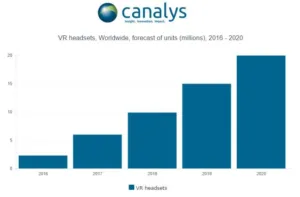

There are lots of reports about VR headset sales and the list of analysts has been joined by Canalys which believes that headset sales will exceed two million units in 2016, with growth forecast to reach 20 million by 2020. This year, shipments of smart VR headsets, which can function independently, will reach over 100,000 units. These estimates only include VR headsets with integrated displays, so exclude simple viewers, such as Samsung’s Gear VR and Google’s Daydream View, which are also shipping in the millions.

As expected, Sony has quickly become the VR market leader, with its affordable PlayStation VR catering to the vast PlayStation 4 installed base. Canalys expects over 800,000 shipments in less than three months on the market. Shipments would have been greater if it were not for one key problem: PlayStation VR was delayed until October and is still seriously supply constrained due to problems making its OLED displays.

‘Though some believe Sony has de-prioritized promoting VR in favor of the standard or Pro PlayStation 4s, it is not worth investing in major marketing campaigns while current supply remains sold out,’ said Canalys Analyst Daniel Matte. ‘Sony should push VR more forcefully when supply constraints ease, and especially as promising titles such as Farpoint and Golem are launched.’

While Sony has not significantly marketed PlayStation VR during the holiday sales period, Black Friday and Cyber Monday’s US$100 discounts have helped increase sales of HTC’s Vive in the US. HTC will ship around half a million units in 2016, putting the Vive in second place. Facebook’s Oculus Rift, meanwhile, is currently getting a boost from its long-awaited Touch motion controllers and will reach almost 400,000 shipments this year.

‘Over 300,000 VR headsets are estimated to ship in Greater China in 2016,’ said Canalys Analyst Jason Low. ‘HTC has led the charge, while local vendors, such as Deepoon, Idealens, 3Glasses and ANTVR, have provided their own unique innovations and localization efforts that are vital for the massive Chinese market. Business model experimentation is especially important to monitor due to unique economics and the sheer speed of development.’

Some expected products from large vendors were delayed until 2017, leaving significant room for growth. ‘The VR market has barely begun, and Canalys believes it will take several years to ramp up,’ said Low. ‘There are encouraging signs of consumer adoption and positive customer satisfaction, however, especially among gamers. Many billions of dollars of research and development are needed to continue advancing VR technology, form factors and software to further grow the industry.’