In the great scheme of things, Apple was banking on the tried and true iPhone cash cow to dominate the world’s number two market for wireless devices, China. But things didn’t work out that way and it has the company scrambling for a plan B.

In the March 2016 quarter, the company found itself with quarterly sales in Greater China (including Taiwan and Hong Kong) down a whopping 26% (according to Counterpoint Research), and a declining China market share: down 6 points from 18% in Q1’15 to 12% in Q1’16. This included a YoY unit sales drop of 3 million, from 16 million units sold in the same 2015 period. Meanwhile, home-grown Chinese brand Huawei beat Apple with a whopping 50% growth, reaching 16 million units in the quarter.

Huawei is not the only company beating Apple at its own game, as local Chinese brands seem to have reached parity with the advantages of Apple’s iPhone 6S and 6S Plus devices. For example, China’s LeEco (a new name for the old LeTV brand) developed its “super phones” that boost performance using a Mediatek 10-core Helio X20 chip and feature a 5.5″ display with 1920 x 1080 resolution. The “super phones” were added to its Le Max2 phone line and have a larger 5.7″ 2560 x 1440 resolution display and 4GB or 6GB of RAM plus Snapdragon 820 SoC. LeEco Phones sell for between $170 and $385:  well below the Apple iPhone price offerings.

well below the Apple iPhone price offerings.

To add to its troubles in China, on April 22, China’s State Administration of Press, Publication, Radio, Film and Television closed down Apple’s iTunes, Movies, and iBooks services on the mainland, limiting an already beleaguered iPhone value proposition for Chinese wireless customers. Some of this pain was self-inflicted, as Apple’s major iPhone release this year (on March 31st) was an upgrade to the 4″ display version (the iPhone 5 series) even though 80% of the phones shipped in China are 5-inch and above according to director of Counterpoint Research, Neil Shah.

There is no official word on how long this will take to resolve with the Communist government’s agency, but some see the timing coinciding with Apple’s staunch stand on consumer privacy rights with the US federal government over its phone data encryption policy. Putting privacy above the government’s demands flies in the face of Chinese policy, practice and status quo – and comes with a price.

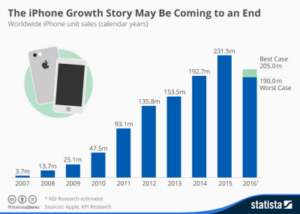

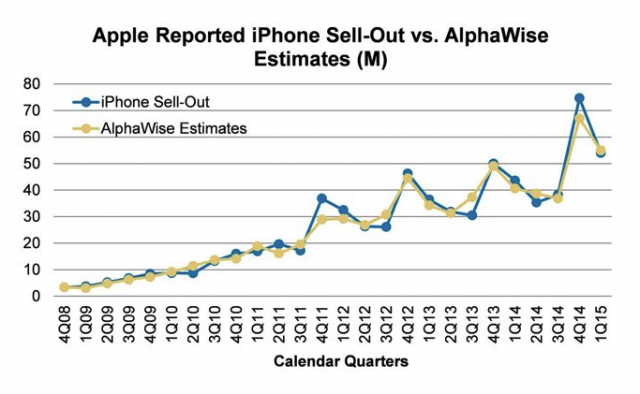

Bottom line: Apple last week reported its first ever volume decline in iPhone sales (down by 16% YoY, on sales of 51.2 million iPhones in the recent quarter. That number is off about 10 million units from 61.2 million units in the same quarter of 2015). It’s a milestone of a different kind for Apple that has investors worried.

Warning signs include the highest market cap company title moving from Apple to Google’s parent, Alphabet Inc., back in February of this year. More recently, in April, Japan’s Nikkei newspaper reported weak sales along with rising inventory levels of Apple flagship iPhone 6S and 6S Plus, which forced production cuts by 30% for Q1’16. Vendors disclosed that they were told by Apple that this will continue through June, according to the Japan-based publication. Sales of the Apple Watch also failed to materialize according to plan; perhaps the device Tim Cook was counting on taking up the slack as the maturing iPhone franchise begins to face market saturation?

When Apple introduced its first iPhone, the company offered a unique new concept using the display as a key product differentiator. The face of the device, that consumers could literally touch, empowered its new virtual keyboard. Its now-trademark single button on the front of the phone, plus its plethora of new options, went on to change everything in the wireless phone business. Fast forward to 2016 and eight consecutive years of stellar profit from iPhone sales rocketed Apple to become the highest market cap company in the world.

And while the innovation was compelling, Apple – and those eight long years of technology cycles – has been unable to duplicate that remarkable event, offering only incremental improvements in the device (and display). Consequently, the company is beginning to show signs of wireless phone market atrophy, perhaps much sooner than most folks expected.

– Steve Sechrist

You will find more statistics at Statista