The Europe, Middle East, and Africa (EMEA) traditional PC market (desktops, notebooks, and workstations) posted strong growth in 2020Q3 (11.7% YoY) and totaled 21.0 million units, according to International Data Corporation (IDC). Consumer demand mirrored the extraordinary strength of the previous quarter, growing 29.3% YoY, which was more than enough to offset the minor softness on the commercial side (-2.1% YoY).

The Western European PC market experienced another strong quarter, growing by 10.2% YoY as the ongoing exceptional demand for notebooks drove high double-digit growth for the mobile form factor across both segment groups.

“Consumer shipments for Western Europe recorded solid double-digit growth for the second consecutive quarter,” said Malini Paul, research manager for IDC Western European Personal Computing Devices. “Strong back-to-school demand stemming from remote learning needs, coupled with solid consumer orders for entertainment and gaming, were the primary growth drivers.

“While Lenovo, HP, and Apple held the lion’s share of the Western European consumer market, Lenovo replaced HP to gain the top spot in 2020Q3.”

Western European commercial shipments, on the other hand, declined 4.5% YoY. Desktop performance continued to drop off heavily, declining by 52.2% YoY. There was already high inventory in the market, and with working from home encouraged and offices largely remaining closed, commercial demand for stationary devices was extremely low in Q3. Notebooks continued to be met with strong demand, growing 24.8% YoY. Mobile form factors remained the desired solution to address the ongoing necessity to work from home and were highly prioritized for the large education tenders that were rolled out to facilitate studying from home as schools remained closed. Nevertheless, notebook demand could not offset desktop weakness.

CEE and MEA both recorded good performance in 2020Q3, with CEE outperforming the MEA region. In CEE, the traditional PC market grew by 19.5% YoY, driven by demand in both the commercial and consumer segments.

“Commercial sector success was achieved by a few large education deals in the region as well as home-working and reported annual growth of 7.3%, whereas the consumer segment continues to be fueled by entertainment needs and home-schooling preparation, recording another strong quarter growth of 29.2% YoY,” said Stefania Lorenz, IDC CEMA. “Uncertainty about the progress of the pandemic in the fall and year-end powered demand during the quarter in both segments.”

In MEA, the traditional PC market grew 8.7% YoY, driven by the consumer strong results of 17.1% YoY, while the commercial sector remained flat YoY as only few education deals were fulfilled.

Vendor Highlights

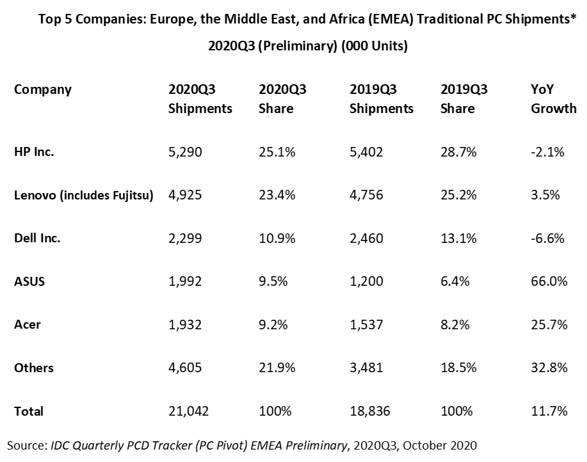

Traditional PC market consolidation slowed slightly, with the top 5 vendors’ share dipping in 2020Q3. The top 5 players accounted for 78.1% of total market volume, compared with 84.0% in 2020Q2, and 81.5% in 2019Q3.

-

HP Inc maintained the leadership in the EMEA PC market, posting a market share of 25.1% (-3.6 pp YoY). Growth on the consumer side (8.7% YoY) was not enough to offset the decline on the commercial side (-7.5% YoY) leading to an overall decline of 2.1% YoY.

-

Lenovo (including Fujitsu) remained in second position, posting a market share of 23.4% (-1.8 pp YoY). Lenovo’s growth has come from the consumer side and the continued demand for devices to work and learn from home.

-

Dell Inc. also held its place, registering the third-highest market share of 10.9% (-2.2 pp YoY). For the first time after 16 consecutive quarters, the vendor posted a decline and saw a 6.6% decrease YoY in shipments.

-

ASUS regained fourth place over Acer with a market share of 9.5% (+3.1 pp YoY). The vendor was able to meet the huge demand on the consumer, gaming, and commercial side and posted growth of 66.0% YoY.

-

Acer ranked number five in the EMEA market, posting a market share of 9.2% (+1.0 pp YoY). Pushed by double-digit growth on the consumer and commercial sides (28.7% and 18.7% YoY, respectively), the vendor showed its ability to satisfy the ongoing demand in the market.

Table notes:

-

Some IDC estimates were made prior to financial earnings reports.

-

Shipments include shipments to distribution channels or end users. OEM sales are counted under the vendor/brand under which they are sold.

-

Traditional PCs include desktops, notebooks, and workstations, and do not include tablets or x86 servers. Detachable tablets and slate tablets are part of the Personal Computing Device Tracker, but are not addressed in this press release.

-

Data for all vendors is reported for calendar periods.