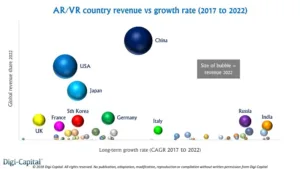

America delivered more AR/VR revenue than China last year, but Chinese growth in the next five years could see it dominate the market long-term, and not by a small margin, according to Digi-Capital. China has the potential to take more than $1 of every $5 spent on AR/VR globally by 2022, while Asia could deliver around half of global AR/VR revenue in five years’ time.

The report goes on to indicate that AR could dominate VR long-term. AR could approach an installed base of 3.5 billion and $85 billion to $90 billion revenue by 2022, while VR might deliver an installed base of 50 to 60 million and $10 billion to $15 billion revenue. Entertainment could account for two-thirds of VR revenue long-term, with hardware taking just over a quarter.

Click image for higher resolution

Click image for higher resolution

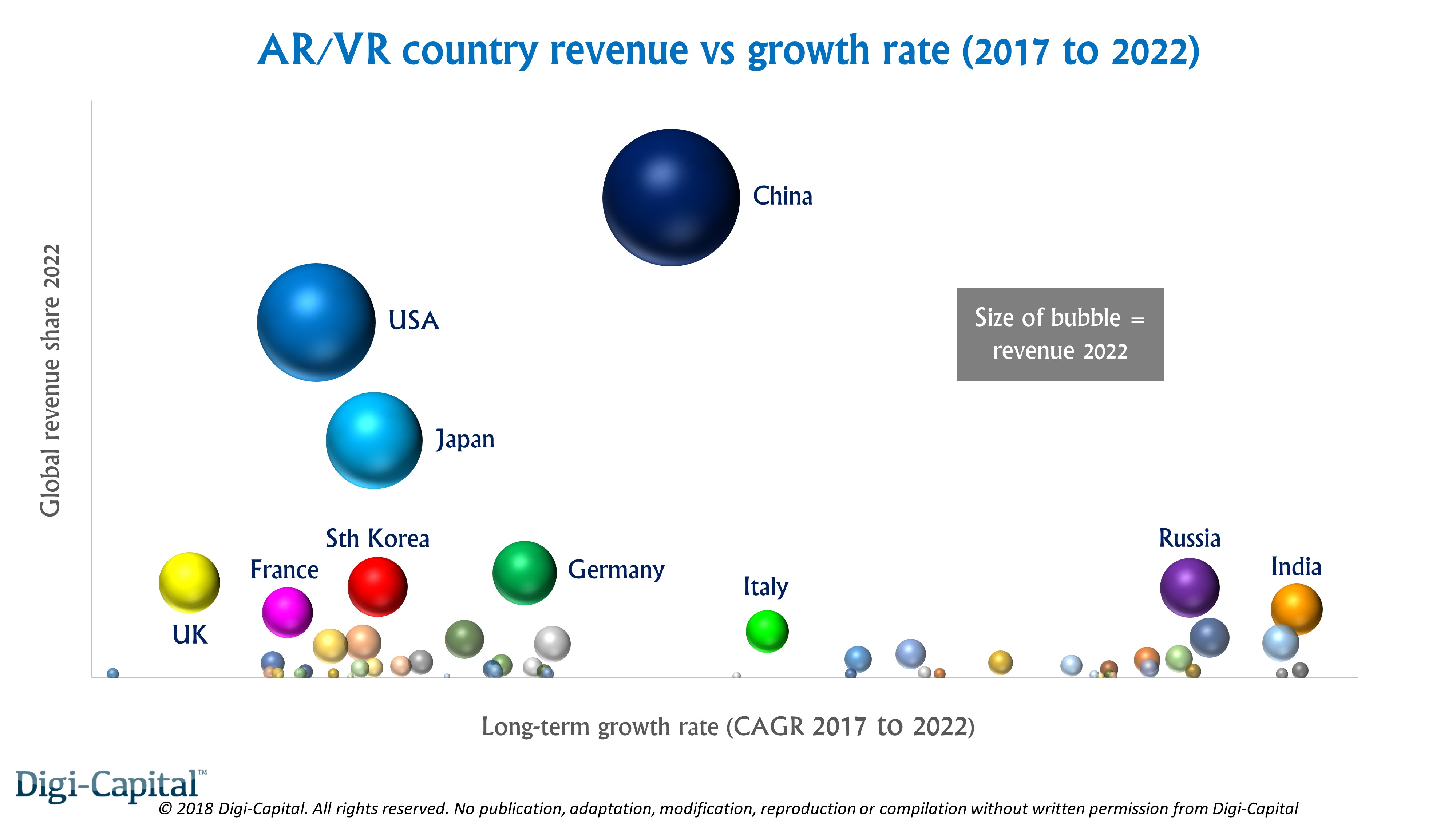

The VR market’s country dynamics have much in common with the wider video games market. The US has a significant installed base of Sony’s VR capable games consoles (banned in China until recently) and high-end VR capable PCs. It also has highly profitable core gamer economics, which could give it an advantage if premium standalone VR hits its stride in a few years.

While China has a much larger mobile installed base, mobile/standalone VR’s trajectory took a fundamental hit last year, following the launch of mass-market mobile AR. Combined with lower ARPU for mobile/standalone VR, China is at a relative disadvantage to the West on a per user basis. The US could take around a fifth of global VR revenue by 2022, making it slightly larger than China. Europe could also deliver, but the region combined might only be slightly larger than either the US or China individually.

