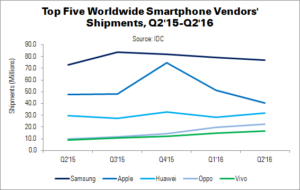

343.3 million smartphones were shipped worldwide in Q2’16: a relatively flat result, up 0.3% from Q2’15 (342.4 million units), says IDC. Quarterly growth was higher, up 3.1% from 331.3 million.

Ryan Reith, IDC’s mobile device programme VP, highlighted changes in the smartphone market. “Mature markets continue the transition away from pure subsidy and over to EIP programs”, he said, adding, “Apple is beginning to put more emphasis on ‘Device as a Service’ to try to prevent lengthening replacement cycles. This is a growing theme we have heard more about from PCs to smartphones.”

Reith said that the slowing smartphone market in China is causing competition to ramp up in other high growth markets. These include India, Indonesia and the Middle East. Low-end Chinese OEMs are (surprisingly) having some success expanding outside of their home market, despite low-end competition from established local brands.

| Top Five Smartphone Vendors’ Shipments, Share and Growth, Q2’16 Preliminary Data (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | Q2’16 | Q2’15 | Q2’16 Share | Q2’15 Share | YoY Change |

| Samsung | 77.0 | 73.0 | 22.4% | 21.3% | 5.5% |

| Apple | 40.4 | 47.5 | 11.8% | 13.9% | -15.0% |

| Huawei | 32.1 | 29.6 | 9.4% | 8.6% | 8.4% |

| Oppo | 22.6 | 9.6 | 6.6% | 2.8% | 136.6% |

| Vivo | 16.4 | 9.1 | 4.8% | 2.7% | 80.2% |

| Others | 154.8 | 173.6 | 45.1% | 50.7% | -10.8% |

| Total | 343.3 | 342.4 | 100.0% | 100.0% | 0.3% |

| Source: IDC | |||||

Samsung maintained its market lead, gaining share thanks to strong sales of the Galaxy S7 and S7 Edge. New features like removable storage and waterproofing proved popular with consumers. Samsung’s J-Series also performed well in emerging and developed markets, thanks to its wide range of models.

Apple remained in second place. Q2 is traditionally the company’s slowest season, as consumers delay purchases ready for an iPhone refresh in Q3. Apple shipped 40.4 million iPhones (-15% YoY), its lowest volume in seven quarters – despite the introduction (and success) of the iPhone SE mid-way through Q2. The SE captured both new smartphone buyers and Android users. The popularity of the iPhone SE affected iPhone ASPs, which fell 10.1% YoY: from $662 to $595.

The third-largest vendor was Huawei, which performed well in China and even better in Europe. Shipment rose 8.4% YoY to 32.1 million units. Huawei’s new premium phones, like the P9 and Mate 8, pushed 25% of its volume to the high-end ($500-$600). The Honor and Y-Series balanced out the mid- and low-end. Huawei was China’s most popular vendor, but it still faces challenges when it comes to the US market.

The fourth and fifth spots also went to Chinese firms. Oppo was in fourth place, promoting itself and its devices aggressively. The firm used its strong presence in tier 3-5 Chinese cities to drive growth, and sponsored shows in tier 1 cities. Overall growth is still primarily in low-tier Chinese cities, as well as growing markets like India.

Fifth-place Vivo is growing domestically and is fully focused on the APAC region. The company launched several smartphones in Q2 and hired Korea’s Soon Joong Ki as a celebrity endorser to boost its brand.