A recent report in the Wall Street Journal and on the Fierce Video site details Comcast’s efforts to expand the reach of its video-over-IP X1 platform. Apparently, the company has been working with Hisense and Wal-Mart since last fall to develop smart televisions that would support a number of streaming apps, but feature the Xfinity OS. This crop of smartTVs might even carry a Comcast brand. (Shades of Apple’s stillborn venture into branded TVs!)

To me, it looks like Comcast isn’t at all sure where its future lies as the world rapidly moves away from conventional pay television delivered over cable to content streaming over fast broadband. The video streaming industry barely existed a decade ago. Now, it’s the preferred way to access feature films, “binge” TV programs, documentaries, and catch up with your favorite social commentary (think “Last Week with John Oliver”).

To be sure, this has been a frenetic year for media giants. Led by the 800-lb gorilla (Disney), Hollywood studios are rapidly consolidating television and movie operations and focusing on streaming platforms. Since early 2019, we’ve seen the launch of Disney+, Apple+, Hulu+, and this past March, Paramount+ (the rebranded CBS All Access.)

Comcast, as the owner of NBC Universal, also has its own content streaming platform – Peacock – but according to the Journal article, Comcast Xfinity TV subscriptions already include the service. Subtract them out, and the paid subscribers to Peacock (10 million) are only a small percentage of the 100+ million that Disney+ claims, not to mention Netflix (204 million) and Amazon Prime (upwards of 175 million Prime members streamed content in 2020).

Should Comcast Create?

Should Comcast keep one foot in the content creation business? So far, marriages of multichannel video programming distributors (MVPDs) and content creators haven’t work out well. Earlier this year, Verizon – the largest mobile phone network operator in America – threw in the towel on Yahoo! and AOL, two brands admittedly way past their prime. Not long after, AT&T – another cable TV company – opted out of the content business by spinning off Warner Media into a merger with Discovery Communications.

In both cases, the acquiring companies bit off way more than they could chew, with some self-anointed-genius executives thinking that by controlling the entire content creation-and-delivery chain, they could simply snap their fingers and the cash would come pouring through the doors. But running a communications company is a vastly different task than running a movie studio or television network, as Verizon and AT&T found out (and Amazon is also finding out!).

And what’s to be gained by introducing a line of X1-equipped Comcast televisions? That would put the cable giant on a collision course with 3rd-party streaming hardware brands Amazon, Google and Roku, not to mention smartTV manufacturers Samsung, Vizio and LG. In 2018, Samsung supported a Xfinity Stream app in some models of smart TVs, and last month added the Peacock app. That latter arrangement might not last should Comcast opt to come out with its own line of televisions via Hisense.

Not Much Profit

There’s not much profit in selling televisions these days, let alone give-away products like the Fire Stick and Roku/TiVo USB sticks. Rather; the goal is to use that hardware to generate revenue through subscriptions or targeted advertising. (Roku and Google had a battle royale over the latter recently). Even though Comcast does operate a number of Xfinity stores to sign up customers for pay TV, Internet voice, broadband, and even mobile phone service using Verizon’s network, I just can’t see them peddling LCD TVs. Nor can I see big box stores like Best Buy and Target selling a Comcast-branded TV – not with all the well-known brand choices consumers already have. (Although Fierce Video reported late last year that Comcast was talking with Walmart about a deal – Editor)

