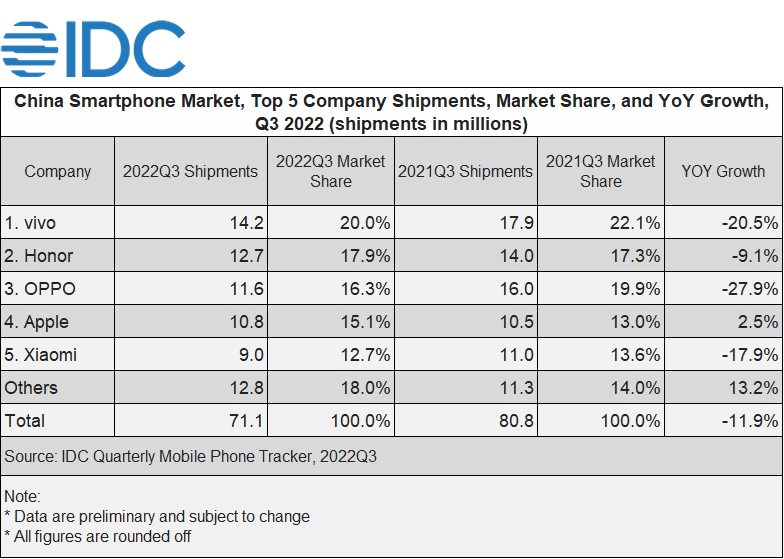

According to the IDC Worldwide Quarterly Mobile Phone Tracker, 71.1 million smartphones shipped in China in 3Q22, down 11.9% year-on-year (YoY). The decline was narrower than the previous two quarters despite the continued weak demand. The market saw its first quarter-on-quarter growth of 6.0% in the year, partly supported by Apple’s iPhone 14 series and Huawei’s Mate 50 series.

The channel inventory adjustments were a focus of the smartphone companies amid the market downturn.

“The gloomy circumstances and clouded outlook of the COVID policy in China are adding more uncertainties to the next year’s market outlook,” said Will Wong, Senior Research Manager for Client Devices at IDC Asia/Pacific. Wong adds, “Vendors that are able to attract resilient high-end consumers stand a better chance in this challenging environment.”

Top 5 Smartphone Company Highlights

• vivo returned to the top spot in 3Q22. The sub-brand, iQOO, achieved a higher market share of 4.6% with its competitive products and pricing. vivo’s X series continued to be well-received and led the US$400-$600 mid- to high-end segment.

• Honor’s 70 series, Changwan 30 series, and Play 6 series continued to see favorable shipment momentum. The new X40 series was well-received with its attractive design and optimized performance, while the flagship Magic 4 series enhanced its position in the commercial segment, including the public sector.

• OPPO’s A57 and A97 models were the volume drivers while its Reno 8 series played a key role in supporting the company’s position in the US$200-$400 segment. With the new generation of the ColorOS and the Pantanal cross-platform smart system, OPPO is expected to enhance the user experience from both hardware and software usage.

• Apple was the only top 5 vendor that achieved growth from the previous year. The new iPhone 14 Pro series was more better received than the base iPhone 14 models as the latter has limited upgrades. Furthermore, the iPhone 13 series still saw good demand in the quarter.

• Xiaomi’s Redmi products continued to be the key shipment contributor with the Redmi K50 series and Redmi Note 11 series being the volume drivers. The new Mi 12S series received good word of mouth, which in turn, would help Xiaomi’s penetration in the high-end segment.

