A Chinese media report identifies BOE as formally announcing its investment to build a further G10.5 fab in Wuhan (BOE Formalises Second G10.5 Plan) for 120K per month substrates (around 1 million per month TVs). The project will have registered capital of CNY26 billion ($4.1 billion) with BOE taking a 23% share.

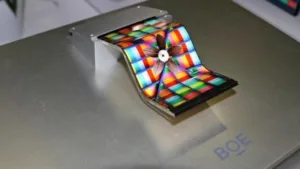

BOE has also officially announced plans to construct its third 6G flexible OLED line in Chongqing’s Liangjiang New District, at a cost of CNY46.5 billion ($7.3 billion). Nikkei reports that BOE will be contributing around CNY10 billion with the city contributing CNY16 billion and the paper quoted specialist financial analysts as estimating the firm is only investing around 15% of the total, but the Chinese press puts the ownership at 38.5%. The new facility will have a monthly capacity of 48,000 substrates at G6. Under the company’s current plans, the fab will start operations in the second half of 2020.

The company is reported to have decided to spend a further CNY4 billion ($630 million) on an assembly plant for TVs and monitors in Suzhou.

Analyst Comment

This is an aggressive move, when the global leader in flexible OLED, Samsung, is slowing down its investments in OLED production because of lower than hoped for demand from Apple. DSCC reports that not only has Samsung delayed the start of its new A5 fab, but has also significantly delayed the ramp of its A4 (L7-1) fab. The analyst said that equipment that has been delivered may be kept in crates and not considered for depreciation this year. The A5 fab will not now start until the first half of 2019, the firm believes.

LG Display is also reported to have delayed equipment orders for its P7 fab and DSCC believes that LG has cancelled POs and are not likely to be re-issued until early 2019, with production in 2020. Tianma will also delay its fab by around six months and may change to only make rigid OLEDs, rather than the original plan for 50% rigid first, then 50% flexible.

CSOT and EDO are also likely to have delayed, DSCC said, and the problems may have caused the authorities in China to review financial support for OLED fabs.

The issues, in the end, are to do with timing. It’s hard to see the vast majority of smartphones not switching over to flexible OLED, given the form factor advantages. (BR)