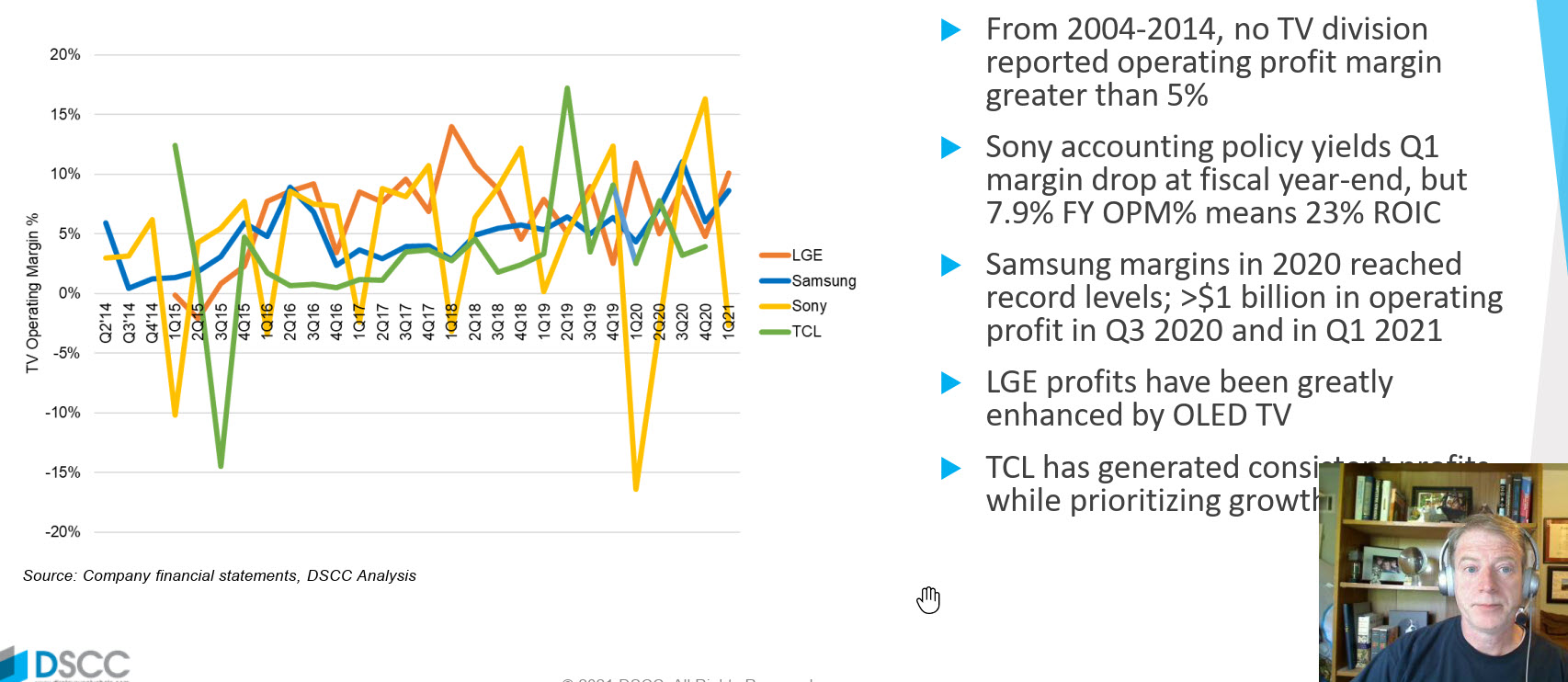

TV Margins are reasonably slim, according to this slide from DSCC’s Bob O’Brien at this year’s Display Week. Still Sony has a good ROIC because it turns its money over several times per year.

TV Margins are reasonably slim, according to this slide from DSCC’s Bob O’Brien at this year’s Display Week. Still Sony has a good ROIC because it turns its money over several times per year.

The long-term problem for Comcast (like all other cable MSOs) is the growing number of people (like me) who finally had enough of paying through the nose for channels they never watch and dropped cable TV in favor of fast broadband and cheaper services like Sling TV. (Hmmm…Peacock doesn’t come with that package!) Analysts agree that pay TV subscriptions, following the trend in DVD and Blu-ray sales and rentals, are long past their peak and will continue to drop YoY. That dog just don’t hunt anymore!

Okay; so maybe coming out with a line of Comcast televisions is a far-fetched idea. What’s the next move? Comcast has already introduced a home security system business (a “quadruple” play) for Xfinity subscribers. And they’re also offering discounted mobile phone service (Xfinity Mobile) using a combination of Xfinity WiFi hot spots and Verizon’s mobile network.

An Eye on an Acquisition?

The WSJ/Fierce Video stories speculate that Comcast CEO Brian Roberts has his eye on the recently-consolidated Viacom/CBS media conglomerate that just launched Paramount+. It’s already out-performing Peacock, approaching 40 million subscribers since an early March debut. And there is a precedent for more industry consolidation: Recall that Disney swallowed up 20th Century Fox studios a couple of years ago (not Fox’s TV networks and stations), adding them to its Pixar, Marvel Studios, and Lucasfilm operations.

NBC Universal’s library of movie titles – although substantial – isn’t near the size of Disney or Warner Media. Complicating things even further, Amazon recently bought MGM Studios (home of the James Bond 007 franchise), presumably because they haven’t had the expected success in original cinematic content production at Amazon Studios. Would a purchase of Viacom/CBS by Comcast, adding the Paramount library to Universal, level the playing field? Or would things go just as wrong as they did for Verizon and AT&T?

It doesn’t help that executives at NBC Universal can’t seem to hang onto the hits they do have. “Manifest,” a popular drama about an airplane and its passengers that disappears for 5+ years and mysteriously reappears, was abruptly canceled by NBC after the finale of Season 3 last month, even though showrunner Jeff Rake already has three more seasons mapped out and ready to go. (Note: I’m a fan of “Debris,” another NBC sci-fi series that’s well-written, engrossing, and will probably also wind up on the chopping block as a result.)

According to a story on MSN from June 19,

“…The first two seasons of Manifest arrived on Netflix on June 10. The streaming service gave it a notable spot on the platform’s home screen and only days later the show had climbed Netflix’s popularity list to be the streaming service’s #1 show in the US, an achievement it managed to hold for several days straight.”

That has to be sticking in somebody’s craw at Comcast headquarters. In the meantime: “Hey, here’s a great idea! Let’s come out with a line of Xfinity TVs! It can’t miss!” (PP)