It’s hard to see how retail pricing models are sustained during holiday shopping seasons like Black Friday and Cyber Monday, which just passed us by. I had wanted to look at pricing and see if I could model out projections for future pricing moves, but the data is very fluid. There are many reasons for this.

First, sale prices can move in many ways when you search for them online because we have dynamic pricing and algorithms that can account for user behavior adapting to competitor pricing, demand, or just looking to convert viewers to shoppers. Then there are all manners of bundling, volume, and segment pricing methodologies that can be applied and adapted on the fly with online retailers. Finally, there are referral engines, which for the most part just look to create lead generation from links in articles and posts on blogs and online tech sites. Some of these referral engines are very sophisticated and also adaptable to user behavior and traffic flows to articles. Publishers can make a lot of money from a list like this one if they have affiliate links to Amazon or Best Buy, for example, and means that a smart vendor can never be undersold, if it doesn’t want to be.

| Brand | Product | Size of screen | Price on sale | Original price | Discount percentage |

|---|---|---|---|---|---|

| Samsung | TU690T 4K Smart Tizen TV | 75 inches | $549.99 | $749.99 | 27% |

| TCL | Q5 Series QLED 4K Smart TV | 65 inches | $399.99 | $599.99 | 33% |

| Hisense | A4 Full HD 1080p Smart TV | 40 inches | $139.99 | $179.99 | 22% |

| Samsung | The Frame 4K QLED TV | 43 inches | $799.99 | $999.99 | 20% |

| Sony | X90L 4K Google TV | 65 inches | $999.99 | $1,299.99 | 23% |

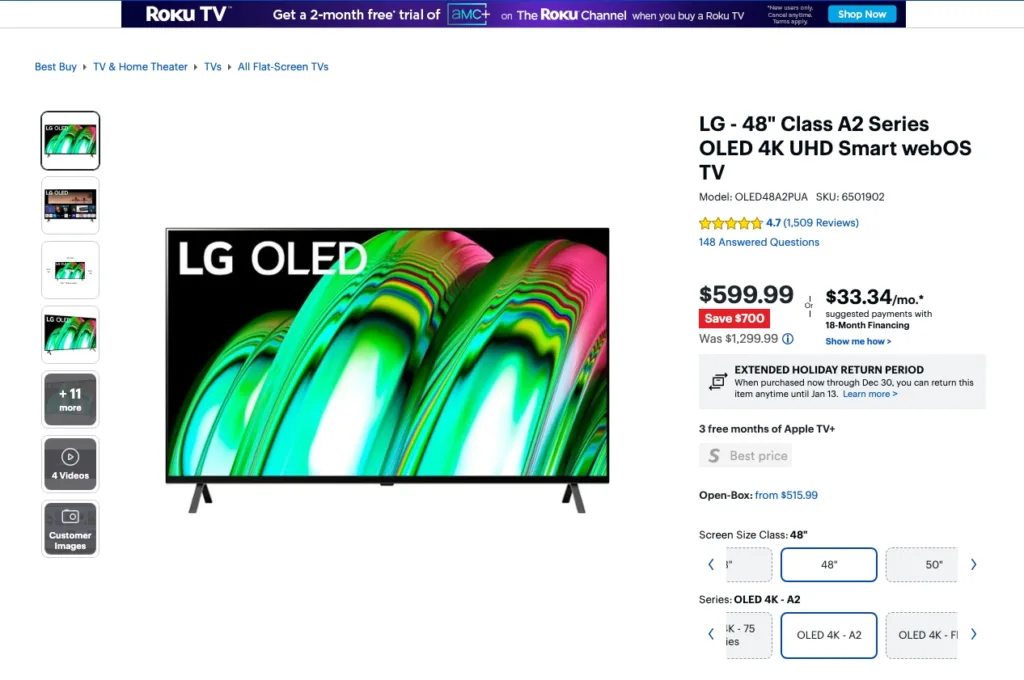

| LG | A2 OLED 4K TV | 48 inches | $549.99 | $1,299.99 | 58% |

| Samsung | The Terrace Outdoor 4K TV | 65 inches | $2,990.00 | $4,999.99 | 40% |

