BOE Technology Group, Ltd (BOE) announced this week the proposed acquisition of majority stakes in two of the four CEC Panda LCD fabs in China, the Gen 8.5 fab in Nanjing and the Gen 8.6 fab in Chengdu. While no specific transfer price was stated, a minimum price for each fab was described. While some uncertainty remains because the transactions will still need approval from BOE shareholders, this is the most complete description thus far for the sale of CEC Panda assets, and it looks likely to proceed.

Formally, BOE described the proposed acquisition of 80.831% of Nanjing CEC Panda Flat Panel Display Technology Co., Ltd. (which we will refer to as “Nanjing G8.5”) and a 51% stake in Chengdu CEC Panda Display Technology Co., Ltd. (“Chengdu G8.6”). The Nanjing equity has been held by Huadong Technology (57.646%), China Power Co., Ltd. (17.168%) and Nanjing CEC Panda (6.017%). It’s worth noting that one of the other shareholders of Nanjing G8.5, which will not be part of the BOE transaction, is Sharp Corporation, which owns 7.718% equity. In the Chengdu G8.6 case, BOE expects to acquire the 51% stake currently held by Chengdu Advanced Manufacturing, Konggang Xingcheng Group and Konggang Xingcheng Construction Management.

In each case, BOE engaged an evaluation agency to assess the value of the fabs from an asset-based method and a market method, with relatively small differences between the two numbers, and took the larger amount. The equity of Nanjing G8.5 was publicly listed for transfer earlier this month, with a listing price of CNY 5,591,221,400 ($821 million), and BOE’s statement indicated that it intends to acquire Nanjing G8.5 at a price not lower than the listing price. BOE stated that an appraisal report valued the assets of Chengdu G8.6 at CNY 12,795,124,500 ($1.88 billion), and therefore BOE intends to acquire the 51% stake in Chengdu G8.6 for not less than CNY 6,525,513,500 ($958 million).

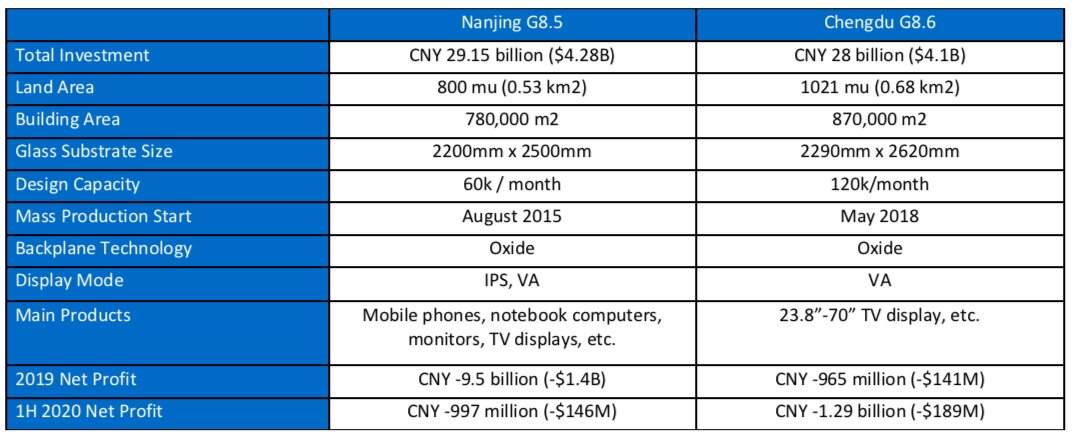

In its statement BOE listed the main features of both fabs, as follows:

The CEC acquisitions will give BOE its first oxide TFT LCD lines, which will enable BOE to offer more advanced products in TV and IT markets, and oxide TFT will also be required if and when BOE would build a fab for OLED TV. BOE will also acquire its first lines producing Vertically Aligned (VA) mode LCDs, whereas the rest of the company’s fabs focus on In-Plane Switching (IPS) mode LCD.

