AR/VR Display Summit by DSCC (Counterpoint Research) was held on last week in Silicon Valley, California. It focused on technologies and innovations from companies that are bringing next generation reality for AR/VR display.

At the conference, Said Bakadir, Senior Director of Qualcomm, said in his keynote speech, ”The age of 5G, AI and XR, connecting virtually everything. Displays supercharge the transformative power of Gen AI. Today consumer can speak with Gen AI assistant and in near future one can get contextual information right in one’s field of view with XR.”

He said that to create the immersive future, growth of the XR ecosystem is needed with combinations of XR platforms, software algorithms, reference designs, turnkey software solutions and platform collaborations.

Ajit Ninan, Senior Director AR/VR display and optics at Meta talked about role of perceptual imaging in AR/MR which are starting a new display era where focus has to go past resolution to perceptual imaging. Image quality in a standard display where same image is going to both eyes, can be based on resolution, dynamic range, color gamut and frame rate. In an AR/MR application where two different images going to each eye, display image quality will be determined by more factors: resolution, field of view, dynamic range, color gamut, stereo, frame rate, latency, degrees of freedom and accommodation-vergence. Our vision also influences other sensory inputs. Image quality also needs to be combined with image comfort.

Meta has introduced an AR glass prototype “Orion” at the end of September which includes optical quality silicon carbide waveguides with 70-degree field of view and RGB MicroLEDs.

Market and Industry Trends

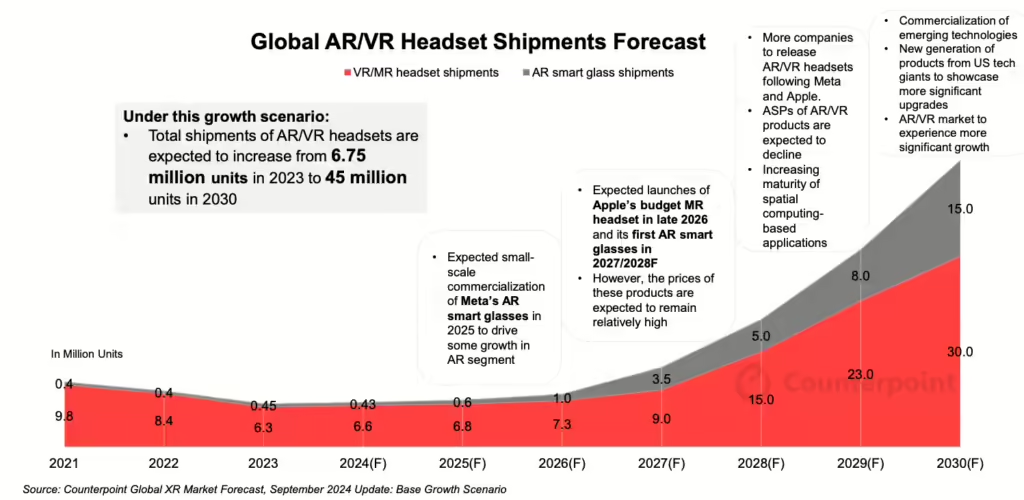

According to Flora Tang, Senior Analyst Counterpoint research, XR (Extended Reality) is an umbrella term that covers VR (Virtual Reality with full immersion), AR (Augmented Reality- Optical see through to overlap with real world) and MR (Mixed Reality- Color video see through also known as pass through). As per Counterpoint Research market outlook:

- Global VR shipments declined 21% YoY in H12024, dragged by weak sales of tethered products

- Meta Quest 3 was top selling VR headset in H12024 with 1.44 million units followed by Apple’s Vision Pro at 0.25 million units.

- Smaller OEMs in the consumer market are either withdrawing or delaying new product commercialization.

- Global VR/MR market is expected to see moderate growth from 2024 after two years of decline.

- Global AR smart glass shipments declined YoY in Q2 2024 after three consecutive quarters of growth.

- Despite lackluster 2024, global AR smart glass market expected to grow from its current small base.

