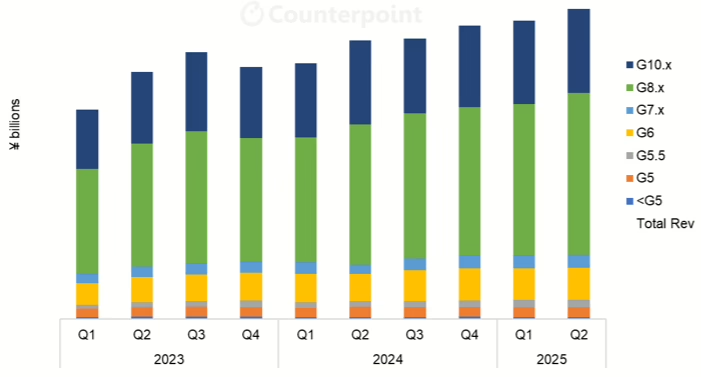

Display glass revenues are poised to surge by 14% year-over-year (YoY) in the first half of 2025, driven by a combination of strategic price hikes, recovering demand, and significant capacity expansions by domestic Chinese manufacturers, according to the latest update from Counterpoint.

In Q4 2024, the market already demonstrated its resilience with a 16% YoY increase in revenues and a 7% YoY rise in shipments. Despite a slight 1% quarter-over-quarter (QoQ) decline in overall capacity, the sector witnessed 2% annual growth. This growth was fueled by aggressive capacity additions in China, where domestic glassmakers bolstered their production with new Gen 8.5 facilities during 2023–2024.

While China accounted for 75% of global demand in Q4 2024, with expectations of a 9% YoY increase in H1 2025, the region’s influence is set to grow even further. Projections indicate that China’s share of the display glass market will hit an all-time high of 77% by Q2 2025.

Leading supplier Corning, despite historically holding a commanding market position, experienced a 5% YoY decline in shipments in Q4 2024. This decline came even as the overall market enjoyed a 5% rise, allowing nimble Chinese players such as Irico and Tunghsu (also known as Dongxu) to capture additional market share by expanding their Gen 8.x production capacities.

Price adjustments have also played a critical role in the market’s performance. In the latter half of 2024, Corning implemented a double-digit percentage price increase, a strategy that saw display glass prices climb by 3% in Q3 and 7% in Q4. This pricing strategy, executed in Japanese yen, was influenced by the recent weakening of the yen and has resulted in revenues growing at a faster rate than shipments. Competitors AGC and NEG have followed suit, establishing a rough price parity among the top three suppliers.

Looking ahead to 2025, shipment trends are expected to be mixed. Projections indicate a modest quarterly increase of 2% in Q1 2025, with a YoY rise of 6%, while Q2 is forecast to see a further 4% quarterly growth but a more tempered YoY increase of just 1%.