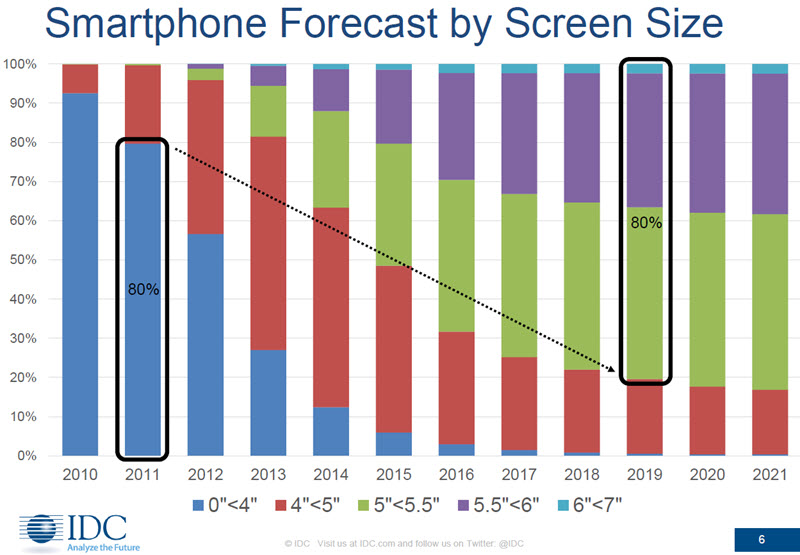

Ryan Reith is Program VP for IDC’s Mobile Tracker and he started by saying that there is plenty of room for growth in smartphone volumes as, at the moment, penetration globally is only 43%. 2016 was the first year with only single digit growth, but the market is likely to rebound as there are regions that could grow if economic conditions improve. The ASP of smartphones is $282 and is declining, but not a lot. There is still a premium segment to the market.

Ryan Reith is Program VP for IDC’s Mobile Tracker and he started by saying that there is plenty of room for growth in smartphone volumes as, at the moment, penetration globally is only 43%. 2016 was the first year with only single digit growth, but the market is likely to rebound as there are regions that could grow if economic conditions improve. The ASP of smartphones is $282 and is declining, but not a lot. There is still a premium segment to the market.

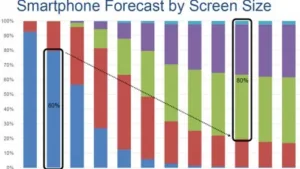

In displays, 5″ and 5.5″ are the standards and 5.5″ is now available in phones at just $150, so they are very accessible.

The Chinese brands, Xiaomi, Lenovo, Huawei, Vivo and Oppo have good products with sharp pricing, even with big displays and that means that Chinese vendors will continue to develop outside China.

Smartphone average screen size by year is now 5.0″, up from 3.1″ in 2010. Looking at the forecast, the trends to bigger displays are slowing down. 5.0″ to 5.5″ is probably a sweet spot and will grow to 45% of the market, IDC thinks. Sizes less than 4″ have dropped to 3% of the market. 5.5″ to 6″ is the premium segment and more than 30 % of the market (see chart). IDC classifies 6″ to 7″ as phablets and that segment remains a niche.

How important is the screen size? Brand and price are the #1 and #2 factors in purchase decisions, but screen size very important and resolution is even higher with around 65% of buyers taking it into account.

Looking by region, some regions are in replacement mode, but there should be a rebound in 2017 or 2018. Part of that will be driven by the Apple iPhone 8. The market in MEA should rebound and Latam has been struggling because of economic and political issues. The low end of the market priced at less than $200 has been the driver of growth for the last two to three years and China was especially important in that. However, customers are trading up to get better performance when they come back into the market, after trying entry level devices. Brand promotion is getting better and that is working with consumers and persuading them to spend more.

AR/VR is becoming the next big thing after wearables. The slowing growth in the smartphone market will mean more bundles of VR headsets with phones and IDC expects to see brands trying to use VR for generating interest in smartphone marketing.

Because consumers expect more from their devices and because of VR, there is an increased demand on processor power.

Reith forecast that the smartphone installed base will get to 4.7 billion in 2021 and the Middle East and Africa should become big markets.

IDC expects smartphone market growth to return. Click for higher resolution

IDC expects smartphone market growth to return. Click for higher resolution

Replacement cycles have been around two years up to now, but cycles are not expected to keep lengthening a lot. Consumers want more and better performance and AR/VR will demand a lot of power. 5G will have a big influence on the market at the high end.

There is still room to roll out for higher penetration and the smartphone remains the ‘go to device’ and consumers are doing more and more on their phones. This has had an effect on tablets. Tablets are less and less a mobile device and more and more a coffee table device.

Analyst Comment

I remember the discussion about the tablet being a shared ‘coffee table’ device, typically shared between family members, from several years ago! (BR)