Apple consistently out performed sales estimates of its iPhones but Digitimes is convinced Samsung will stay on top of the Smartphone heap

The research arm of Digitimes (D-T) has released a prediction that flatly states Samsung Electronics will lead the rankings of top smartphone vendors in 2015 with more than 1/2 billion units coming from the two top firms, Samsung (at 330 million devices) and Apple (230 million devices) alone. By the group’s reckoning, Android will ship in 70% of the total smartphones sold in 2015, according to the D-T research tracking team that looks at global market device supply chain data. Other top smartphone sellers forecast by the group include Lenovo (with its Motorola Mobility acquisition) ramping up to 84 million units, LG ranked 4th in the forecast at 67 million and Huawei at 65 million.

Samsung has had problems lately as sales of the Galaxy S5 suffered at the hands of the launch of Apple’s iPhone 6 franchise, that brought the screen size to parity with Samsung. Barons is also reporting a study by Cowen and Company which surveyed iPhone 6 users to find that a full 25% of all iPhone6 and 6 Plus purchasers came from those new to the iPhone platform, and reported, mostly from Android. The population surveyed included 1,000 from the US and China, plus 500 from the UK and Japan. It included 1500 iPhone owners and 1500 who planned a purchase within 12 months. The group also reported that a large number of iPhone users (35%) have already begun using the Apple Pay NFC-powered option on the device. This feature topped the list of “important factors” in the buying decision according to the group. From these results, Cowen increased its price target for Apple to $135.

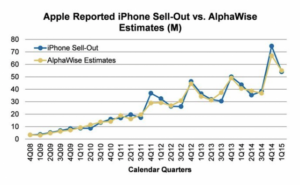

For its part, Apple is having a very good Q1-15 with Morgan Stanley reporting on March 11, a forecast of 53 million iPhone6 units sold, an increase of two million from the investment group’s original numbers. In all, 54 million iPhones of all types will sell in Q1-15 according to its tracking. This news came on the heels of a record breaking quarter for Apple in the last three months of 2014. The company sold a whopping 74.5 million units, and net profits for the company were up an equally stunning 38% at $18 billion, from sales of $74.6 billion. Samsung is not revealing exact smartphone numbers for Q4-14 stating rather that it sold 95 million total phones (of all types) and “somewhere in the high 70% range” of those were smartphones (…so go figure – OK, somewhere between 71 million to 75 million units.) See: Who Won the holiday quarter Apple or Samsung?

Perhaps most stunning were Apple’s Q4-14 results in China with sales up a whopping 70% at $16.1 billion, and this in the face of both a strong dollar and other world currency issues that probably cut revenue by up to 4% according to a Forbes report in late January. Keep in mind, the China numbers were produced two weeks into the month of October. Apple’s iPhone 6 and 6 Plus didn’t begin shipping there until Oct 17th.

Going forward, Apple’s iPhone 6 supply chain orders for Q2 delivery are currently at 45 million units, again a slight boost from initial reports that ranged from 42 million – 44 million units. Meanwhile, Digitimes is reporting supply chain orders for (non-Samsung) Android devices in 2015 are all down year on year characterizing the climate for the bulk of the Android Smartphone device suppliers as “cautious,” according to Digitimes.

Analyst Comment

But the group is anything but cautious when it comes to Samsung’s dominance in 2015. The new Galaxy 6S and Galaxy Edge are reporting strong pre-orders and an April 10th launch in some 20 countries worldwide. We’ve already reported impressive display test results on the new OLED-based devices that achieved ground breaking results, and did so with OLED on a flexible backplane. What is still yet to be determined, is whether Samsung can not only keep up the sales numbers, but get the price margins it needs to drive up profitability and the ultimate health of the company. – Steve Sechrist