| LG | C3 OLED TV | 77 inches | $1,049.99 | $1,299.99 | 19% |

| LG | UQ7570 Series 4K Smart TV | 50 inches | $296.99 | $459.99 | 35% |

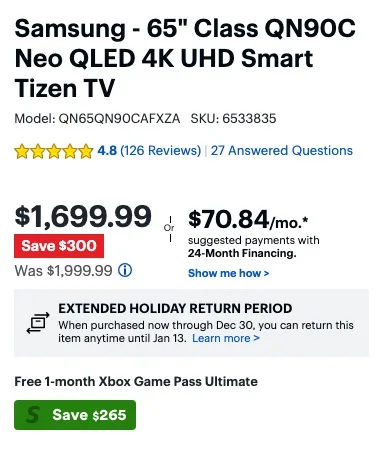

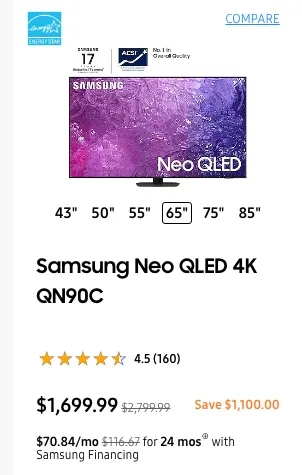

| Samsung | Neo QLED QN90C TV | 65 inches | $1,697.99 | $2,797.99 | 39% |

| Samsung | CU7000 TV | 65 inches | $427.99 | $479.99 | 11% |

| Samsung | Q80C TV | 65 inches | $997.99 | $1,499 | 33% |

| TCL | S4 TV | 65 inches | $349.99 | $429.99 | 19% |

| Sony | X80K TV | 65 inches | $698 | $899.99 | 22% |

| Amazon | Fire TV Omni | 65 inches | $589.99 | $799.99 | 26% |

| LG | UQ7570 TV | 65 inches | $429.99 | $629.99 | 32% |

| Sony | X77L TV | 65 inches | $598 | $688 | 13% |

| Vizio | V-Series TV | 65 inches | $448 | $509 | 12% |

| Samsung | S90C TV | 65 inches | $1,599.99 | $2,099.99 | 24% |

| LG | B3 OLED TV | 65 inches | $1,299.99 | $1,999.99 | 35% |

| LG | UQ70 TV | 65 inches | $399.99 | $599.99 | 33% |

| TCL | Q5 Series TV | 65 inches | $399.99 | $599.99 | 33% |

| Sony | A80L TV | 65 inches | $1,699.99 | $2,299.99 | 26% |

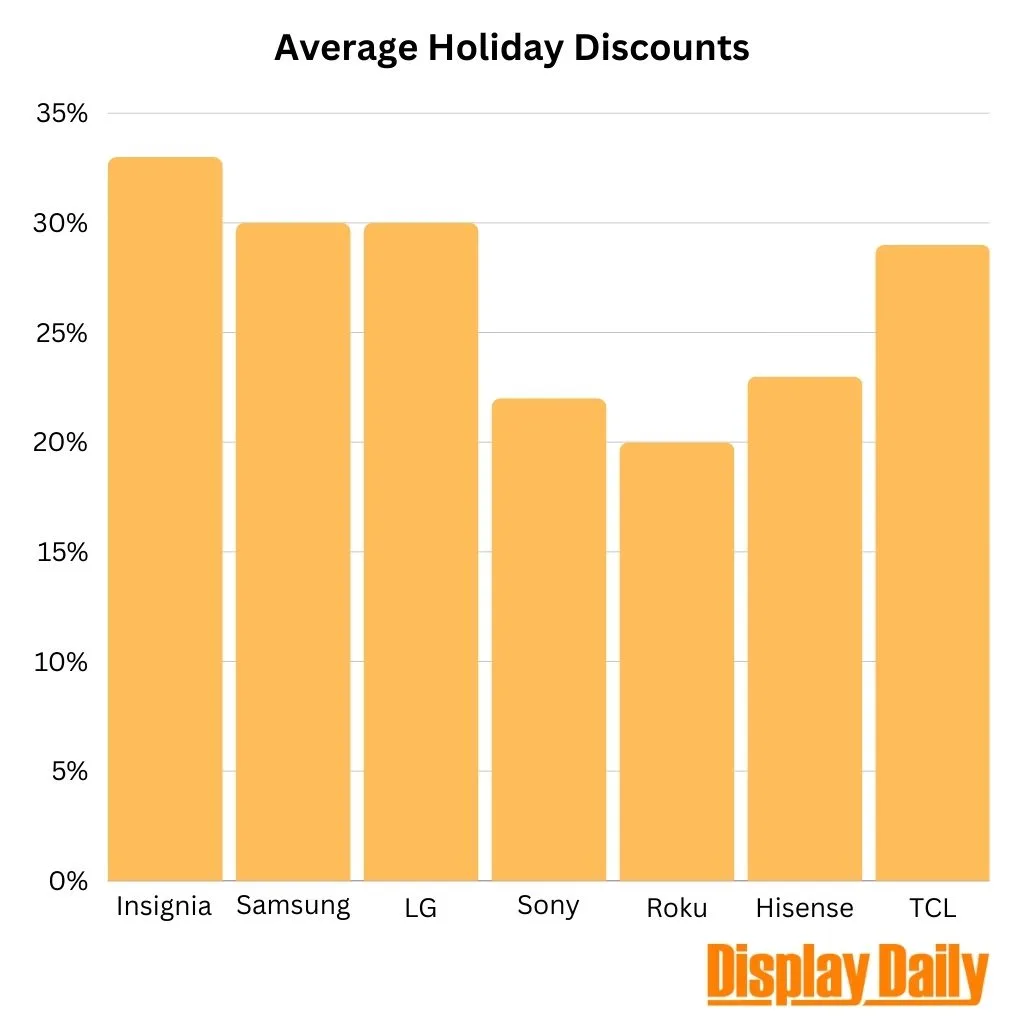

So, to some extent, it is a bit meaningless to expect much of an insight from holiday shopping prices beyond a magic figure: 35%. It may be anecdotal but 20-35% in discount terms seems like a good deal, attracts buyers, and can keep profit margins. Once you go into the 35-50% discounts and you have to start wondering how desperate is the vendor to move a particular product. And when you go beyond 50%, well they must be clearing out inventory.

Well, LG certainly got there, and seems to be still there today, with a 58% discount on the 48-inch A2 OLED. It could be that no one wants to deal with OLED TVs below 55-inch anymore because they are not as profitable as the larger displays. It could be that prices are going to drop enough on bigger displays to make it pointless to put any more money into stocking up at this size. It could be that an algorithm has figured out the optimal price to clear out a particular SKU and make it stand out among the crowd.

So, now, we have a wrinkle, as can be seen above. When is a deep discount not really a deep discount? Well, according to Samsung, it’s 39% and according to Best Buy, it’s 15%. Who cares, you say, the end price is the same. Sure, but it’s also a reflection of the psychology of the site. Best Buy, and this is speculation, may have figure out that it can’t really be seen to giving 39% discounts through the end of the year on premium products, while Samsung may be more concerned about not showing any drop in MSRP, and just be seeing as taking advantage fo the season or being aggressive against the competition. I mean, come on, LG has a 58% discount.

