I am the CEO of the OLED Association a trade group that promotes the use of OLED technology and as a result, I am biased about OLEDs. Smartphones are the driving force that has invigorated OLED displays and is just the latest application to boost the flat panel industry.

In the 90s the display market was driven by IT, in the first decade of the 2000s it was the TV and in the second decade it has become the smartphone. Smartphones have had a wide impact on the growth of display technology and are the dynamic force for a wide range of new trends and inventions, including:

- LTPS capacity

- AMOLED Mass Production

- Merger of cell phone and tablet features

- Multi-touch capability becomes ubiquitous

- Emergence of the 1st high volume use of flexible displays

- Multiple OS – Android and iOS

Smartphone production has also changed the rankings of IC by applications as Comm., which includes smartphones, has pushed IT into the second position, as shown in the following table.

Table 1

| IC Production by Application (M of Ics) | ||||||

|---|---|---|---|---|---|---|

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015e | |

| Comm. | 73,877 | 85,206 | 88,239 | 99,435 | 114,293 | 128,743 |

| Computer | 112,955 | 109,231 | 97,291 | 98,012 | 93,801 | 85,283 |

| Consumer | 42,160 | 35,159 | 33,555 | 33,321 | 33,089 | 32,529 |

| Auto | 15,590 | 18,110 | 18,645 | 19,344 | 21,073 | 23,415 |

| Industrial | 17,461 | 15,793 | 14,776 | 14,905 | 15,185 | 15,626 |

| Gov./Mil | 1,758 | 2,133 | 2,307 | 2,297 | 2,310 | 2,346 |

| Total | 263,801 | 265,632 | 254,813 | 267,314 | 279,751 | 287,942 |

| Source: IC Insights | ||||||

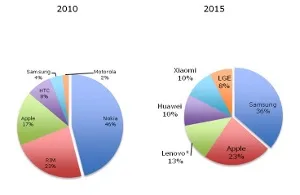

Annual smartphone growth rates from 2010 to 2015 have averaged ~25% and Apple and Samsung have been the leaders, with Apple establishing a lock on profits. The smartphone supplier base has shifted from the North America and Europe to China and Korea as shown in the next figure.

Figure 1 – Smartphone Market Share by Supplier * Includes Motorola – Source: Canaccord Genuity, OLED-ASamsung, the supplier of OLED displays for smartphones has the largest market share but is on the decline and shares the lead with Apple, depending on the quarter. Apple the originator of the touch-based smartphone reported the following number of shipments for its products during the quarter:

Figure 1 – Smartphone Market Share by Supplier * Includes Motorola – Source: Canaccord Genuity, OLED-ASamsung, the supplier of OLED displays for smartphones has the largest market share but is on the decline and shares the lead with Apple, depending on the quarter. Apple the originator of the touch-based smartphone reported the following number of shipments for its products during the quarter:

- 61.17 million iPhones compared to 43.71 million in the year-ago-quarter, representing 69% of its total revenue with an ASP of $659

- 12.6 million iPads compared to 16.35 million in the year-ago-quarter

- 4.56 million Macs compared to 4.13 million n the year-ago-quarter

- Internet services, led by sales of Apps on on the iOS and Mac App Store, Apple Pay and others generated revenue of $4.996 billion, compared to $4.573 billion in the year-ago-quarter

The net quarterly profit was $13.6 billion and 85% of these profits came from the iPhone.

