The Europe, Middle East, and Africa (EMEA) traditional PC market (desktops, notebooks, and workstations) grew 3.0% YoY in 2019Q3 and totaled 18.8 million units, according to International Data Corporation (IDC).

A strong pipeline of deals ahead of the ongoing Windows 10 transition continued to translate into commercial strength (+9.4% YoY), while the consumer space had a stronger quarter and only posted a marginal decline (-4.0%), ultimately offsetting the overall negative impact of the component shortage.

The Western European traditional PC market grew by 3.3% YoY, as a relatively weak consumer performance (-3.3% YoY) was offset by strength in the commercial sector (+8.3% YoY), with desktops (+8.2% YoY) growing at a stronger rate than notebooks (+8.1% YoY) for the second consecutive quarter.

“Commercial growth in Western Europe was supported by the tail end of Windows 10 refreshes in the enterprise and public space, particularly among the slower moving organizations that have higher data sensitivity and legacy architecture,” said Liam Hall, senior research analyst, IDC Western Europe Personal Computing. “Vendors were largely able to cope with ongoing component shortages by transitioning to alternate configurations and manufacturers where possible, enabling them to satisfy sustained demand for the ongoing refresh.”

On the consumer side, desktops had another soft quarter as demand for stationary devices continued to be weak, and the pocket of growth provided by gaming proved insufficient to reverse the trend. Notebooks fared significantly better, though they still posted a slight decline, as mobile and thin and light devices continue to capture consumer interest. Seasonal demand drove a slightly more optimistic overall consumer picture, and improvement in the inventory situation enabled a higher volume of units to be pulled in to meet demand for upcoming sales such as Black Friday and Christmas.

The overall PC market in CEE and MEA performed better than expected, thanks to the strong demand in the commercial space.

“The commercial PC market in CEE recorded a strong 10.7% growth YoY with large deals fueling the corporate, public, and education sectors in a few countries across the region,” said Nikolina Jurisic, product manager, IDC CEMA. “Consumer, on the other hand, remained weak due to constraints in the supply chain and low consumer sentiment, contracting by 11.3% YoY.”

Thanks to the visible recovery and economic stability in the MEA region, the PC market regained momentum after four declining quarters and reported YoY growth of 9.3%. The consumer and commercial segments increased by 5.2% and 13.7% respectively. Turkey recorded respectable results on the back of very poor performance in the previous year and regained the leading position in terms of the largest PC volume shipments in the region.

Vendor Highlights

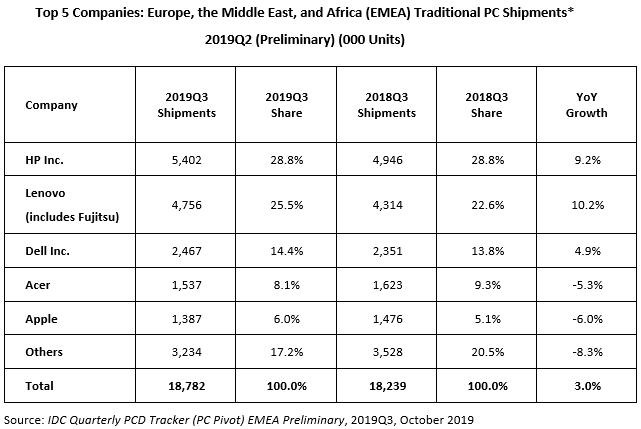

Traditional PC market consolidation persisted, and the top 3 vendors’ share continued to grow in 2019Q3. The top 3 players accounted for 67.1% of total market volume, compared with 63.7% in 2018Q3.

-

HP Inc. maintained its lead in the EMEA PC market, with 28.8% market share (up 1.6% points YoY). The vendor recorded shipment growth of 9.2% YoY, thanks to strong commercial results, supported by positive consumer growth.

-

Lenovo (including Fujitsu) claimed second position, registering 25.3% market share (+1.7% points YoY). Solid commercial growth helped the vendor to close the market share gap with leader HP in the segment, while boosting the overall result.

-

Dell Inc. achieved 13.1% market share (up 0.2% points YoY), securing third place. The vendor maintained its positive results for the 13th quarter in a row, registering unit growth of 4.9% YoY in 2019Q3. Propelled by the commercial segment, desktop was the prime driver with double-digit growth, closely followed by notebooks with a mid-single-digit growth rate YoY within the segment.

-

Acer ranked fourth with 8.2% market share (-0.7% points YoY). However, given the weak consumer market and CPU constraints, the vendor posted a much softer decline of 5.3% YoY in units, thanks to strong back-to-school sales and early preparation for the holiday season.

-

Apple secured fifth position with a share of 7.4% (-0.7% points YoY). Like Acer, consumer softness inhibited growth prospects for the vendor (-6% YoY), but strong education demand contributed to the relatively softer decline in the commercial space (-4.3% YoY).

Table notes:

-

Some IDC estimates were made prior to financial earnings reports.

-

Shipments include shipments to distribution channels or end users. OEM sales are counted under the vendor/brand under which they are sold.

-

Traditional PCs include desktops, notebooks, and workstations, and do not include tablets or x86 servers. Detachable tablets and slate tablets are part of the Personal Computing Device Tracker, but are not addressed in this press release.

-

Data for all vendors is reported for calendar periods.