The global tablet market fell almost 15% YoY in Q1’16. A combination of the traditional low first quarter and a lack of consumer interest conspired to bring shipments down to 39.6 million units, says IDC.

Slate tablets – although still falling – represented 87.6% of all shipments. These devices have now come to symbolise low-end products. This perception will help some vendors, such as Amazon, which rely on hardware sales to increase the size of their ecosystem. Others, however, will struggle – specifically those looking to increase their margins.

Detachables experienced triple-digit growth, reaching an all-time Q1 high of 4.9 million units. While Microsoft’s Surface was arguably responsible for creating this market, it is Apple that is benefiting from it. The firm is enjoying an impressive short-term lead, although IDC’s Jitesh Ubrani warns that “long-term success may prove challenging, as a higher entry price point staves off consumers and iOS has yet to prove its enterprise-readiness, leaving plenty of room for Microsoft and their hardware partners to re-establish themselves.”

Traditional smartphone vendors, such as Samsung and Huawei, also introduced hybrid tablets in Q1. These devices have mid-range pricing, which makes them a hard sell to consumers looking for a premium or entry-level device. However, research director Jean Philippe Bouchard says, “The introduction of detachables from traditional smartphone vendors is only beginning and pose[s] a real threat to traditional PC manufacturers… Their understanding of the mobile ecosystem and the volume achieved on their smartphone product lines will allow them to aggressively compete for this new computing segment.”

| Top Five Tablet Vendors’ Shipments, Market Share and Growth, Q1’16 (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | Q1’16 Unit Shipments | Q1’15 Unit Shipments | Q1’16 Share | Q1’15 Share | YoY Change |

| Apple | 10.3 | 12.6 | 25.9% | 27.2% | -18.8% |

| Samsung | 6.0 | 8.3 | 15.2% | 18.0% | -28.1% |

| Amazon | 2.2 | 0.0 | 5.7% | 0.1% | 5421.7% |

| Lenovo | 2.2 | 2.5 | 5.5% | 5.4% | -13.8% |

| Huawei | 2.1 | 1.1 | 5.2% | 2.4% | 82.2% |

| Others | 16.9 | 21.8 | 42.6% | 46.9% | -22.5% |

| Total | 39.6 | 46.4 | 100.0% | 100.0% | -14.7% |

| Source: IDC | |||||

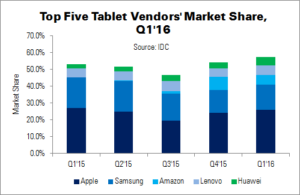

Apple remained the tablet market leader, again, although IDC expects that the iPad’s future lies in replacement demand of older tablets and PCs. The new iPad Pro (9.7″ and 12.9″) models are ‘healthy additions’ to the product range.

In second place, Samsung continued to perform well with its Galaxy Tab line – one of the last remaining premium Android tablets. Reactions to the TabPro S have been lukewarm, due to its relatively high price point, although IDC feels that is more of a short-term problem that Samsung will correct in the future.

Amazon came in third place in Q1. The low-cost Fire tablet is not the first of its kind, but its success highlights Amazon’s brand recognition. Annual growth is in the quad digits (5,241.7%!) – although note that Amazon’s Q1’15 lineup featured a 6″ tablet that was not included in IDC’s data, as it did not meet the requirements for the firm’s taxonomy.

The final two places were filled by Chinese brands: Lenovo and Huawei. Lenovo suffered from falling demand for Android slate tablets. It has introduced some hybrid and Windows 10 products, but gaps in its portfolio remain. IDC expects these to be filled soon, however. As for Huawei, the ‘vast majority’ of its shipments were in the slate tablet category. The firm introduced its first detachable, the MateBook, at MWC 2016 (Huawei Lays Down Productivity Gauntlet); IDC expects this to be of help going into Q2. Huawei recorded growth above 80%, showing the benefits of its resource allocation and the optimisation of its carrier relationships.