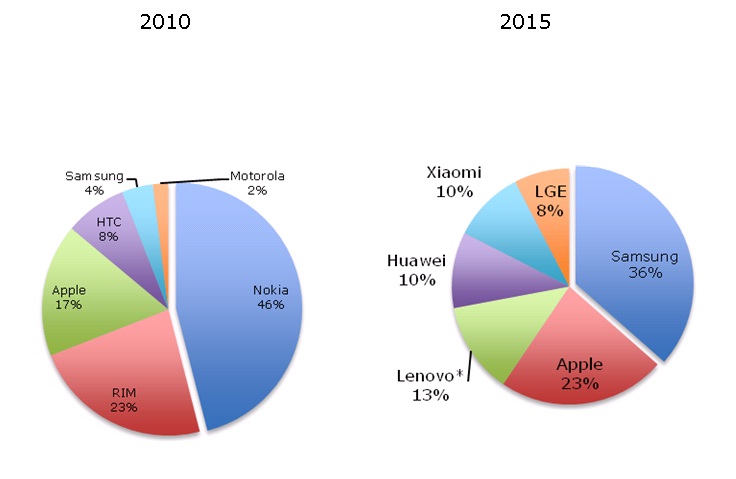

Figure 2 – Smartphone Shipments and Growth by Supplier *Includes Nokia ** Includes IBM – Source: Canaccord Genuity, OLED-AThe smartphone market has reached a tipping point:

Figure 2 – Smartphone Shipments and Growth by Supplier *Includes Nokia ** Includes IBM – Source: Canaccord Genuity, OLED-AThe smartphone market has reached a tipping point:

- Installed base of smartphones is close to 50% of all cell phones

- Even as shipment volume exceeds 1.2B units and 95% of all cell phones; growth is slowing. The CAGR is dropping significantly and could turn negative after all the feature phones have been replaced

- 2008 to 2015e – 30% CAGR

- 2005e to 2019e – 3% CAGR

- Growth – has become a function of the developing world’s evolution

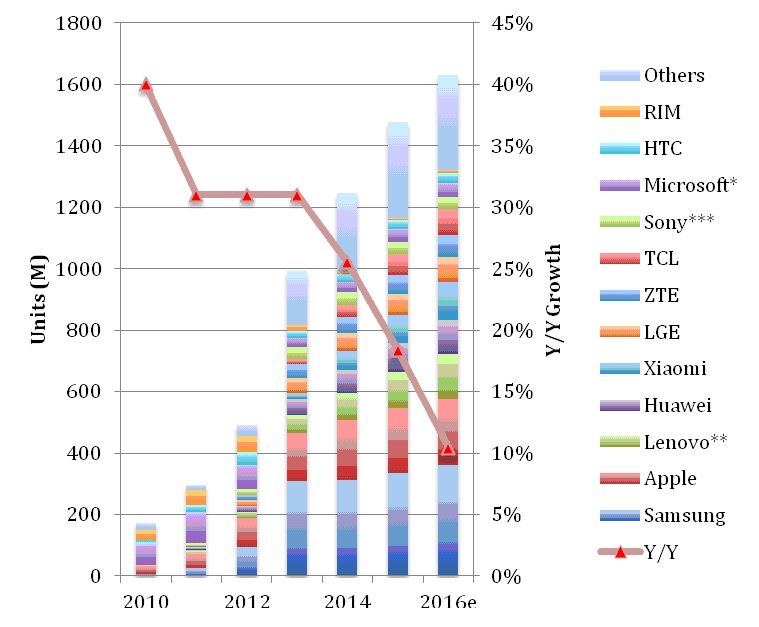

Figure 3 – Projected Global Smartphone Penetration Source: PWCThe industry is starting to show signs of maturity, where a lack of differentiation is leading to a race to commoditization. In order to forecast what will happen to the smartphone industry now that the product is maturing, we can examine the PC Industry. PCs and notebooks are one example of an industry that has shifted from high levels of innovation and growth to a commodity like structure and could be used as a predictor of smartphone behavior. PCs in the 90s can be characterized by:

Figure 3 – Projected Global Smartphone Penetration Source: PWCThe industry is starting to show signs of maturity, where a lack of differentiation is leading to a race to commoditization. In order to forecast what will happen to the smartphone industry now that the product is maturing, we can examine the PC Industry. PCs and notebooks are one example of an industry that has shifted from high levels of innovation and growth to a commodity like structure and could be used as a predictor of smartphone behavior. PCs in the 90s can be characterized by:

