Koenig of the CTA. Image: Meko LtdThe next speaker was Steve Koenig who is Senior Director of Market Research at the CTA and is also a regular at these events.

Koenig of the CTA. Image: Meko LtdThe next speaker was Steve Koenig who is Senior Director of Market Research at the CTA and is also a regular at these events.

Koenig started by talking about the global tremor that ran around the world on the day of the event, triggered by stock exchange drops. CTA (USA) works with GfK (RoW) to develop forecasts for seven regions around the world. The analysis is very dependent on currency as the $ is stronger than it has been for 13 or 14 years and that has had a big impact.

Many innovations are shown at CES, and may be adopted quickly in the US, but global impact takes a bit longer. A new category in 2015 was wearables and in the future IoT will be added, along with other new categories.

The global economy is getting back on track, with emerging markets developing, but with China’s growth slowing down. Some moderate recovery has been and is expected in Japan and Europe.

Turning to devices, there is a “magnificent seven” of product categories that represent around 80% of all CE (and $761 billion in 2015, $740 billion in 2016) and they are: tablets, notebooks, smartphones, feature phones, PCs, digital cameras and TVs.

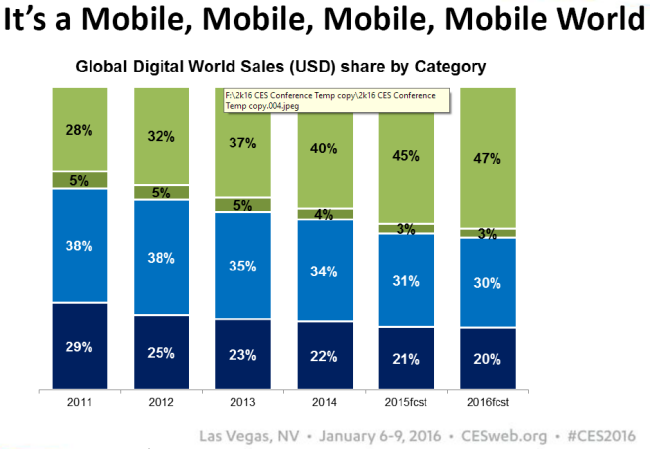

47% of consumer spending is now “communications”. The smartphone is the biggest market at 40% of spending. However, Koenig expects no growth in smartphone revenues over the next year. Combining smartphones and tablets represents 46% of all sales and adding in mobile PCs, you get to 58%. That means that these three “mobile” devices underpin services and many other categories.

How long will this grouping last as a “triumvirate”?

Koenig showed the split by region (good chart) Smartphone sales are based on population, so the global share is bigger in Asia, where the countries with the largest populations are.

The increase in smartphone sales is now into single digits and that is likely to be the future. That means a steadying of the share of the market. This is the new normal, Koenig said.

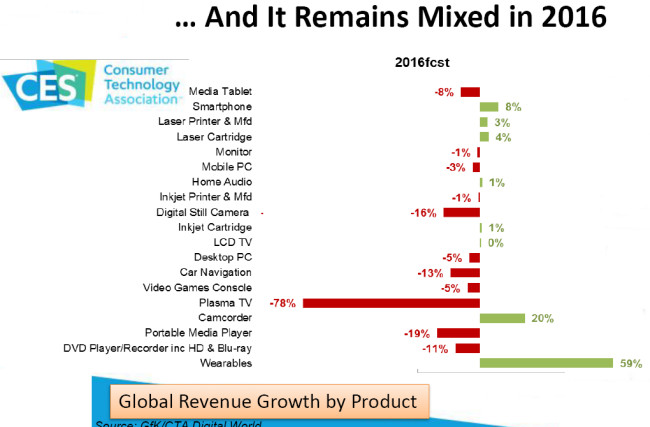

Looking at revenue growth, the largest opportunity is in wearables, with a number of other markets forecast to grow, including camcorders (by 20%!), smartpones (8%) and laser printers (3%) and their cartridges. All other categories are likely to be flat or down.

Units will see growth in other categories, but no revenue growth as unit improvement is offset by lower prices. Prices have been coming down to allow access to the technology by less wealthy consumers.

In China there are two markets for smartphones – very low cost units alongside premium handsets bought by those that can afford them.

In 2010, the majority of smartphones sold were in “Mature” markets, but by 2012 59% was in the developing world and the 2016 forecast is for 71% of sales to be in that part of the world.

Tablets – could they be squeezed out by convertibles at the top end and phablets from below, Koenig asked? Tablet ASPs have declined – there are a lot of value tablets again this year. The US has 56% penetration of tablets – larger phones and convertibles have eaten into the market. At Christmas, Amazon had a promotion of a “6 pack” of Fire tablets for $250 – the price for five bought individually.

