Tablet shipments will fall for the second straight year in 2016 – down 9.6% YoY, says IDC. The firm expects tablets to decline in 2016 and 2017, with a slight rebound in 2018 and beyond thanks to detachable growth. Currently, detachables make up about 16% of the market; IDC believes that this will grow to 31% by 2020.

Although initially assumed to have a lifetime similar to smartphones, tablets have proven to be more like PCs in the early 2010s; consumers keep them for about four years, on average. Tablet makers are now shifting towards detachable tablet production, which has led to more choice, higher consumer awareness and lower ASPs. PC makers, which had assumed that the detachable market was a ‘natural extension’ of PCs, are now facing competition in the space.

Jean Philippe Bouchard, research director at IDC, commented that “some manufacturers, like Apple, [see detachables] as a way to spur replacement cycles of the existing slate tablet installed base… One reason why the slate tablet market is experiencing a decline is because end-users don’t have a good enough reason to replace them, and that’s why productivity-centric devices like detachable tablets are considered replacement devices for high-end larger slate tablets.”

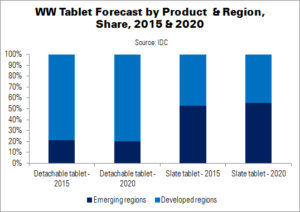

Despite the negative sentiment towards slate tablets, IDC still expects shipments of these devices to remain well above 100 million units through 2020. This is mainly due to their low cost and new smaller screen sizes. Sub-9″ slates had an ASP of $183 in 2015, expected to fall to $157 in 2020. Emerging markets are especially fond of these products.

“It wasn’t long ago the industry talked about one PC per person and to some extent that theory has vanished,” said Ryan Reith, IDC program VP. “I’d rather look at it and say the PC we were referencing six to eight years ago has changed, drastically. In many emerging markets the only computing device for many will be a mobile device, whether that is a small screen tablet, smartphone, or both. This is the main reason why, despite all the hype that the detachable category receives, we believe cheaper slate tablets fill an important void.”

| Worldwide Tablet Share Forecast by Product Type and OS, 2015-2020 | ||||

|---|---|---|---|---|

| Product | OS | 2015 (A) | 2016 (F) | 2020 (F) |

| Detachable tablet | Android | 16% | 12% | 20% |

| iOS | 14% | 38% | 29% | |

| Windows | 70% | 49% | 51% | |

| Total | 100% | 100% | 100% | |

| Slate tablet | Android | 72% | 75% | 75% |

| iOS | 25% | 22% | 21% | |

| Windows | 3% | 3% | 4% | |

| Other | 0% | 0% | 0% | |

| Total | 100% | 100% | 100% | |

| Source: IDC | ||||