What all this means is that prices are going to come down a lot more over the next 2-3 months between the end of year sales, the New Year sales, and some desperation to clear out inventories in February, 2024. You can just smell the fear in the algorithms and the referral engines. It may be hard to get real deals, ones where the bottom price is lower than if you just browsed Amazon or Best Buy, but you have no FOMO here, the discounts are going to be there, they are going to be deep enough to hurt for most manufacturers, and they may go even deeper. The question is, who is going to buy these TVs in a month or two months? Won’t the last few days of shopping fever have emptied consumer wallets of all the pent up spending that was waiting for the big Black Friday and Cyber Monday sales? The algorithms won’t care. They’re just going to keep pushing for sales, whatever the cost to their human overlords.

The DSCC View

As a counterpoint, DSCC has written up its own analysis of holiday pricing discounts on TVs, which got handed to me after I had finished this. The analysts there, who are much smarter than me I am sure, believe that Black Friday 2023 broke more all-time low price records for larger premium TVs, while smaller budget models did not sink to new lows. Retailers offered very similar deals, and prices may still reduce further if holiday sales lag expectations. The DSCC takeaway is:

- There were more premium TV deals this year compared to 2022, with notable discounts on OLED and QD-OLED models from LG and Samsung in multiple sizes. The 48″ LG OLED TV hit another new all-time low price.

- Major retailers Walmart, Best Buy, and Amazon offered many identical TV deals. Lowest prices were not exclusive to just one retailer (I write about this above as being a function of how online algorithms drive prices and not individual retailers).

- LCD TV panel prices peaked in September 2022, so Black Friday likely saw the lowest prices for this holiday season. However, additional deals are still possible before end-of-year if holiday sales underperform.

- Premium OLED and MiniLED TV deals may continue even into early 2024 as the holiday sales season extends past New Year’s and peaks near the Super Bowl (I don’t think that’s a maybe, but a definite).