Smartwatches are higher priced than fitness bands so developments in the market are helping to boost the value opportunity.

TVs (hardly mentioned for nearly 90 minutes – Man Ed.) will be flat in volume. Video viewing is spreading across multiple screens in the home. In emerging regions, TVs may not ever be needed. TV sizes continue to grow in line with the trend in recent years.

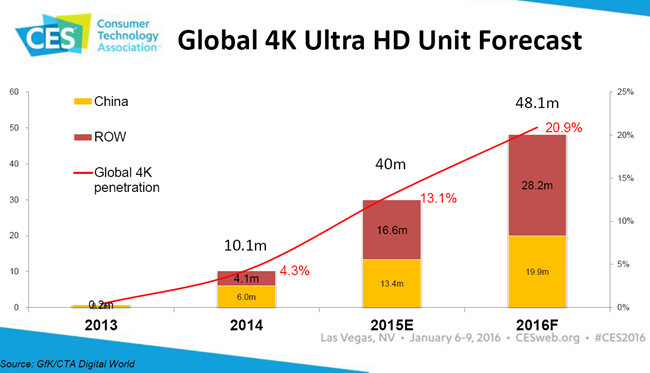

21% of the TV market is at 50″ and above, in the forecast. UltraHD will grow, with nearly all 55″ and above at UltraHD resolution.

Regional View

Koenig then went around the global regions to look at the “big picture” for each.

In Latin America, Brazil is still struggling because of spill over from China (Brazil spplies a lot of raw materials to China – Man. Ed.). A small decrease in orders from China can have a big impact on material suppliers. Political issues are still a problem and values may drop in the next year by 4%.

Central and Eastern Europe is a problem because of eurozone issues and problems with Russia, although low oil prices are helping consumer disposable income growth. “I see more head winds than tail winds”, Koenig said. Poland and the Czech Republic are not looking good, he added.

Emerging Asia (mainly China) is transitioning from being export and manufacturing driven to consumption and services – and there may be just 6.5% growth this year. India is looking positive for many economists and could see 8% growth this year. It has a large population and that makes it an attractive market for an increasing number of brands.

Unit sales will increase a little but values drop over the near term forecast, Koenig said.

The Middle East and Africa region is also impacted by the Chinese slow down. Africa is seeing reduced orders for raw materials and oil is a critical factor as many countries in the region depend on oil revenues. The market is seen as “generally flat”.

The US buoys North America. GDP growth was weaker in Q3 than in Q2 and Mexico still has some economic momentum. Canada has been hard hit by low oil and commodity prices.

Western Europe has had to deal with the weak euro but has more disposable consumer income because of low oil prices. Political challenges such as possible “Brexit” and the refugee situation are still causes for concern. Unit sales will be flat, but Koenig characterised Western Europe as the “Bastion of consumption”.

Developed Asia is really Japan and Korea, but is seeing slowing consumption. It’s always a challenge to get Japanese consumers to spend their money rather than saving it. Local brands in both countries are still innovating. The region often sees innovations coming to market first.

“Has emerging Asia peaked in growth? Probably.”, Koenig said. It will be a few years before the region goes past 30% of the global market but in the end, populations will drive market shares.

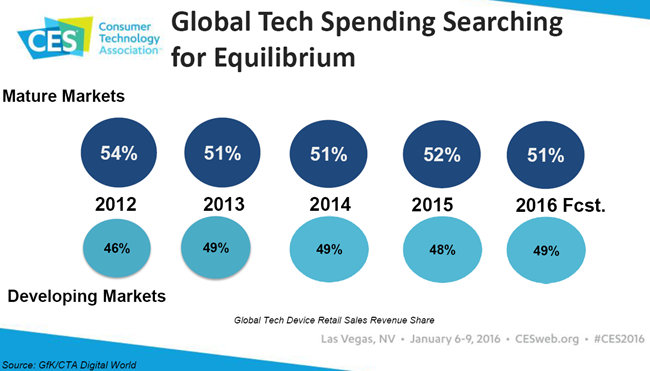

There is broad equilibrium between developed and emerging regions and Koenig expects this to continue for some time.

Overview

Koenig finished with an overview. GDP growth is moderate and uneven around the world with slowdowns everywhere. Low commodity prices are impacting many regions.

Unit sales are very flat – and this will not change quickly, as it will take time for new technologies to disperse globally.

Revenues will be flat because of the strong dollar. It’s not just electronics that is suffering, “adjacent industries” are having the same kind of issues, Koenig concluded.

The materials from the talk can be downloaded at

https://prezi.com/yylpzufa0d8v/2016-ces-trends-to-watch/

CTA.tech/salesandforecasts