- Driver of display innovation

- Low Power

- Flat Panel Monitors >15”

- Fabs – Gen 5 to 7

- Thin displays <1mm

- LTPS and Integrated drivers

- Highest demand for ICs and IC innovation

- Microprocessors

- Memory

- DRAM

- Flash

- Storage Technology

- Graphics Processor

- CAGRs in double digits

- Two OSs

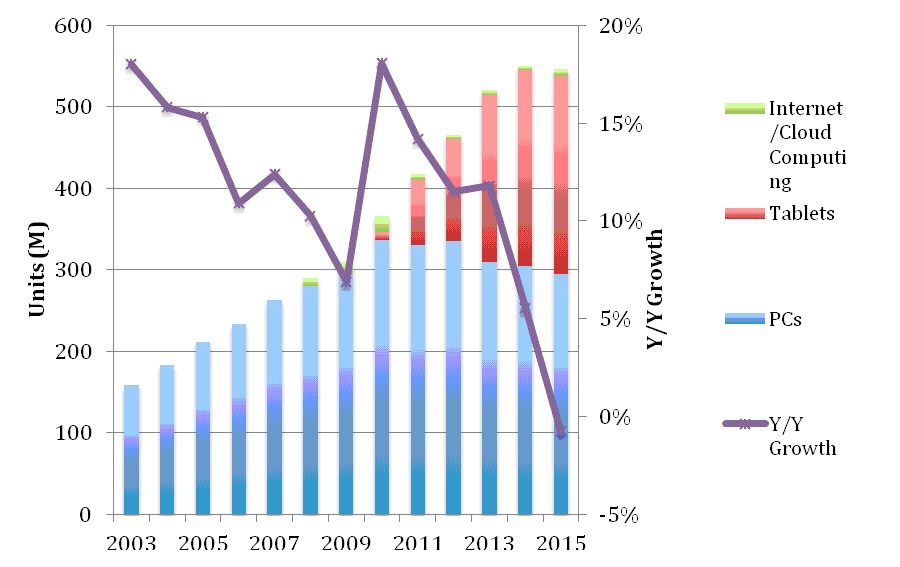

The IT industry has slumped from double digit growth in the 90s to single digit growth in the 2000s, with the majority of the growth coming from tablets as shown in the next Figure. In the recent quarters, growth has turned negative.

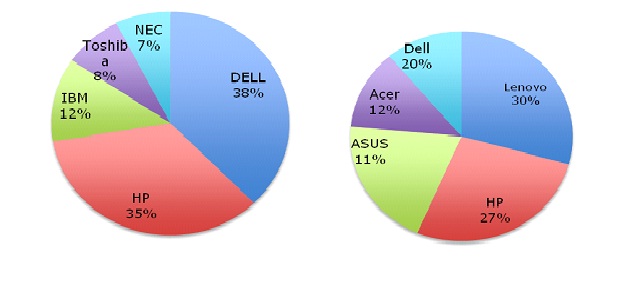

Figure 4 – IT Shipments (M) and Growth (2003-2015) Source: IC InsightsThere has been a shift in the supplier source with the leading suppliers in the 90s coming from North America, Europe and Japan to now, where the leading suppliers are from China and North America as shown in the next figure.

Figure 4 – IT Shipments (M) and Growth (2003-2015) Source: IC InsightsThere has been a shift in the supplier source with the leading suppliers in the 90s coming from North America, Europe and Japan to now, where the leading suppliers are from China and North America as shown in the next figure.

