company of leaking equipment used in the OLED flexible lamination process to a Chinese panel manufacturer. Although Toptec had produced the equipment, Samsung Display had collaborated with them in developing its design and structure.

In the summer of 2023, the South Korean Supreme Court upheld a lower court’s decision, maintaining the guilty verdict against Toptec’s management for the technology leak. Samsung Display now wants a more than 20-fold increase in damages and Toptec is not happy, asserting that the new figure is solely based on unilateral accounting on Samsung Display’s part.

Barry Young has been a notable presence in the display world since 1997, when he helped grow DisplaySearch, a research firm that quickly became the go-to source for display market information. As one of the most influential analysts in the flat-panel display industry, Barry continued his impact after the NPD Group acquired DisplaySearch in 2005. He is the managing director of the OLED Association (OLED-A), an industry organization that aims to promote, market, and accelerate the development of OLED technology and products.