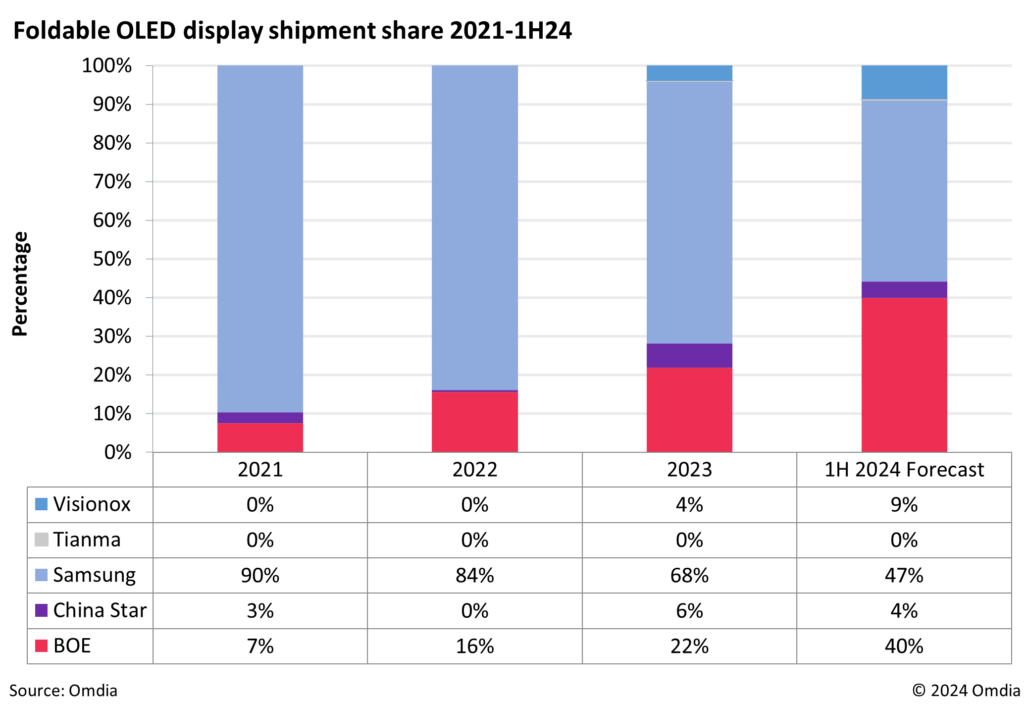

Chinese manufacturers of flexible OLED displays are rapidly advancing their technology and increasing shipments, posing a significant challenge to Samsung Display’s long-held market dominance. In the first half of 2024, projections indicate that China’s foldable OLED shipments will reach 6.4 million units, outpacing Samsung Display’s 5.7 million units in South Korea, according to Omdia. This shift suggests that Chinese-produced foldable OLEDs will account for 53% of the global shipment share during this period.

Samsung Display and the Samsung Galaxy Fold have traditionally led the foldable smartphone market, being recognized for their technological innovation and strong consumer preference. However, Chinese brands such as Huawei, Honor, Oppo, Vivo, Xiaomi, Transsion, ZTE, and Lenovo MOTO are rapidly closing the gap. These brands have launched new and advanced foldable products, significantly boosting the position of Chinese flexible OLED manufacturers in the global market.

From 2021 to the first half of 2024, the shipment share of foldable OLED displays has seen notable changes. Chinese OLED makers have made substantial progress in developing foldable OLED technologies, including LTPO (Low Temperature Polysilicon Oxide), Touch on Thin Film Encapsulation, COE (Color Filter on Encapsulation), variable refresh rates of 120Hz, peak brightness improvements, ultra-thin foldable glass, and reducing the folding crease. These advancements have been successfully integrated into the latest models from Chinese smartphone brands, while the Samsung Galaxy Fold continues to primarily use technologies from Samsung Display.

David Hsieh, Senior Research Director at Omdia’s Displays practice, commented on the evolving market dynamics. He noted that while Samsung Display has traditionally been the market leader with high production yield rates, Chinese OLED manufacturers have been steadily increasing their shipment shares since 2023. He highlighted the efforts of Chinese flexible Gen6 fabs such as BOE’s B11, ChinaStar’s T4, and Visionox’s V2 and V3 in ramping up foldable display production, benefiting from improved yield rates and an expanding customer base.

The foldable smartphone display market has experienced significant growth, with shipments rising from 10.7 million units in 2021 to 16.6 million units in 2022, and 21.8 million units in 2023. Omdia projects that this market will reach 30 million units in 2024. Hsieh pointed out that the strategic initiatives of China’s OLED makers, along with the expansion efforts of Chinese smartphone brands, are expected to be crucial drivers of this growth trajectory.