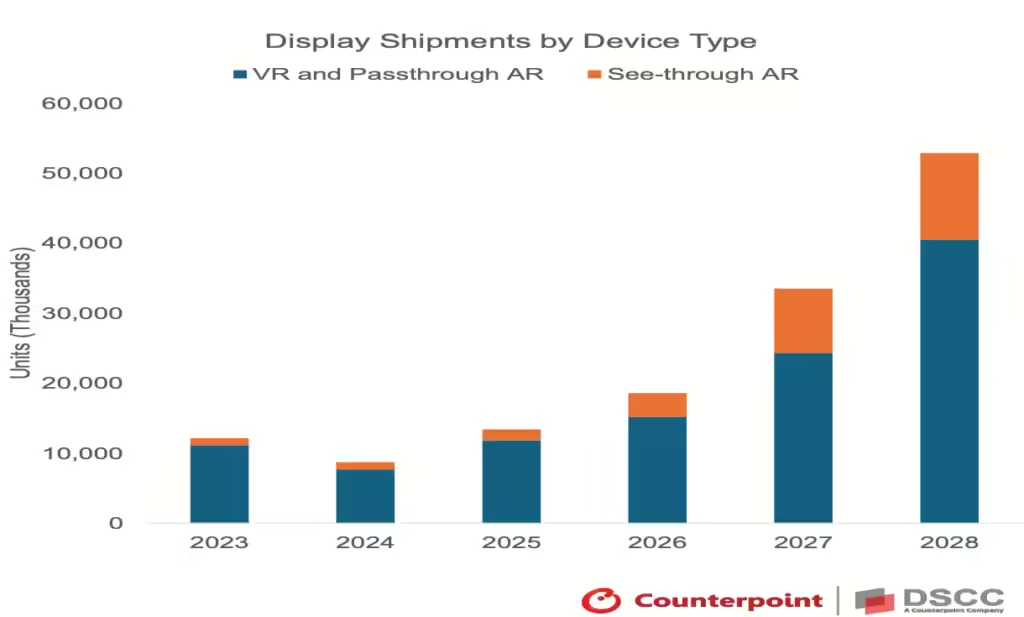

According to Guillaume Chansin, Director of display research for DSCC:

- Back in June, DSCC expected a 12% increase in AR/VR display shipments in 2024. However, the latest assumptions indicate that shipments could be lower than in 2023:

- Slower growth for VR

- Large inventory,

- Higher proportion of single-panel headsets vs dual-panel.

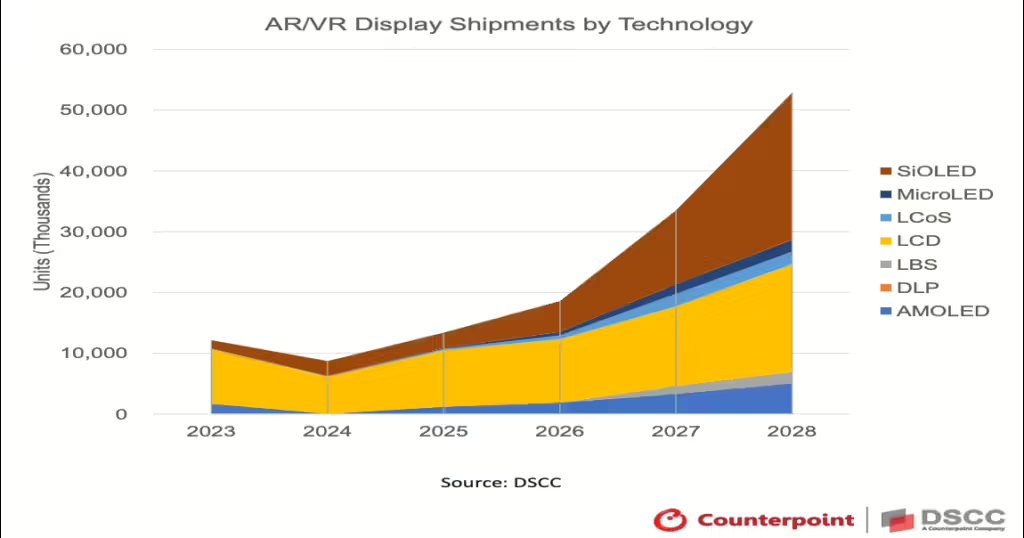

DSCC expects strong long-term growth for AR/VR display shipments driven by transition from single panel to double panel configuration, Apple’s launching cheaper Vision headset, and increased demand for AR smart glasses. The company forecasts 29% CAGR in shipments for VR display panels and 65% CAGR in shipments for see-through AR display panels between 2023 to 2028.

AR/VR Display Technology Trends

Apple’s use of MicroOLED (SiOLED) in its Vision Pro product has started the growth and higher investment for MicroOLED. As Guillaume Chansin reported, it is the only technology that is currently being used for both AR and VR devices. LG display (1.3’, 10K nits, WOLED, stacked), BOE (0.5”, 5K nits, RGB side by side OLED) and SEL (1.5”, 15K nits, RGB side by side tandem) have already shown MicroOLED demos. MicroOLED delivers high contrast and high resolution for media consumptions but still expensive. All new fabs are using 12” wafer to increase output and lower cost. Apple is expected to continue the use of MicroOLED however according to industry news Apple is exploring the use of AMOLED in future head set. Manufacturing innovation can enable higher PPI for glass-based AMOLED in future. MicroOLED expects to overtake LCD by 2028 unless glass-based AMOLED becomes a viable alternative.

