China’s smartphone sales decreased 14.2% YoY in Q2 2022, according to Counterpoint’s Market Pulse report. The quarter’s volumes were 12.6% lower than the level seen during the severe pandemic-hit Q1 2020, and less than half of the historical peak of Q4 2016. The last time the sales were lower than this point was nearly a decade ago in Q4 2012, when the iPhone 5 was introduced.

Commenting on the Chinese smartphone market’s performance, Senior Analyst Ivan Lam said, “China’s economy merely grew 0.4% YoY in Q2 2022, lower than the market expectation of 0.8%-1%. During this period, major cities across China, including financial and manufacturing hub Pan-Shanghai, went through full or partial lockdowns. The hardest hit was the services sector, which fell into contraction territory, from 4% YoY growth in the first quarter to 0.4% in the second quarter. The deepest decline occurred in April’s consumption data, with total retail sales of consumer goods falling 11.1% YoY. Weak consumer sentiment combined with the high smartphone penetration rate in China resulted in poor Q2 performance of smartphone sales.”

Lam added, “Smartphone sales rose during the 618 e-commerce promotion period and with the gradual lifting of lockdowns in major cities. However, the sales during this promotion period were still down around 10% YoY. Given the low sales volume number for Q2 2022, we expect smartphone sales to rebound in the next quarter. At the same time, with the demand continuing to be underwhelming due to weak consumer sentiment and lack of new innovations, it is going to be very hard to make the situation better in the second half when compared to last year.”

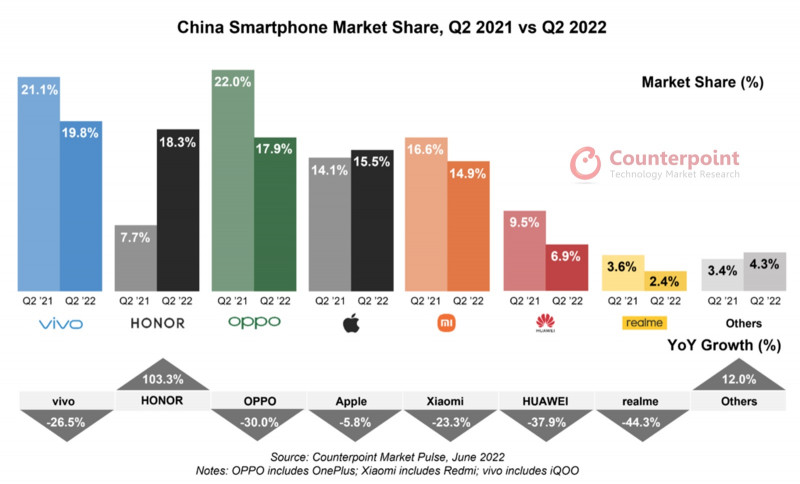

On key vendors’ performance, Research Analyst Mengmeng Zhang said, “During the quarter, vivo maintained its leadership. The mid-to-high-end S12 series helped vivo grab a good share in the $250-$399 segment. Sub-brand iQOO also received positive market feedback, especially from younger customers.”

Zhang added, “HONOR continues its great comeback by expanding its offline presence. With the lockdowns hitting major cities, HONOR’s coverage in lower-tier cities, which saw fewer lockdowns, helped the brand steer through the turbulence in Q2 2022. It may be noted that HONOR managed to take share from all the leading Chinese brands, including Huawei, during the quarter. It is time for OPPO and vivo, known as the “offline channel kings”, to take HONOR seriously.”

Apple still saw a comparatively good performance thanks to the shining sales of the iPhone 13 series in Q2 2022. Xiaomi saw a sales pick-up in June driven by the models like the Redmi K50 and Note 11 series. Research Analyst Archie Zhang said, “The increasing 5G penetration in China allows Xiaomi to tackle the shortage of 4G/LTE SoCs. But though its products can be seen on the shelves of more than 10,000 offline shops, Xiaomi is still grappling with sluggish sales.”

Despite the discouraging performance in Q2 2022, major Chinese OEMs continued efforts to strengthen their positions in the high-end segment. HONOR and Xiaomi have been benchmarking their high-end models against Apple by incorporating several iPhone features. OPPO and vivo are also leveraging their newly launched foldables to increase premium segment share. Commenting on the fast-growing new form factor, Lam said, “Major Chinese OEMs have not many options when it comes to penetrating the Apple-dominated premium segment. Foldable smartphone sales in the first half of 2022 have already surpassed that of 2021 with Huawei leading the segment, followed by Samsung and OPPO. We expect at least 4-5 new foldable models to be launched in the second half of 2022.”