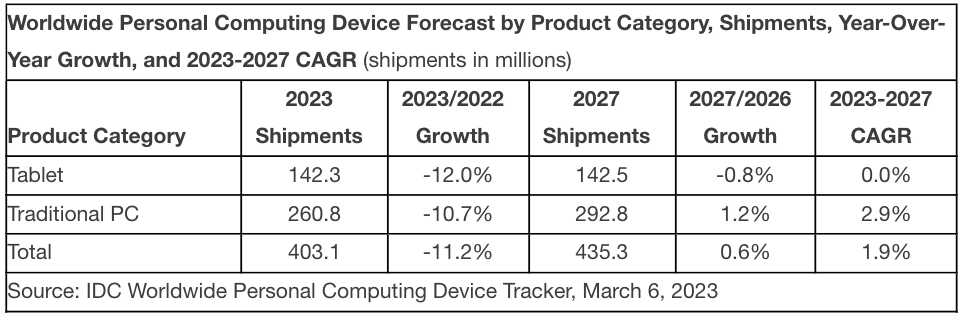

Declining demand and challenging macro-economic conditions have caused International Data Corporation (IDC) to further lower its forecast for the worldwide PC and tablet markets. Global shipments are now expected to total 403.1 million units in 2023, down from the 429.5 million units forecast in December 2022 by the IDC Worldwide Quarterly Personal Computing Device Tracker. While 2023 volumes will be below 2019 levels, IDC expects 2024 to be a year of recovery with PC and tablet shipments growing 3.6% compared to 2023 and surpassing pre-pandemic levels as total volume reaches 417.7 million units.

The tide had been building toward a market slowdown for some time. With consumers no longer bound by COVID restrictions and commercial backorders for PCs largely completed, the second half of 2022 sent a strong signal that endpoint devices are no longer the focal point and that 2023 will be a time for inventory clearing and shifting priorities.

“Commercial demand, both from businesses and schools, will remain a bright spot throughout the forecast as hybrid work and 1:1 deployments in schools have permanently increased the size of the total addressable market,” said Jitesh Ubrani, research manager for IDC’s Mobility and Consumer Device Trackers. “The sunsetting of Windows 10 is expected to drive PC refreshes in 2024 and 2025 while Chromebooks and Android tablets benefit from educational deployments and refreshes. Despite Apple’s slow and steady commercial gains in recent quarters, the company’s lack of broad adoption among commercial buyers will likely lead to Microsoft- and Google-based platforms outperforming Apple’s products over the next two years.”

On the consumer front, the strength of the US dollar as well as rising inflation have greatly impacted buying power across the globe. Although the long-term outlook remains positive and above pre-pandemic levels thanks to increased household density of PCs and tablets, the market does risk consumer spending shifting back to smartphones and other purchases.

“This year will be about resiliency for personal computing device vendors,” said Linn Huang, research vice president, Devices and Displays. “Surplus inventory, declining demand, and receding macros will continue applying negative pressure on both volumes and ASPs, before returning to growth mode in both departments in the subsequent two years.”