Click image for higher resolution

Click image for higher resolution

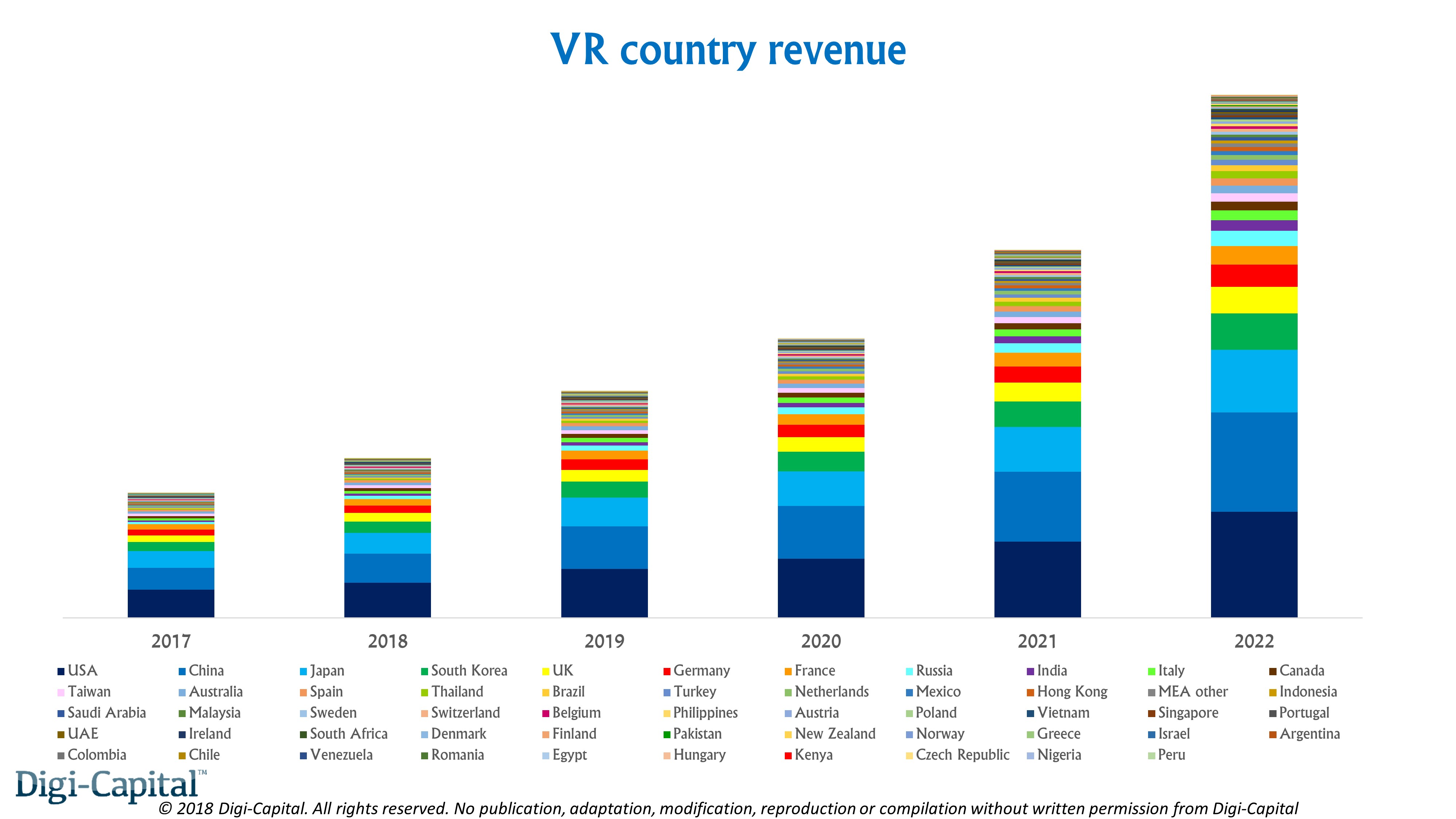

E-commerce sales, hardware sales, ad-spend, app store, enterprise and location-based entertainment hold significant promise for AR. Chinese ARCore could have a global installed base approaching ARKit’s scale long-term. From 2020, smartphone tethered smartglasses could become premium peripherals to Apple and others’ phones. This could see China dominate global mobile AR and smartglasses long-term. Then there’s China’s market dynamics, business models and economics to consider:

- China drives 40% of global e-commerce and its mobile payment market is 11 times that of the US.

- Apple took 85% of Chinese premium smartphone shipments in the fourth quarter of 2017.

- China overtook the US in iPhone sales in 2015.

- Mobile advertising could take 60% of Chinese advertising and over 80% of Chinese digital advertising long-term.

- As early as 2014, Chinese domestic Android app stores rivalled Google Play worldwide outside China.

- Chinese iOS developers have earned $17 billion so far, 25% of global iOS app store revenues.

Click image for higher resolution

Click image for higher resolution

E-commerce could be the largest AR application, where China might dominate. Smartglasses hardware sales could come next, with premium Chinese iPhone users core to Apple’s potential long-term smartglasses dominance. Tencent is in prime position for the third largest application of AR advertising, not to mention Chinese iOS and Android AR app store revenues, enterprise AR and location-based AR entertainment at scale.

Combining China’s impending AR installed base, business models and economics, and it could see nearly one-quarter of all AR revenues globally by 2022. Merging all the country data for a regional view, Asia could take over half, Europe under one-quarter and North America less than one-fifth of global AR revenues.

While the US might win VR, China could dominate the much larger AR opportunity. Digi-Capital maintains that the US and other western countries can still do well from AR/VR long-term. However Asia, China in particular, is critical to the future of the market. Global players need to find a way to compete, or risk being left behind.