Worldwide PC shipments fell 7.7% YoY in Q3’15, Gartner’s preliminary PC results show. Desktop PCs continued to exhibit weakness, with declines in the high single digits, while mobile PCs (notebooks and premium ultramobiles) fell by low single digits. 73.7 million units were shipped through the quarter.

Due to the sharp appreciation of the US dollar, global PC prices have increased by about 10% this year, said Gartner’s Mikako Kitagawa. This increase was a major cause for the weaker demand in certain regions, including EMEA, LATAM and Japan, which all posted double-digit declines. APAC and the USA were more stable.

Despite the fast adoption quoted by Microsoft, Windows 10 failed to have a significant impact on shipments in Q3. This is likely because the focus was on free upgrades from Windows 7 and Windows 8, rather than on shipping new devices. The rollout is expected to ramp up in Q4’15.

Although results were down, there was a positive aspect to them. Gartner’s 2015 personal technology survey showed that 50% of consumers intend to purchase a new PC in the next 12 months, compared with 21% intending to buy a tablet. This trend was shown in Gartner’s data, where US consumers exhibited positive growth towards notebooks and premium ultramobiles. Soft recovery is expected to begin in Q4, with the appearance of Windows 10 product refreshes. “In the meantime, PC manufacturers should adjust configurations for 2016 without the impact of price hikes seen in 2015, which will lead into more stable market conditions in the upcoming year”, said Kitagawa.

| Preliminary Worldwide PC Vendor Unit Shipment Estimates for Q3’15 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q3’15 Units | Q3’14 Units | Q3’15 Market Share | Q3’14 Market Share | YoY Change |

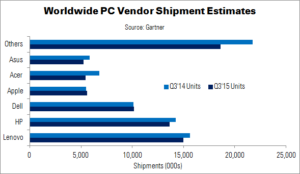

| Lenovo | 14,995 | 15,623 | 20.3% | 19.6% | -4.0% |

| Hp | 13,658 | 14,226 | 18.5% | 17.8% | -4.0% |

| Dell | 10,160 | 10,106 | 13.8% | 12.7% | 0.5% |

| Apple | 5,603 | 5,521 | 7.6% | 6.9% | 1.5% |

| Acer | 5,448 | 6,804 | 7.4% | 8.5% | -19.9% |

| Asus | 5,233 | 5,824 | 7.1% | 7.3% | -10.1% |

| Others | 18,630 | 21,737 | 25.3% | 27.2% | -14.3% |

| Total | 73,728 | 79,842 | 100.0% | 100.0% | -7.7% |

| Source: Gartner | |||||

In vendor terms, Lenovo took the top spot worldwide, with its share rising to 20.3%, despite a 4% fall in shipments in Q3. EMEA and Japan were challenging regions for the vendor, with double-digit declines. However, these results were offset by 22% growth in the USA. Lenovo introduced several hybrid laptops, across a range of price points.

Second place was taken by HP, with a share of 18.5% – and, like Lenovo, a 4% fall in shipments. Results were weak in EMEA, but offset by growth in APAC and the USA. Dell, in third place, saw flat shipments YoY. The company performed well in most regions – growing faster than the regional average in APAC and the USA – but declined in double digits in Japan.

In the US market, PC shipments reached 17 million units: a 1.3% increase, YoY. As in the worldwide market, the US saw growth in the mobile PC segment, which was offset by desktop PC declines.

HP maintained its market leadership in the USA, taking a 27.8% share. Lenovo (fourth place) had the strongest growth, though, rising 22% to a 12.5% share. This was due to the company’s strong performance in hybrids.

PC shipments were down 15.7% in EMEA, to 20 million units. Currency devaluation was a major contributor to this result, as prices remained high. The inventory build up from the first half of the year began to show signs of improvement. Back-to-school sales were weak in Western Europe, as inventory clearance delayed the introduction of new products until the end of September.

The APAC market fell 1.7%, with shipments reaching 26.3 million units. Consumer spending remained cautious, due to weak economies and currency fluctuation across the region. Mobile PC shipments rose 2.2%, while desktop PCs fell 4.9%.