I loved to play connect-the-dot puzzles as a kid sitting in the family car on long vacation drives… Guess that’s why I write articles like this one. I planned to title it “Beware of Big Niche Markets”, which I have talked about several times, but news items kept adding related dots to connect.

Here is some recent news to ponder.

- Foxconn plans to hire one million assemblers in India

- Africa approaches one billion mobile phone customers

- Gartner forecasts device shipments will grow 3% a year

- Taiwan’s panel makers report declining sales for 1H’2015

- Taiwan’s panel makers talk-up their prospects in niche markets

- Most touch panel makers report sales declines and many may close

- IHS reports slowing growth for cover-glass and Corning buy-backs its shares

Yep, it’s that old demand-elasticity thing. If you want to increase demand, you must decrease price. The only question is whether your sales will increase or decrease as a result. With global demand for devices such as PC’s, tablets, convertibles, ultra-mobiles and phones growing at the same sluggish pace as the global economy, prices come under extra pressure from AMLCD capacity that is growing twice as fast. Profits get squeezed even harder if sales revenue declines with price.

Time for the big niche strategy

No wonder AU Optronics (AUO) and Innolux have stolen a page from the Japan playbook and talked up strategies to profit from exciting opportunities in niche markets. The problem, of course, is similar to the one Winnebago Grand Tour motor home drivers face finding a 60-foot parking space (“So what if it’s 43-feet long? It sure rides nice!”). Smaller producers such as CPT drive Smart cars in comparison. They might park one or two wheels in a niche market. Together, AUO and Innolux have 27% of global panel capacity. I think it would be fun to watch them try parking any significant portion of their RV caravan in a niche market space!

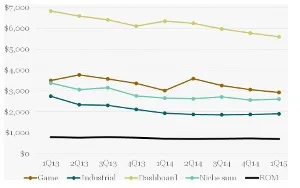

AAP (USD/m²) for Some Niche Markets and the Rest of the AMLCD Market (ROM)

Market researchers often illustrate niche markets with exemplars such as game, industrial (e.g. medical) or car dashboard display segments. Data from the IHS-supplied set used for the SID Business Conference shows that the combined share of AMLCD sales into these applications has remained in the 2%-3% range since 2013. So, no real growth here… what about prices? Oops, these average area prices have been falling twice as fast as AMLCD prices in the rest of the market. Looks like niche parking spaces are getting tighter.

Time for the market-mix shuffle

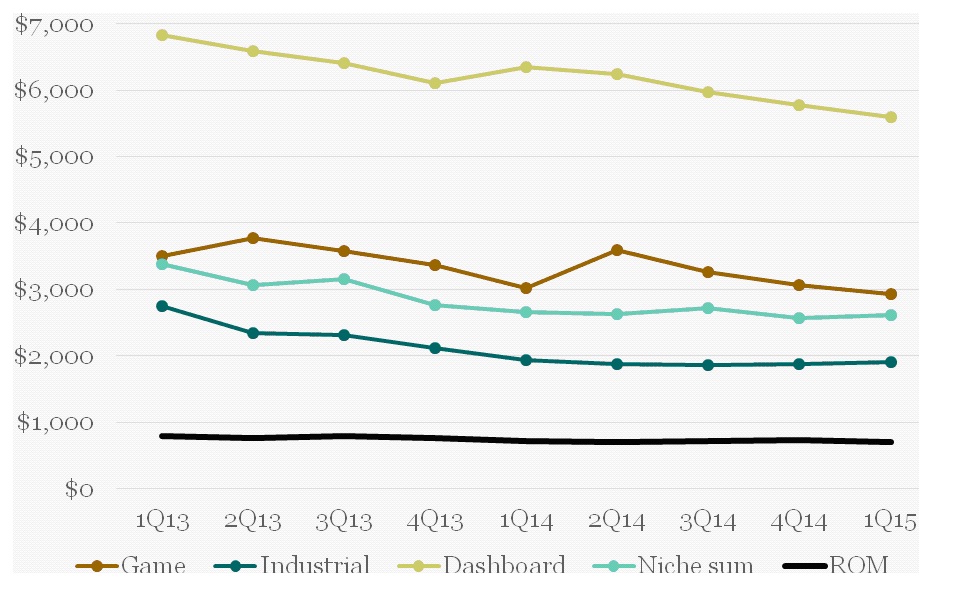

Even the 8K TV panel market is starting to look better than phones. There’s plenty of room at the bottom and that’s where mobile prices have to go in India or Africa. No wonder we see AUO and Innolux shuffling more capacity into larger panels. Looking at their monthly sales reports since 2008, we can see the two Taiwanese leaders adjust their shipments of small panels between 60% and 75% of their panel totals. The values for June (green dot) were 66% small panels and a NTD1,132 ASP overall.

Such charts are interesting and can estimate how ASP changes with the small-large panel mix. In this case, we can see approximate fit in the 70% mix region estimate a 4% ASP decline for one-point more small panel mix. For a ten-point increase in the percentage of small panels, the ASP may fall 33% or more.

ASP (TWD) versus Small Panel Mix for AUO+Innolux (Jan’08–Jun’15)

There is no such thing as a big niche market, of course. What I think executives outside China are trying to say is they seek ways to serve market segments that are not being commoditized by new entrants. If a panel maker cannot serve a high-value brand such Apple, it must scramble its engineers to serve a host of smaller customers. On that subject, did you read about the estimate that Apple and Samsung capture 107% of smartphone operating profits? Yep, that means that more than half of all units are sold below cost. No wonder panel makers find it hard to price above full cost.

So next time you notice a big RV on the road this summer, think about the parking space it must find. No wonder there are no niche RV parks. – David Barnes