Automotive display panels totalled ~148m units last year and unit volumes are expected to grow to ~170m units this year, but with displays ranging in size from 1.5” to 20+”, it is difficult to determine how much of display industry capacity the segment uses.

Making it a bit more complex, the value of the three major on-board display categories, center stack, instrument cluster, and HUD were estimated at over $11.5 billion last year and are expected to grow to over $20 billion in five years, but again what is actually included in those numbers makes them hard to reconcile.

There are a few things that are more definable however, such as the typical viewing distance for automotive displays, which is 27.5” (70 cm), considerably greater than typical smartphone viewing distance of 10.2” (25.6 cm), which makes it necessary to have a minimum resolution of 300ppi for most automotive displays. Brightness is certainly a major consideration in that the displays will be used in both bright light and full darkness, and probably the most important, automotive displays must be able to last five years at a minimum, and more likely ten years given automotive warranties. One would expect that the brightness and the lifetime issues would eliminate OLED displays from the automotive market in their current state, but OLED displays built on flexible substrates have the ability to conform to almost any shape, making them quite attractive from a design standpoint. For now, LCD displays dominate the space as can be seen from the share leaders below, many of whom have little or no OLED presence.

To put the automotive display space in perspective, we offer the following calculations with the understanding that they are based on estimates and suppositions that do not represent actual specifications:

Using a range of 2” to 20” and weighting each on squares, we estimate an average screen size of 6.28” or .0108869 m²/unit. 0108869 * 147,600,000 = 1,606,906 m² of capacity needed last year and 1,850,773 m² this year.

Comparing this to an average smartphone that is 6”, which uses .0099219 m²/unit, the average automotive display is ~10% larger than a flagship smartphone.

Given the relative size of each market – 147.6m automotive units and 1.485b smartphone units, the automotive market would demand ~10.9% of display capacity relative to smartphones, and while these are truly back-of-the-envelope calculations, they indicate the incremental display capacity needed to feed the automotive market. What does make the automotive display market worth following however, is the growth rate, both at the unit volume level (13% to 15% y/y this year) and the dollar value level, especially when compared to unit volume growth for smartphones, which is likely between 3% and 5%, which makes it clear why panel producers would focus on a product with a long lead time. If the automotive display market continues to grow at 10% or greater over the next few years, those producers who have established working relationships with automotive brands and OEMs could see a long-term boost to small panel demand down the road, but we reiterate that the outcome of the small panel automotive ‘refocus’ that is touted by small panel display producers is a long-term strategy that will be a substitute for small panel business lost to other technologies.

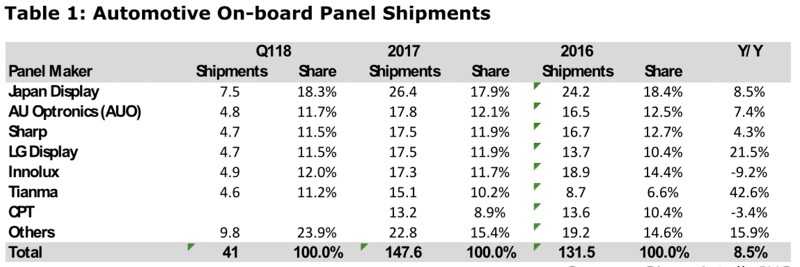

Table 1: Automotive On-board Panel Shipments

Source: Sigmaintell, IHS

Source: Sigmaintell, IHS

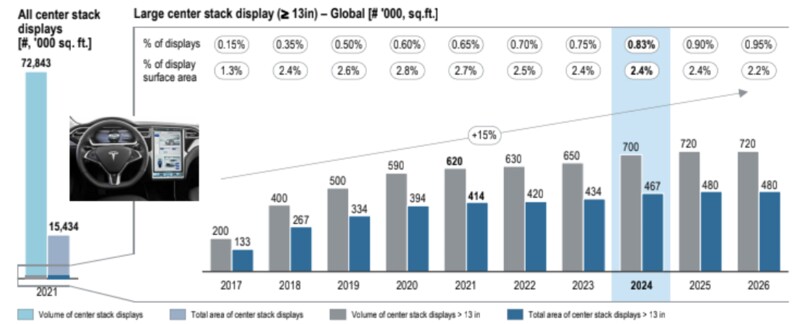

Displays are expected to pay an significant role in the automotive industry with a median content of 4.5 displays/car by the end of the decade. However, large displays (>12.3”) will not be a differentiator until the auto industry can figure out how to make a edge-to-edge display meaningful, because current vehicle architecture limits the diagonal size of instrument clusters and center stack clusters