Figure 5 – 2003 AND 2014 PC Share by Supplier Source: Gartner OLED-APC companies in the west can no longer produce predictable profit growth so that they have been sold, or spun out to eliminate the quarterly financial burdens of public companies:

Figure 5 – 2003 AND 2014 PC Share by Supplier Source: Gartner OLED-APC companies in the west can no longer produce predictable profit growth so that they have been sold, or spun out to eliminate the quarterly financial burdens of public companies:

- Merged or Sold – IBM, Compaq

- Exited – Siemens, Tandon, Wyse

- Gone Private – Dell

- Spin out from Parent – HP, Sony

Smartphone and PCs have much in common and are depicted in the next table. Differences are also shown.

| Comparison of PC and Smartphone Industries | ||

|---|---|---|

| Similarities | PCs | Smartphones |

| OS | 2 OS – 1 proprietary, 1 Open | |

| Speeds & Feeds | No Longer a Differentiator | |

| Selling to Lenovo | IBM | Motorola |

| Chinese/Taiwan Entries | Acer/Asus | Huawei/Xiaomi/ZTE |

| Japan Loses Share/Exits | Sony/Panasonic/Toshiba/Sharp | |

| Leaders: Restructure/Sell | HP/Dell | Nokia/Blackberry |

| S/W Differentiation | Apple | Apple |

| IC Industry | #2 | #1 |

| Growth | Desktop to Notebook | Flip Phone to Smartphone |

| Saturation | Near Saturation | |

| Differences | ||

| Apple | Top 6 or 7 – High Price | Top 1 or 2 – Comparable Price |

| Telecom Carrier Relationship | NA | Close |

| Replacement Cycle | 3-5 Years | 2 Years |

Table 2 Comparison of PC and Smart Phone Industries

As is evident, the smartphone is facing many of the same issues today that the PC industry faced in the early 2000s:

- Lack of innovation is leading to commoditization and low profits (except for Apple)

- Western manufacturers have lost interest in the industry

- Growth limited to economic conditions and the lower end of the market, where smartphones are already priced from $60 to $200

- Apple must innovate to sustain its 3X to 10X price premium, but can it last?

- Samsung/LG/HTC/Sony struggling to maintain market share

- The production and brand base has shifted to China

- The two OS approaches create competition for Android adopters and leaves only Apple free to produce a common architecture for the phone, the tablet and the PC.

Although the trends for PCs and smartphones are common, there are some technological shifts that could change the industry’s direction. First, 5G cellular technology is on the horizon and will push speed up to 100X their present level, which would allow a motion picture to be downloaded in 14 seconds and broadband in Korea is scheduled to increase by 1000X, which could allow downloading a movie in 1 second, eliminating the need for storage on most devices; second, Apple is reportedly planning to adopt OLEDs for the iPhone having tested the use of flexible OLEDs in its watch and proving that OLEDs have higher performance, including using less power then LCDs, can be manufactured in volume and perform on a plastic substrate at the same level as glass substrates; third, the flexible OLED will enable new form factors, including foldable displays that produce the first real form factor change in the smartphone since 2007; fourth, new battery technology recently announced by Samsung and an MIT spin out could lead to batteries with double the capacity at half the cost; fifth, maturing of the software business model that allows users to run individual applications only when they are needed.

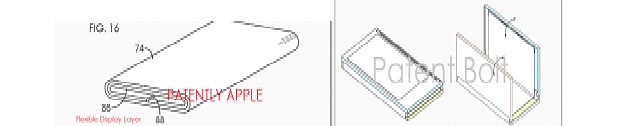

By eliminating the need for a hard drive, increasing the communications speed, creating a new software business model, and focusing on folded OLEDs, the next real convergence device, will enable one product to serve as a foldable smartphone; unfolded tablet, and a powerful cloud computing computer. It is likely that Samsung will develop the first such device since it has come the furthest in flexible OLEDs, but Apple seems to be close behind. The next figure shows examples of Samsung and Apple patent disclosures for foldable OLEDs. Maturing such a device will take some time, but it is on the drawing board. Too bad Microsoft opted out of the smartphone space just when it had made the most progress in tying the tablet and the PC together.

Figure 6 – Foldable Display Examples from Apple and Samsung Source: Apple and Samsung

Figure 6 – Foldable Display Examples from Apple and Samsung Source: Apple and Samsung

Look in this space to learn the real story about OLED TVs. – Barry Young