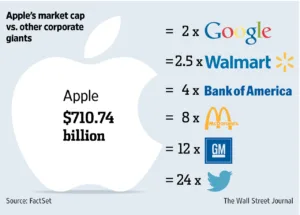

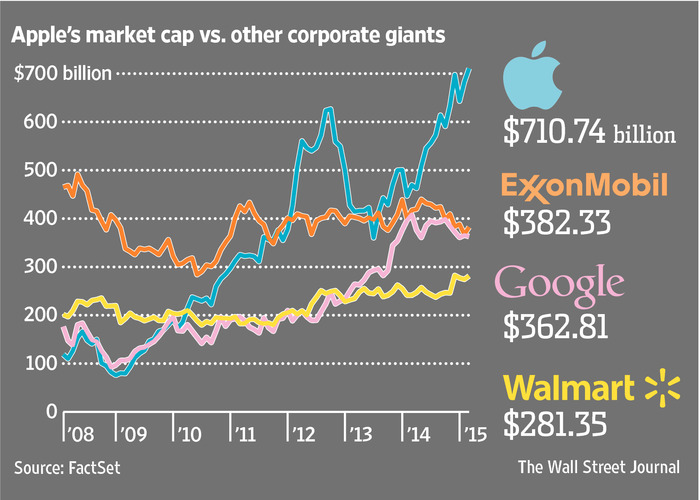

Apple recently exceeded $710 billion in market capitalization when its share price rose almost 2% (1.9%) to $122.02 creating a company with an overall market value of $710.7 billion. That number nearly doubles the market cap of its closest household name rivals including Exxon Mobile (at $382 billion), Warren Buffett’s Berkshire Hathaway ($370 billion) and technology rival Google ($363 billion). Market cap is based on the total value of its shares of stock at the current price.

Of particular interest to the display industry is the fact that Apple accomplished its latest market share bonanza on the heels of breakthrough smartphone sales in China, boosted by the larger 4.7″ and 5.5″ diagonal displays from its iPhone 6 and 6 Plus line, the company launched just four months ago to very strong demand. The iPhone 6 and 6 Plus broke Apple’s first day and first week sales records selling 4M and 10M units respectively. But it was sales in China that started just one month after the initial launch that helped continue to propel the company’s profitability skyward.

But it was the average selling price (ASP) for Apple’s coveted smartphones that boosted the company fortunes to the top of the global heap. IDC reported “…at a time when ASPs for smartphone are rapidly declining, Apple managed to increase its reported ASPs in the fourth quarter due to higher-cost new models,” and “the growth of iPhone sales in both the U.S., which is considered a saturated market, and China, which presents the dual challenges of strong local competitors and serious price sensitivity, were remarkable,” according to Ryan Reith of IDC.

Apple grew its market share by 46% in the last quarter of 2014, and did it in the face of a slowing mobile market overall. Growth came largely at the expense of Samsung which shed 11 points y/y in smartphone shipments for the fourth quarter, recording 75.1M units in Q4’14, to 84.4M in Q3’14. IDC reported that in Q4’14, Apple was nearly at parity with Samsung selling 74.5M units just 600K fewer than its Korean rival.

Apple grew its market share by 46% in the last quarter of 2014, and did it in the face of a slowing mobile market overall. Growth came largely at the expense of Samsung which shed 11 points y/y in smartphone shipments for the fourth quarter, recording 75.1M units in Q4’14, to 84.4M in Q3’14. IDC reported that in Q4’14, Apple was nearly at parity with Samsung selling 74.5M units just 600K fewer than its Korean rival.

The “remarkable” growth was also not lost on Apple CEO Tim Cook, who took time to challenge the conventional wisdom by selling his high priced smartphones in China’s price sensitive market. Cook said yesterday at the Goldman Sachs Technology and Internet Conference in San Francisco, that its China market growth for the three month period (ending in December) was 70% with a whopping $38 billion in sales for the year. And the Wall Street Journal cited a Canalys Research study reporting the fourth quarter of 2014, Apple, sold more smartphones in China than any other company. That China market includes the mainland, Taiwan, and Hong Kong. Remarkable growth indeed considering just five years earlier the company sold just $1 billion.

Apple CEO Cook claims the company capitalized on the rising middle class of China and and that country’s rapid economic growth. But ABI Research says the engine behind growth in China may be slowing. The group is reporting a drop in growth from the heady 43% in 2013 to 17% last year and is forecasting a further reduction to 10% for 2015. ABI also expects to see a significant slowing of the $400-tier smartphone sales in China with 2014 to 2019 numbers at just 5% for the category. The sub-$200 smartphone category should grow some 14% in the same period.

Since the 1980 public offering, Apple’s market value has increased a remarkable 50,600% by 2015, with some bumps and mis starts in-between. – Steve Sechrist