Can LCD (a-Si and LTPS), OLED (flexible and rigid), MiniLED (LCD), and MicroLED display technology co-exist in the smartphone market in next three to four years?

Smartphone unit growth has slowed down considerably in the last few years. Current growth is mostly coming from emerging markets which need more affordable products. High priced flagship models based on flexible OLED displays are not driving strong replacement demand for the total market and there is need for lower cost, more affordable products based on LCD. Upcoming iPhone products from Apple are expected to have two high-end flexible OLED-based models and one lower cost mid-range LCD model. Strong competition is bringing breakthrough innovations, higher performance and lower costs to each display technology opening up new possibilities for co-existence.

Flexible OLED can help high end products

Smartphone brand manufacturers want to adopt flexible OLEDs to differentiate their products and in the hope of driving strong demand. New differentiated products can help replacement demand at the high end. But due to the higher costs, most of the new products will be at high end, far from the affordable products needed for the emerging markets. Even though suppliers other than Samsung, such as LG Display are planning to ramp up production, it will take time. New fab capacity will be coming from China in the near future. That may lead to aggressive price reductions in next few years helping demand growth by bringing product to more affordable price level.

Foldable smartphones coming in the future

Samsung and many other companies are working on foldable phone prototypes. A big advantage of a foldable display is the ability to have “thin light unbreakable larger displays in a smaller form factor”. While the display curvature radius of current generation flexible displays may be 8mm, foldable display curvature will need to be able to roll to a 1 – 3mm radius and need to provide the ability to bend multiple times without degradation. However, many display industry people believe foldable phones can only be ready for high volume production in 2019 or later, as the technology needs more time to mature.

There are many challenges including process technology, materials, manufacturing issues, high capex, higher costs, high prices for consumer devices, durability of the products, design acceptance by consumers and consumer willingness to pay higher prices for the new designs. Samsung has been in the forefront of smartphone development with its rigid and flexible OLED display-based products. They are also expected to introduce their first foldable smartphones in the market in the near future.

OLED technology enables flexible and foldable display products

OLED display technology is in the forefront for flexible and foldable display. Combined with printable OLED manufacturing capabilities, it has the potential to enable lower-cost flexible, foldable, and stretchable displays in the future. OLED displays can be thinner, lighter, have better color, lower power and better design differentiation especially with flexible displays and plastic substrates. Flexible OLED is expected to gain market share in the smartphone market due to its innovative design differentiation.

Even though the potential future of next generation flexible and foldable displays is very promising, the technology needs more time to develop for reality to meet expectations. Higher performance and differentiated form factor will not be enough, it has to be combined with higher production volume and lower costs before it can be the saviour for the next gen smartphone market. In the short run, the industry has to depend on lower cost LTPS LCD and even a-Si LCD to meet lower price smartphone demand from the emerging market, in order to drive growth.

LTPS LCD reinvents its capabilities in the face of fierce competition

LTPS LCD has higher electron mobility than other TFT-LCDs, especially a-Si (Amorphous Silicon). It enables better use of the light, and so power consumption can be reduced or brightness can be increased. LTPS LCD is suitable for high pixel densities and up to 800 ppi is already possible.

Suppliers such as JDI, AUO and others are making products with advanced in-cell touch technology that enables thin, highly sensitive panels with lower costs. LTPS enables smartphones with a narrow border, resulting in full active bezel-less (or thin bezel) product with a screen-to-body ratio closer to AMOLED-based products from Samsung or Apple. Redesigned LTPS LCD-based smartphones have been able to reduce the performance, features and design differentiation gaps with OLED-based products at a lower cost opening up new growth opportunities for LTPS LCD. Amorphous Silicon (a-Si) LCD panels are serving the low-end market and are losing market share.

Rigid OLED receiving renewed interest

The possibility of a lower price gap with LTPS LCD combined with the advantages of OLED is bringing renewed interest in rigid OLEDs. Samsung Display has increased its utilization rates in recent months bringing in higher production. Tianma, has also started rigid OLED production. Still, there exist many challenges such as: not enough suppliers are focusing on rigid OLED and most of the new planned capacity from China is for flexible displays. There is very little design differentiation between LTPS LCD and rigid OLED smartphones due to new 18:9 full active bezel-less screen designs.

MiniLED backlight LCD empowering LTPS LCD

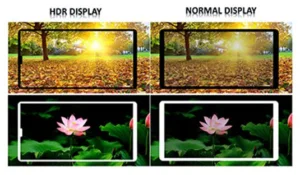

MiniLED backlight options are coming to LTPS offering higher contrast (by local area dimming), faster response time, and reducing the performance gap with OLED. That is why suppliers such as AUO, BOE, Tianma and many others showcased prototypes of miniLED based products at Display Week 2018.

Tianma showcased a 6.46″ HDR LTPS LCD smartphone display prototype, with peak brightness above 1000 cd/m² and maximum local contrast over 3,000,000:1 using miniLED backlights. MiniLED backlight LTPS LCD costs are still high, but it may offer strong competition to rigid OLED in the next few years. For success, the price has to be between rigid OLED and conventional LTPS LCD. MiniLED can have a window of opportunity in next few years if suppliers can reduce the cost and increase production.

MicroLED coming in future

MicroLED displays are capable of very high brightness, high contrast ratio, wide color gamut, fast response time, low power, high flexibility and higher transparency. MicroLED has a simple structure compared to OLED and LCD. It has the potential to be cheaper than OLED, even though it is very expensive now. It still has many manufacturing challenges that need to be resolved before commercialization.

AUO and, several other companies such as Jade Bird Display and PlayNitride showed prototypes in DisplayWeek 2018. Manufacturers are planning to focus more on differentiated product opportunities in automotive, VR, wearable and indoor cinema applications before trying to focus on mainstream general applications such as TV, laptops or smartphones.

The global smartphone market has many different segments. Each segment has its own price; specs and technology requirements. Slower growth and fierce competition is bringing in breakthrough innovations and improvements to each display technology. This will open up new opportunities for co-existence of LCD, OLED, MiniLED(LCD) and even MicroLED in the smartphone market over next three to four years. – Sweta Dash

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insight.com