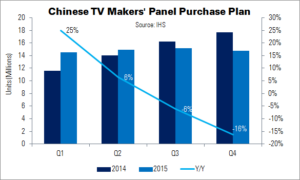

According to IHS, the leading Chinese TV makers are becoming more conservative in their panel purchasing plans – with a 16% fall in LCD TV panel orders forecast in Q4.

TV panel oversupply and falling prices are the main reasons behind the lower orders from Hisense, TCL, Skyworth, Konka, Changhong and Haier, says IHS. These makers are expected to purchase 14.8 million LCD TV panels (including open cells and modules) in Q4’14, down from 17.7 million last year.

The leading panel makers – LG Display, Samsung Display, BOE, CSOT, AUO and Innolux – are heavily invested in the Chinese market. Because of this, the slowdown is forecast to cause these companies to further adjust their capacity utilisation.

“This conservatism is a major shift from the aggressive market in 2014, which has caused display makers to face over-supply and may induce panel prices to drop further at the end of this year”, said Nick Jiang, senior display analyst at IHS.

Panel makers shipped 29.4 million units to Chinese manufacturers in the first half of 2015, leading to 15% YoY growth. However, these Chinese companies ‘drastically’ lowered their planned panel purchases in Q3. Manufacturers shipped 15 million TV panels to China in this quarter, representing a 6% YoY fall. Additional declines are expected in Q4: IHS forecasts that the six leading Chinese TV makers will purchase 59.3 million LCD TV panels this year, down less than 1% from 2014.

LG Display leads the Chinese panel market, with a 22% share. CSOT follows at 20%, and then Innolux (16%), Samsung Display (15%), AUO (13%) and BOE (10%).

At the end of August, Chinese TV makers had an average inventory level of 6.5 weeks: a MoM increase of one week. More panels were purchased in August to prepare for China’s National Day. However, weakening demand meant that inventory levels remained high in September.

“China’s top six TV makers’ purchases in Q2 2015 exceeded our expectations”, said Jiang, “but with the advent of the off-season, inventory is also on the rise, so there is pressure for further panel price reductions in Q3 and Q4 of this year”.