MicroLED promises high brightness and efficiency. Only few brands are currently using MicroLED for AR and volumes are still small. Many suppliers including JBD, Mojo, Playnitride, Saphlux, Porotech, VueReal, and others are focusing on MicroLED display for AR/VR. Only monochrome displays are currently in productions. Meta’s new Orion prototype uses 3 monochrome MicroLED displays on each side according to Chansin. Many companies have shown prototypes of full color MicroLED including Playnitride, Porotech, Jade Bird Display, Raysolve, Q-Pixel and Saphlux.

Dr. Chen Chen, CEO and Co-Founder of Saphlux, presented their full color MicroLED near eye display technology based on Quantum Dots. According to him, AI glass needs micro display for more functions and faster communications. It requires high brightness, compact size and low cost. MicroLED can provide >100,000 nits brightness, high pixel density, high contrast (pure black) and high efficiency but it has manufacturing challenges and full color displays are not in production yet. The company has shown demo of demo of 0.39” monolithic full color demo for consumer AR.

Michelle Chen, CTO of Q-Pixel presented their approach of Tunable polychromatic LED (TP-LED). TP-LEDs are single pixels capable of emitting the full color spectrum without the use of subpixels, color filters, quantum dots, polarizers, or mechanical stacking. They have developed single LED wafer growth with color tuned by applying different electrical currents/voltages TP-LED simplifies display assembly. In 2023 Q-Pixel showed 10K PPI full color display made with 1-micron full color pixel, in 2024 it unveiled 6800PPI color active -matrix display.

Jay Fraser, Head of Business Development at Mojo Vision said that, their approach to RGB simplifies manufacturing using novel Quantum Dot (QD) technology. Their approach is monolithic color display using high performance quantum dots and use of microlens enables high display system efficiency (up to 5x the power efficiency of a display system). Mojo Vision demonstrated a successful integration of RGB sub-pixels into a single panel at Display Week 2024.

LCOS and LBS (Laser Beam Scanner) are still in race for AR/VR display. As per the presentation made by Dr. Louahab Noui, TriLite’s principal optical architect, TriLite designs and delivers world’s smallest laser beam scanner and it overcomes today’s micro-display limitations by being smaller and brighter.

Mike Noonen , CEO of Swave Photonics presented the possibility of using true holographic displays for AI and Spatial computing era. As per his presentation. Swave has developed holographic eXtended reality chipset that has very small pixel which are small enough to steer light and enable true holography. It does not need wave guide and can solve vergence- accommodation issue, prescription glass compatible, with dynamic focal distance and very large field of view and can offer many benefits.

Manufacturing Trends and Requirements

Fenfei Liu director of product marketing at Goertek gave an overview of recent XR devices and their near eye display highlighting the importance of weight and form factor in smart glass and HMD design and 4K resolution enhance MR experience. Kevin Lang, technical sales engineer for Instrument System said the AR/VR market uses small, high resolution, bright microdisplays. OLED on Silicon is one way and used in high priced products. Microlenses and color filters lead to angular dependency of the colors. There is need for accurate measuring. Murat Deveci, VP, Business Development & Sales at OptoFidelity, which focuses on metrology and testing said there is a need for performance testing even the best image quality, resolution and form factor is not enough if you are unable to utilize your HMD without becoming sick.

Satoshi Shiraga, CEO & Founder of Cellid, focused on advanced technologies for plastic waveguide. The company is developing the waveguide and micro projector for AR glasses and high-performance spatial recognition software. According to the company, depending on the use case, there will be two types: information Display Type (plastic waveguide) and Spatial Computing Type (glass waveguide) and mass production will begin in the first half of 2025. Alastair J. Grant SVP of DigiLens presented about holographic waveguides. DigiLens advantages are high transparency (85% 3 layers waveguide and 95% with single layer waveguide) and low eye glow for privacy and social acceptability.

Erin McDowell chief revenue office for FlexEnable said the company has developed multiple applications its low temperature manufacturing and processing technology in AR/VR optics, display, e- privacy cells and smart windows and OTFT backplanes for EPD. Combined with OTFTs, FlexEnable’s approach is the only means for manufacturing spatial (pixelated) dimmers on plastic. Brue Elliot general manager of Sidetek said in his presentation MicroOLED can be commercialized by scale. Sidetek has a brand new 12” production line with investment over $850M. They have developed White OLED followed by RGB MicroOLED solutions according to the company.

Display Technology innovation is critical to reduce manufacturing cost and improve performance to enable next generation AR/VR products.

With more than 26 years of experience in the Display Industry and Display Market plus technology research, Sweta is a highly sought-after consultant and a frequent advisor to firms that invest in the Display value chain. Prior to starting Dash-Insights, Sweta was the Senior Director of Display Research, and Strategy at IHS Technology, and was the head of applied research, consulting, strategy, and Display Expert.