Figure 1: Automotive Concepts—Mercedes Benz Console Design Limits

Source: Richard Berger

Figure 2: Large Display Adoption in Vehicle

Source: Richard Berger

Source: Richard Berger

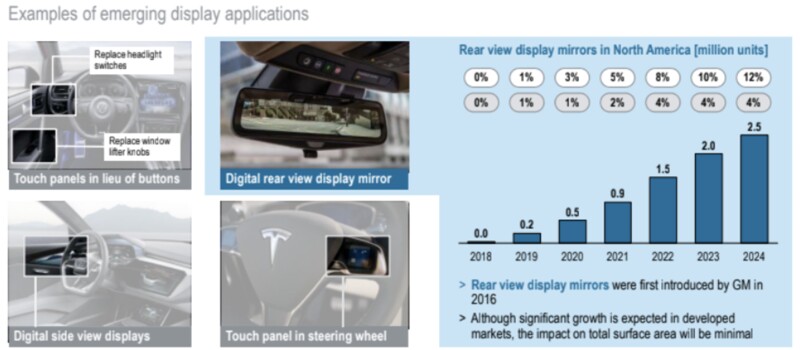

Emerging applications, such as rear view display mirrors are expected to gain rapid adoption from none in 2018 to 2.5m in 2024. At that point it is likely to be phased in on all new self-driven vehicles.

Figure 3: Automotive Concepts—Emerging Applications

Source: Richard Berger

Source: Richard BergerThe automotive industry is, perhaps, under the most stress ever, given that it is gravitating to a new end game of autonomous cars but the timing is uncertain especially across regions.

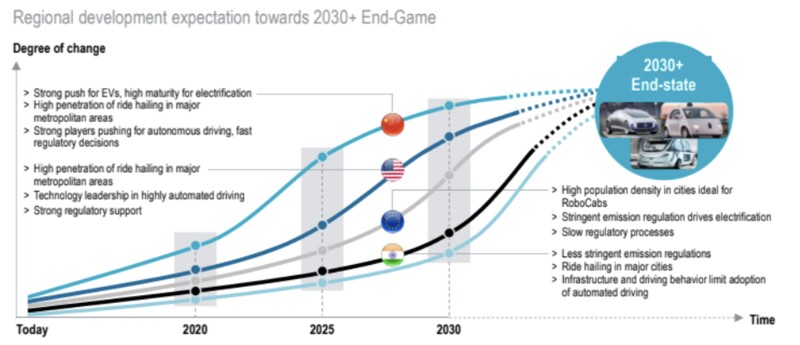

Figure 4: Automotive Concepts—Autonomous Adoption by Region

Source: Richard Berger

Source: Richard Berger

In the future, OEMs are gearing toward premium level 3 and above autonomous vehicles with multiple large displays for entertainment purposes.

Figure 5: Automotive Concepts—Autonomous Vehicles w/Large Display

Source: Richard Berger

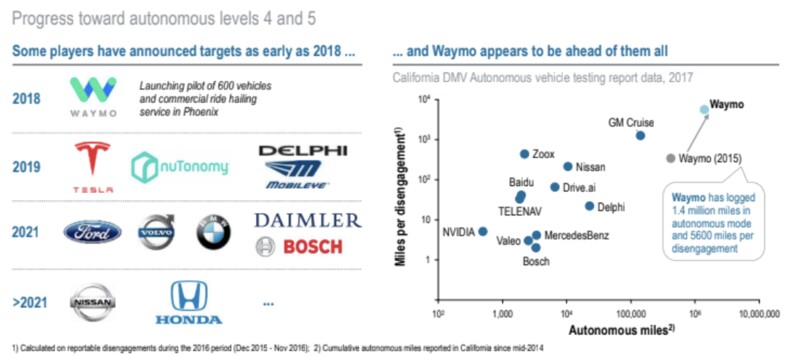

Source: Richard BergerDespite the hype, autonomous level 3 and above is closer that most believe and the actions of key players indicate a tipping point is near.

Figure 6: Automotive Concepts—Autonomous Level 4 and 5 Adoption

Source: Richard Berger

Source: Richard Berger

This article was originally published by the OLED Association and is re-published with permission.