China’s smartphone market suffered its first-ever annual decline, with shipments down by 4% from 2016 to 459 million units in 2017. This drop was partly due to China having one of its worst year-on-year performances in the fourth quarter of 2017, with shipments plummeting by over 14% to just under 113 million units. Huawei’s shipments grew by 9% against the overall market decline, with the firm shipping more than 24 million smartphones and staying in top position.

Shipments fell for both Oppo and Vivo, by 16% and 7% respectively, but they held onto their respective second and third-place positions. Oppo shipped 19 million smartphones, while Vivo shipped 17 million. Apple overtook Xiaomi to take fourth place, pushing Xiaomi back to fifth with 13 million units. Huawei had its best ever quarter in its home market, shipping more than 24 million smartphones in the fourth quarter of 2017, to reach a total of 90 million in 2017.

Mo Jia, Canalys Research Analyst, said:

Mo Jia, Canalys Research Analyst, said:

“Huawei’s push into tier-three and four cities has yielded positive results. Nova and Honor have successfully gained share from smaller vendors, such as Gionee and Meizu. Honor’s performance has complemented Huawei’s success by contributing more than half of Huawei’s total shipments, but competition between Huawei and Honor is getting fierce and Huawei must deal with possible internal cannibalisation”.

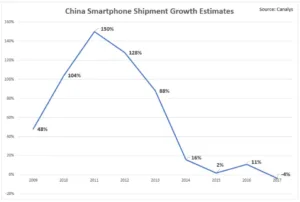

Canalys’ China Smartphone Shipment Growth Estimates. Image:Meko

Despite the dip in the fourth quarter of 2017, Oppo and Vivo both saw double-digit annual growth overall. Jia also commented:

“The market has slowed faster than expected. Being aware of inventory issues, both vendors have set up flagship stores in tier-one cities to boost their branding and drive value growth. Failure to drive footfall, however, will threaten Oppo and Vivo’s ongoing channel transformation and render the exercise futile”.

Hattie He, Canalys Research Analyst, stated:

“The declining Chinese market will have a detrimental impact on those Chinese vendors that have been heavily relying on their home market. It will affect their cash flow and profitability, limiting overseas expansion and bringing their future survival into question.

The threat to vendors such as Gionee and Meizu is now closer than ever. There is little room left for the smaller vendors. The leading players will make aggressive plans to maintain or grow their market share. We can expect a major market shake-up in China in 2018”.

With Lenovo and ZTE refocusing on the Chinese market in 2018, competition will intensify among vendors outside the top five.

Analyst Comment

We have seen reports from the US, credited to Bloomberg, that Verizon will follow AT&T in deciding to stop selling smartphones from Huawei in the US and will not supply the Mate 10 Pro that was launched in the US at CES. (Smartphone Round Up – CES 2018) The operators are said to be under pressure from regulators to cut ties with Huawei and China Telecom and a Texas member of Congress has proposed a ban on the US government buying from Huawei and ZTE. (BR)