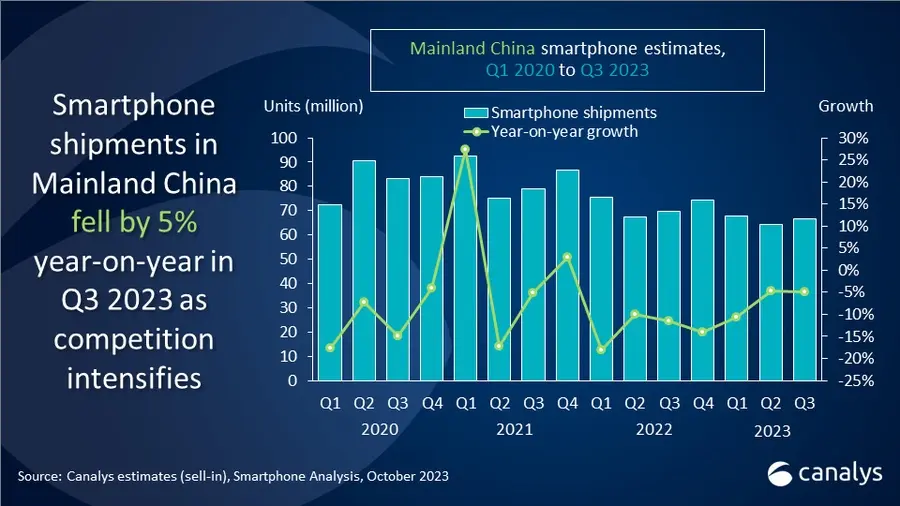

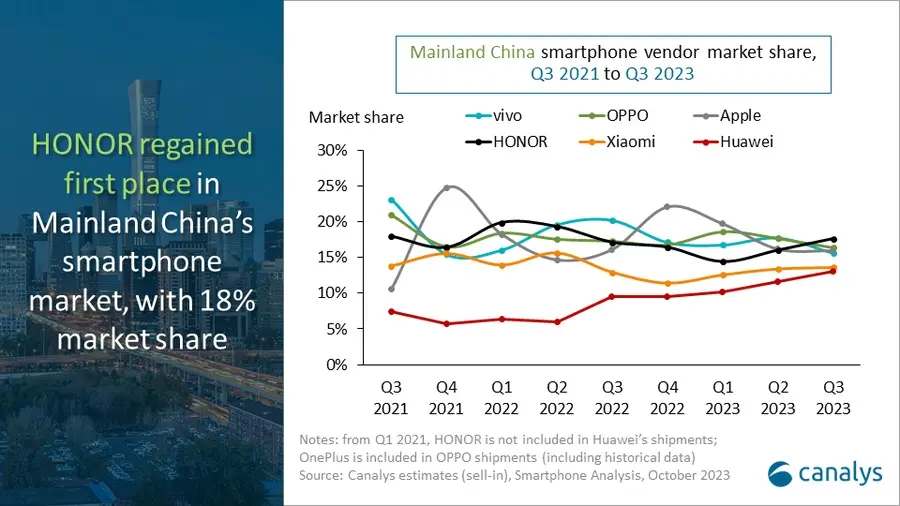

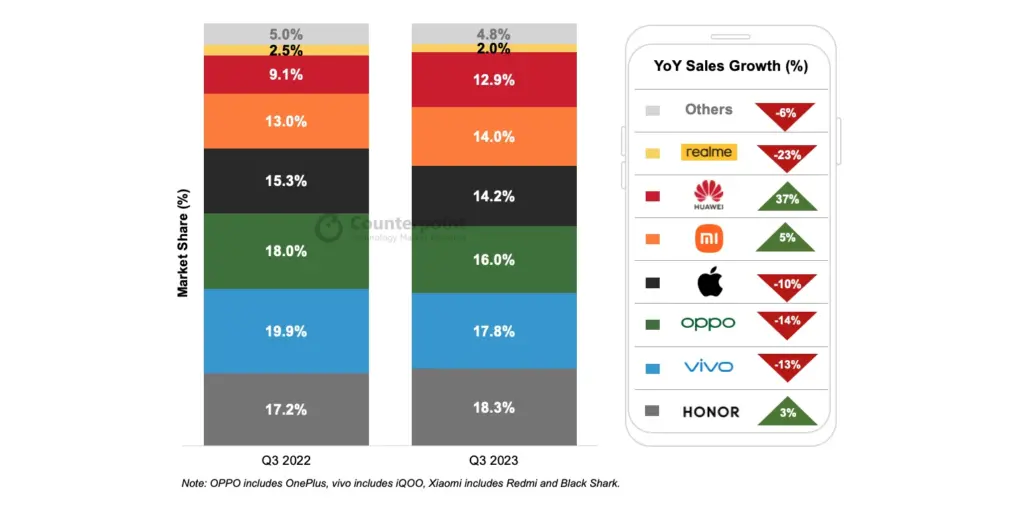

Canalys estimates show that smartphone shipments in Mainland China fell 5% YoY to 66.7 million units in Q3’23, marking the second straight quarterly decline. Honor returned to the top market share position at 18% on shipments of 11.8 million units, benefitting from product and channel strengths. Oppo (including OnePlus) followed in second place with 10.9 million shipments and a 16% share. Apple ranked third with 10.6 million iPhone shipments, helped by the iPhone 15 launch. Huawei also continued to gain share, moving towards the top vendors through high-profile Mate series device debuts.

Vendors and channel partners are collaborating more closely from strategy to operations, especially since 2022 when facing slower demand and inventory risks together. Vendors assist channels in areas like digital financial tools for improved cash flow from Honor and Oppo, and options for ambitious distributors to acquire Xiaomi stores to optimize resources. Facing intense competition, vendors continuously test new symbiotic channel partner models.

Just so we are fair to all the numbers people, Counterpoint has also released its own data on the Chinese smartphone market. This research group has the Chinese market declining by 3% YoY in Q3’23 and notes that Apple lost share in the period because iPhone 15 launch sales volume was lower than that of the iPhone 14 series.

With vendors firmly investing in and refining channel incentives, the market has bottomed out in 2023 with expected gradual recovery. Consumers still pay for attractive value given their budgets, despite lengthening replacement cycles.

| Vendor | Q3’23 shipments (million) | Q3’23 market share | Q3’22 shipments (million) | Q3’22 market share | Annual growth |

|---|---|---|---|---|---|

| Honor | 11.8 | 18% | 12.0 | 17% | -1% |

| Oppo | 10.9 | 16% | 12.1 | 17% | -10% |

| Apple | 10.6 | 16% | 11.3 | 16% | -6% |

| vivo | 10.4 | 16% | 14.1 | 20% | -26% |

| Xiaomi | 9.1 | 14% | 9.0 | 13% | 0% |

| Others | 13.9 | 21% | 11.4 | 16% | 21% |

| Total | 66.7 | 100% | 69.8 | 100% | -5% |