From a product portfolio standpoint, the Nanjing Gen8.5 is well suited to bolster BOE’s offering in IT markets, which have fared well during the pandemic. With oxide TFT technology, BOE will be able to offer enhanced notebook panels with high resolution and high frame rate. BOE’s IPS technology is ill-suited to curved displays, but the acquisition of VA technology can allow BOE to offer curved monitor displays

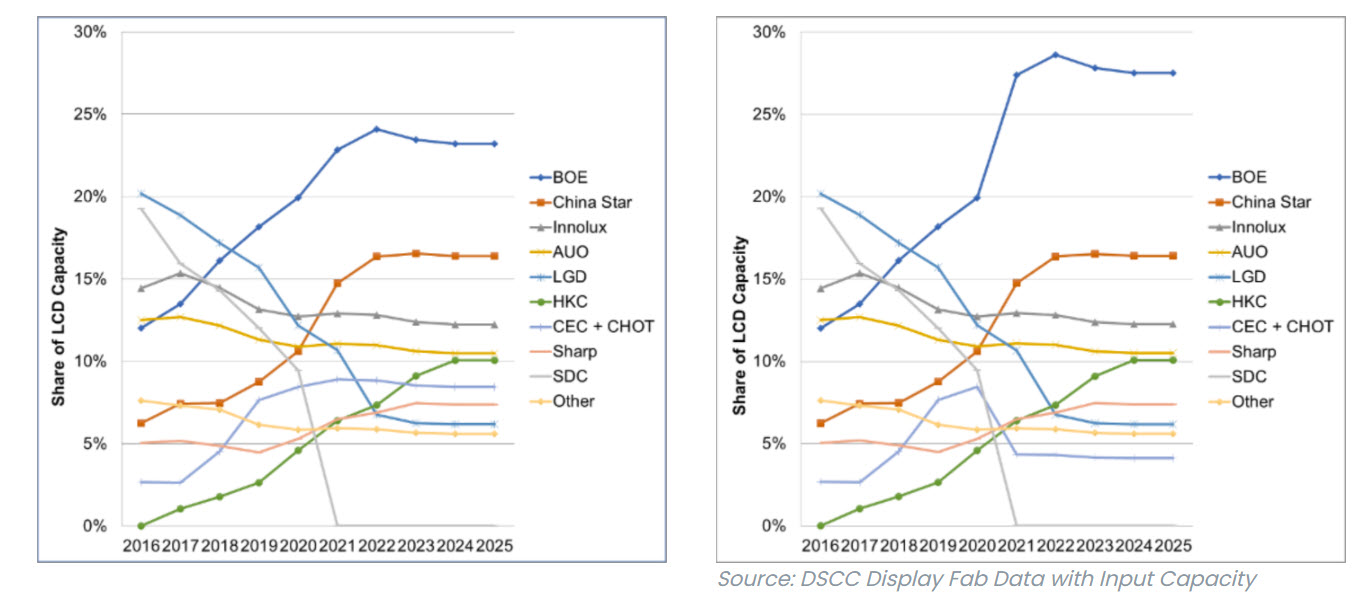

The addition of CEC Panda’s capacity will allow BOE to increase its leading share of the LCD market, as shown in the following two charts. The first chart shows LCD capacity share before the transaction, and the second chart after the transaction, assuming that the transaction takes effect at the end of 2020. Note that the CEC totals include CHOT.

LCD Capacity Share by Panel Maker, 2016-2025, Before (Left) and After (Right) BOE Acquisition of CEC Fabs

Even without the CEC additions, BOE has by far the industry’s highest capacity, but with these additions BOE’s capacity share will reach 29% in 2022, more than 50% higher than its nearest competitor CSOT. Note that this includes CSOT’s acquisition of Samsung Display’s Suzhou Gen 8.5 fab at the same time. The two China giants together will command 45% of industry capacity.

BOE indicated that it would use its own funds for the acquisitions, and this makes sense. As of June 30th, 2020, BOE reported CNY 58.4 billion ($8.2 billion) in cash and short-term investments, so it has plenty to spare to acquire these fabs. While the balance sheet will be fine, the income statement for BOE may be more of a challenge. Based on the BOE listing, the combined net loss of these two CEC fabs in 2019 was CNY 10.47 billion ($1.54 billion), far in excess of BOE’s reported net income of CNY 1.9 billion.

The BOE announcement made no mention of the CEC Panda Gen 6 fab in Nanjing. Our sources in China indicate that none of the potential buyers (BOE, CSOT and Tianma) were interested in acquiring the Gen 6. It is possible that BOE will assign some workers to take over the operations of Nanjing G6, but that the capacity and revenues (and likely, losses) will remain with Huadong, not with BOE.

With LCD panel price rising in 2020, though, BOE is well positioned to take advantage of an improvement in LCD profitability. BOE indicated that “After introducing a series of operation improvement measures such as lean management and supply chain integration, the G8.6 company will bring certain economic benefits, which will help the company strengthen its competitive advantage and increase strong profitability.” – Bob O’Brien

The author of this article was Bob O’Brien of DSCC

This article was originally published on the Display Supply Chain Consultants’ blog and is republished with permission.