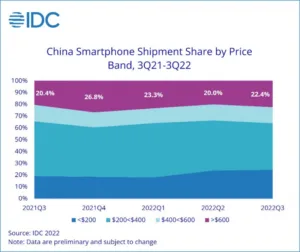

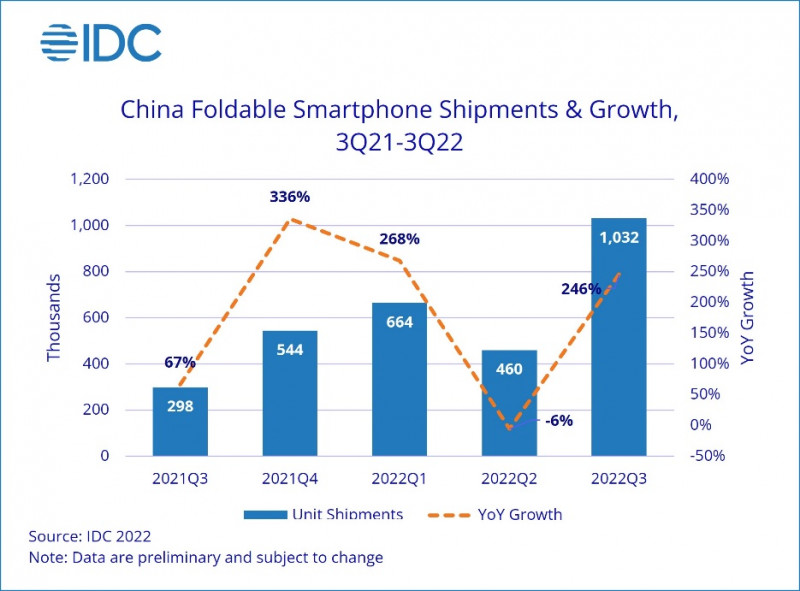

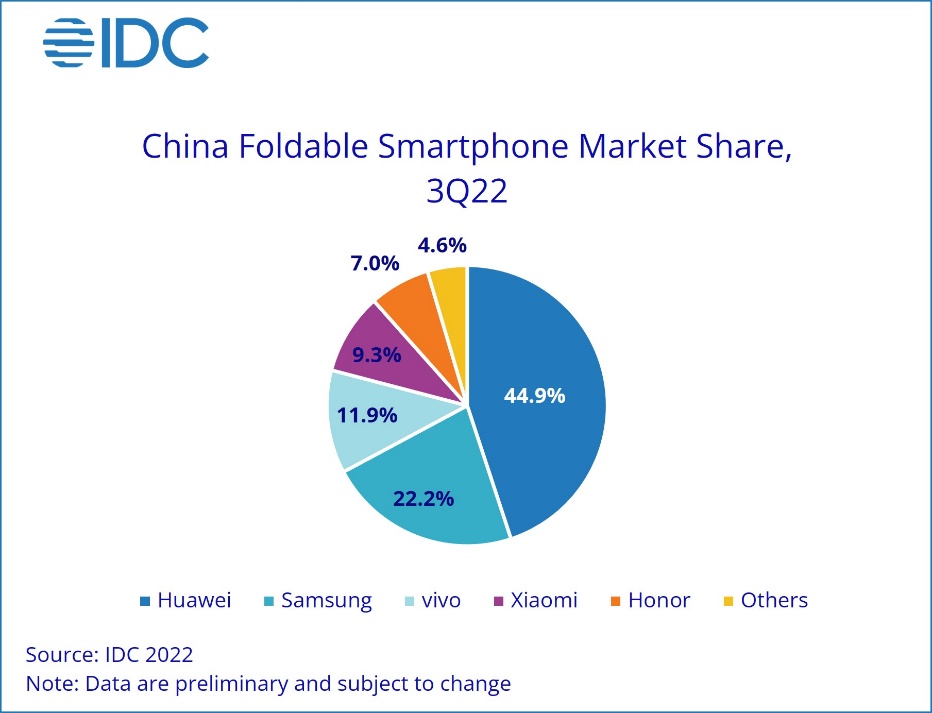

Despite the overall market’s decline, the >US$600 high-end segment saw limited impact with a higher unit share of 22.4%. Furthermore, premium foldable products, again, saw triple-digit YoY growth and shipped more than one million units which were the highest-ever shipments in a single quarter. Huawei continued to be the leader in the foldable market, followed by Samsung, vivo, and Xiaomi, which were supported by new foldable products.

“China’s smartphone market is unlikely to recover in the short term as it faces lingering COVID-19 cases and unfavorable domestic and global economic conditions,” said Arthur Guo, Senior Market Analyst for Client System Research at IDC China. Guo adds, “Nevertheless, investment in product development remains crucial to strengthen the market positions as well as to get prepared for the next recovery.”