CE Week is a miniature Consumer Electronics Show held each June in New York to make sure the CES brand is not forgotten between one January and the next.

Okay, that may be a bit unfair. Quite a few companies pay to exhibit, and the press – including three U.S.-based members of the Display Monitor and Display Daily staff – shows up to report on the proceedings. However, you do have to pay attention if you want to find display-related exhibits. It is much easier to find earphones, including a $2,500 pair from Pioneer that is built by hand at a rate of three per month in Japan, and Bluetooth speakers. Lots of those.

Before taking a necessarily brief display-focused tour of the show floor yestertoday, I started with the Connected Modbility Conference and a presentation from Kelley Blue Book’s manager of commercial insights, Akshay Anand. Anand reported the results of Kelley Blue Book research project, which allowed him to title his report “Ride Sharing is not as Bad as You Think.” That is, from the automotive OEM perspective, ride and car sharing is not going to cannibalize their sales as much as some have feared. The report indicates that most of the people who use ride and car sharing now do so because they can’t afford a vehicle, not because they don’t want one. Indeed, 96% percent of non-car-owning respondents who used sharing services said they would buy a car if they could, while only 88% of non-car-owning respondents who did not use such service said the same thing.

Anand’s report was followed by a panel discussion chaired entitled “How Car-Sharing & Ride-Sharing are Reshaping the Auto Industry.” The panel was chaired by Doug Newcomb, President of C# Group. The members were Akshay Anand of Kelley Blue Book; Steve Banfield, CEO of the BMW car-sharing service ReachNow; and Michael Mikos, CFO and Director of Busness Development for Car2go. Here are some comments from the panel discussion.

Mikos: Transportation authorities have noticed the car- and ride-sharing trends and are supportive.

Banfield: The services are an “overnight success” that have been under development for years. The current explosion of interest is due to a convergence encouragement at the public-policy level and the ubiquity of smart phones.

Anand: Car companies are now acting more like Silicon Valley companies. The OEMs want to attract creative talent and not be left behind.

Banfield: If I can always get what I want when I want it, why should I buy it?

Mikos: We’re trying to break a 100-year-old habit [of driver control and vehicle ownership], and we’re not going to do it overnight.

The second panel discussion was “Predicting the Financial and Societal Impact of Self-Driving Cars,” moderated by Cathering McCullough, Director of the Intelligent Car Coalition. The panelists were Peter Esser, General Representative, Washington Operations for chip-maker NXP; Tushar Sethi, Principal of Quid; and Bryan Reimer, a Transportation Center Research Scientist at MIT Agelab.

Esser: Vehicles will be connected to vehicles and to the infrastructure. The Smart City initiative will soon select a city that will participate in including sensors and other devices throughout the city to interact with vehicles. With automotive vehicles, we will replicate on the ground what we have already insitituted in the air.

Reimer: Having people trust the technology (but not trust it too much) is tremendously difficult.

McCullough: Human error accounts for 96% of accidents. This is really bad but we are used to dealing with the consequences of human error. We are not yet comfortable with the consequences of machine error.

There will be much more discussion, research, development, and system-rollout concerning autonomous vehicles, technology, and products – and their psychological, societal, and business consequences. These systems are using lots of displays, even though the display will not be the most demanding part of the system.

On to the show floor, where I will not mention Nuni’s IndieGoGo-funded tortilla toaster, even to those of you who want to heat both sides of six tortillas at once in less than a minute.

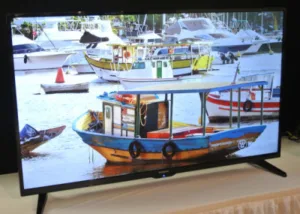

Westinghouse Digital was showing this 4K 50-inch TV, which is currently on sale for $499. (Photo: Ken Werner)

Westinghouse Digital’s Rey Roque was showing off a 4K 50-inch TV that is currently on sale for $499. A 55-inch was on sale for $599. Roque said that the over-capacity and over-production in Chinese panel fabs is creating very low-cost panels that benefit OEMs and their end customers. Brett Hunt added that the company is beginning to incorporate Google TV into their sets, as Vizio is doing.

Automotive radar detector company Whistler showed an aftermarket HUD that sits on the dash and plugs into your cars ODM II interface. Whistler expects the device to be available in August for a street price of $69.

DarbeeVision makes video processors that improve TV detail and add to the sense of three-dimensionality. The company’s processors are built into a variety of TV sets, but the company also has a FHD version in a box that sales to consumers for $199. The company is working on a 4K version, which will be purchased by OEMs before it becomes a stand-alone product.

Nanosys’ Jeff Yurek seems to enjoy explaining the benefits of quantum dots to a member of the press who does not generally attend display shows. (Photo: Ken Werner)And Nanosys’s Jeff Yurek stood in front of a Nanosys quantum-dot enanced Samsung TV and another company’s OLED enthusiastically explaining the benefits of quantum dots to a member of the press corp who does not go to SID Display Week and made no secret of the fact that he was extremely impressed.

Today, Chris Chinnock and I will be attending a shoot-out between several current-model TV displays, which Chris will tell you about later.

– Ken Werner