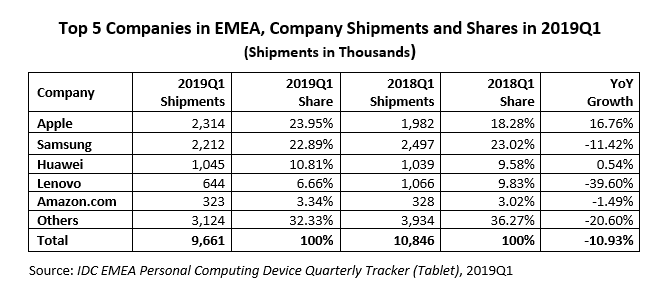

According to the latest figures published by International Data Corporation (IDC), the overall tablet market in EMEA declined 10.9% YoY, shipping 9.7 million units in the first quarter of 2019. Demand remains weak in the consumer segment as the lack of compelling reasons for consumers to refresh their tablets has slowed the pace of device renewals.

Apple emerged as the clear winner in the first quarter, regaining the number 1 position in EMEA, with an impressive run of six consecutive positive YoY quarter performances in the declining market. Market consolidation continues as more b-brands and local champions either exit or become less relevant.

The commercial segment continues to consistently outperform the market average. It only represents around a fifth of the overall market in EMEA, however, so its growth in 2019Q1 did not offset the decline in the consumer space.

“The proliferation of use cases across multiple key industries such as the financial sector, retail, transportation, and education is creating very interesting pockets of growth for tablet devices,” said Daniel Goncalves, senior research analyst, IDC Western European Personal Computing Devices. “As the erosion of the consumer space shows no signs of slowing down, enterprise is the only real opportunity for growth, so cooperation with vertical-specific resellers and the creation of scalable end-to-end solutions are vital.”

Overall, the tablet market in Western Europe declined 7.7% YoY in 2019Q1, while Central and Eastern Europe, the Middle East, and Africa (CEMA) declined 15.8% YoY.

“While consumer demand in the CEE region remained in negative territory during the first quarter of 2019, the commercial segment increased by double digits as it benefitted from significant deliveries to the telco and banking sectors in Poland,” said Nikolina Jurisic, product manager, IDC CEMA.

Vendor Highlights

Apple regained market leadership in EMEA as it continues to grab share from Android, boosted by last year’s iPad release.

Samsung remains strong across the three subregions despite the double-digit decline, especially in the CEMA region where it holds the number 1 position.

Huawei was third and posted a flat performance, leveraging the growing strength of the brand in the region before the recent boycotting of its products by many prominent players in the industry following the U.S. ban.

Lenovo continues to shift its focus away from tablets in favor of a stronger presence in the PC market.

Amazon held on to its top 5 ranking as a result of the very aggressive price points of its Fire devices.

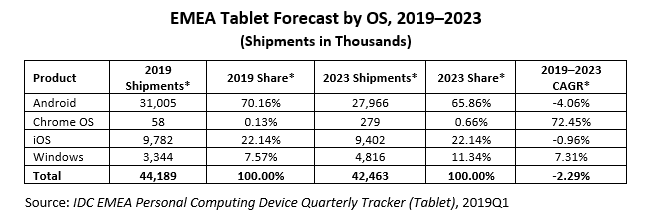

The outlook for tablets in 2019 remains constrained with a forecast decline of 8.7% YoY for the overall year. Lack of innovative features within the category and the growing spectrum of consumer devices in the market will continue to negatively affect demand. iOS-based devices are expected to continue to perform positively and grow in share over the coming quarters.

“Apple has been performing positively despite a soft tablet market. The double-digit increase in 2019Q1, prior to the introduction of new products, leads us to expect ongoing progress, particularly in developed economies where the brand is typically stronger,” said Goncalves. “The iPad continues to drive IB renewals and deployments in education, while the new iPad Air also has the potential to become a strong back-to-school contender later in the year.”

Detachables are projected to rebound in 2020, fueled by commercial segment adoption after years of strong decline.

“Demand for detachable tablets in EMEA has been failing to gain the expected steam due to lack of demand on Windows OS,” said Jurisic. “The lack of vendor focus, and their efforts toward notebooks and the convertible market, are reasons for its negative performance and are likely to continue impacting in the short run. However, in the longer term, the detachable category is expected to benefit from strengthening mobility trends, and adoption of these devices is expected to increase in the commercial space.”

Note: Tablets are portable, battery-powered computing devices inclusive of both slate and detachable form factors. Tablets may use LCD or OLED displays (epaper-based ereaders are not included here). Tablets are both slate and detachable keyboard form factor devices with color displays equal to or larger than 7.0in. and smaller than 16.0in.

IDC’s Quarterly PCD Tracker provides unmatched market coverage and forecasts for the entire device space, covering PCs and tablets, in more than 80 countries — providing fast, essential, and comprehensive market information across the entire personal computing device market.

For more information on IDC’s EMEA Quarterly Personal Computing Device Tracker or other IDC research services, please contact Vice President Karine Paoli on +44 (0) 20 8987 7218 or at [email protected]. Alternatively, contact your local IDC office or visit www.idc.com.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. IDC helps IT professionals, business executives, and the investment community to make fact-based decisions on technology purchases and business strategy. More than 1,000 IDC analysts provide global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries worldwide. For more than 50 years, IDC has provided strategic insights to help our clients achieve their key business objectives. IDC is a subsidiary of IDG, the world’s leading technology media, research, and events company. You can learn more about IDC by visiting www.idc.com.