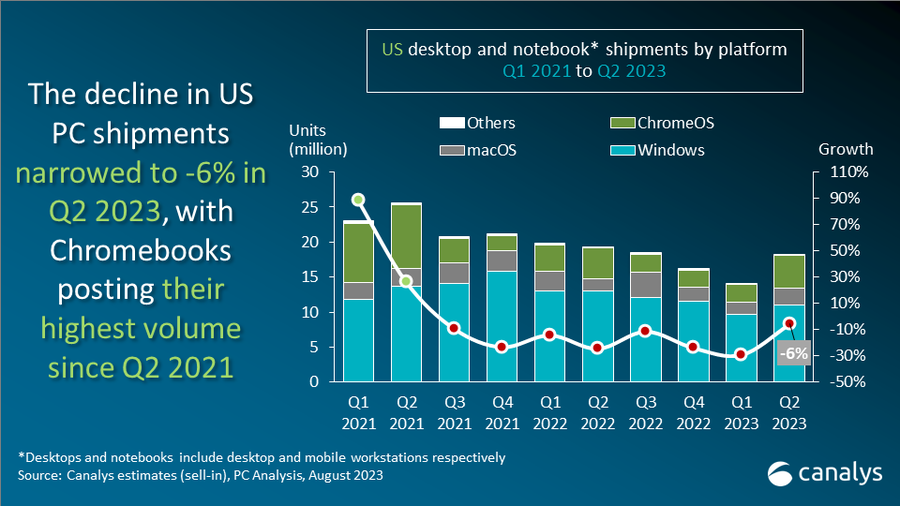

In the second quarter of 2023, Canalys reported that the US saw a decline in PC shipments, which includes desktops, notebooks, and workstations, by 6% YoY, totaling 18.2 million units. This decline was less sharp than in previous quarters. Notebooks, which also account for mobile workstations, faced a 4% dip in shipments, amounting to 15.2 million units. A resurgence in Chromebook demand within the education sector greatly supported this. On the other hand, desktops, counting in the desktop workstations as well, faced a more substantial reduction, witnessing a 12% decrease to 3.0 million units. Parallel to this, the US tablet market also shrank by 5%, with 10.3 million units shipped.

Despite the decline in YoY numbers, one major factor showing improvement was the clearing of channel inventories. This meant that actual demand started influencing the vendors’ shipment data more prominently. A surge in demand from educational institutions became evident, largely backed by the latest federal funding wave. This wave came just before ChromeOS licensing costs rose, leading to Chromebook shipments reaching 4.7 million units, a peak not seen since the first half of 2021.

PC shipments to the commercial sector decreased by 4%, while the consumer sector observed a more pronounced 10% drop. Consumers, given the prevailing economic challenges, have been prioritizing other goods and services over PCs. This trend might reverse in Q4, anticipating attractive discounts during extended holiday season promotions. In contrast, businesses are demonstrating a steadier demand for PCs. Dell, a leading commercial vendor in the US, has show this trend in its home market.

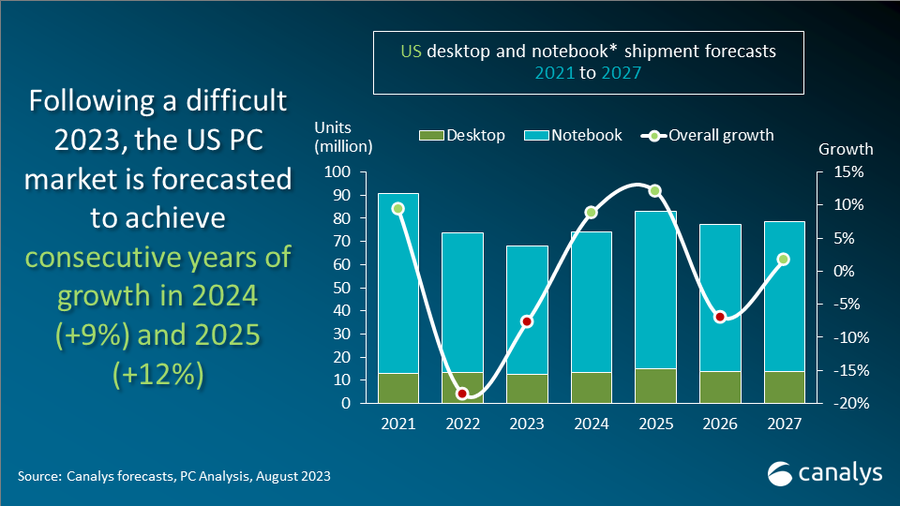

While some caution in PC spending is expected from both businesses and consumers in the immediate term, the overall sentiment is positive. Canalys forecasts a lesser 4% shipment decline in Q3’23, followed by a significant 12% growth in Q4. The market is expected to grow by 9% in 2024 and 12% in 2025.

| Vendor | Q2’23 Shipments (‘000) | Q2’23 Market Share | Q2’22 Shipments (‘000) | Q2’22 Market Share | Annual Growth |

|---|---|---|---|---|---|

| HP | 4,833 | 26.5% | 4,559 | 23.6% | 6.0% |

| Dell | 4,813 | 26.4% | 5,535 | 28.7% | -13.1% |

| Lenovo | 3,019 | 16.6% | 3,326 | 17.2% | -9.2% |

| Apple | 2,310 | 12.7% | 1,742 | 9.0% | 32.6% |

| Acer | 1,067 | 5.9% | 1,339 | 6.9% | -20.3% |

| Others | 2,163 | 11.9% | 2,818 | 14.6% | -23.2% |

| Total | 18,205 | 100.0% | 19,319 | 100.0% | -5.8% |

Dutt remains optimistic about the long-term prospects of PCs in the US. As the weight of macroeconomic pressures lessens, post-pandemic PC usage patterns combined with a more expansive installed base across all segments are projected to benefit the industry. In addition to these factors, the anticipated demand surge due to the transition from Windows 10 is set to gain further momentum with the introduction of AI-capable PCs. Although these new AI devices might not drastically elevate shipment numbers, they hold promise in generating significant revenue, especially for vendors and channels as businesses increasingly adopt them.

| Vendor | Q2’23 Shipments (‘000) | Q2’23 Market Share | Q2’22 Shipments (‘000) | Q2’22 Market Share | Annual Growth |

|---|---|---|---|---|---|

| Apple | 5,348 | 52.2% | 4,451 | 41.3% | 20.1% |

| Amazon | 1,795 | 17.5% | 2,659 | 24.7% | -32.5% |

| Samsung | 1,511 | 14.7% | 1,826 | 16.9% | -17.3% |

| TCL | 517 | 5.0% | 635 | 5.9% | -18.5% |

| Microsoft | 341 | 3.3% | 354 | 3.3% | -3.7% |

| Others | 737 | 7.2% | 856 | 7.9% | -13.9% |

| Total | 10,249 | 100.0% | 10,781 | 100.0% | -4.9% |