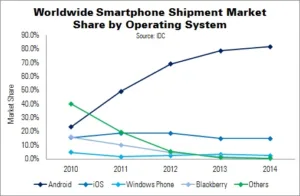

Android and iOS maintained their dominance of the worldwide smartphone market in Q4’14, says IDC, and in fact managed to improve their market share by double digits. These two operating systems represented 96.3% of all smartphone shipments, slightly up from Q4’13’s 95.6%.

The smartphone market grew 27% over the year as a whole and was outpaced by Android’s 32% growth. Meanwhile, iOS grew faster than the smartphone market in Q4: 46.1% and 29.2%, respectively.

A combination of strong user demand, refreshed product lines and new low-cost devices drove both Android and iOS volumes, said IDC’s Ramon Llamas. How they fare this year will bear close observation, especially now that Apple has entered the phablet market – there are few new areas to exploit. Meanwhile, Android was forced to rely on smaller vendors to drive volumes in 2014, as Samsung experienced flat growth.

“Instead of a battle for the third ecosystem…2014 instead yielded skirmishes”, said IDC’s Melissa Chau. Windows Phone grew past Blackberry, Firefox and rival systems, but no platform made the gains necessary to challenge the top two. Vendors are still trying, however; Microsoft is introducing ever-cheaper Lumia models and Tizen was finally launched in India last year (Display Monitor Vol 21 No 39).

Android passed 1 billion units last year, with its volumes exceeding those of the entire 2013 smartphone market. Samsung remained the leader, beating the volumes of the next five vendors combined, although its shipments were essentially flat. Other Asian vendors fuelled Android’s growth.

Market share for iOS fell slightly, although volumes reached a new record, largely due to the popularity of the iPhone 6 and 6 Plus.

Windows Phone experienced the smallest rise of the leading platforms (4.2% YoY) – well below the overall market. Microsoft primarily relied on its entry-level Lumia models, with partners HTC and Samsung covering the high-end. However, IDC believes that Windows 10 will see the OS make a more concerted push into the high-end mobile space this year.

Blackberry was the only leading OS to post a decline, falling almost 70%. 2014 was a year of rationalisation for the platform.

| Top Smartphone Operating Systems’ Shipments, Market Share and Growth, 2014 (Units in Millions) | |||||

|---|---|---|---|---|---|

| Operating System | 2014 Units | 2013 Units | 2014 Market Share (%) | 2013 Market Share (%) | YoY Change (%) |

| Android | 1,059.3 | 802.2 | 81.5 | 78.7 | 32 |

| iOS | 192.7 | 153.4 | 14.8 | 15.1 | 25.6 |

| Windows Phone | 34.9 | 33.5 | 2.7 | 3.3 | 4.2 |

| Blackberry | 5.8 | 19.2 | 0.4 | 1.9 | -69.8 |

| Others | 7.7 | 2.3 | 0.6 | 0.2 | 234.8 |

| Total | 1,300.4 | 1,018.7 | 100 | 100 | 27.7 |

| Source: IDC | |||||

| Top Smartphone Operating Systems’ Shipments, Market Share and Growth, Q4’14 (Units in Millions) | |||||

|---|---|---|---|---|---|

| Operating System | Q4’14 Units | Q4’13 Units | Q4’14 Market Share (%) | Q4’13 Market Share (%) | YoY Change (%) |

| Android | 289.1 | 228.4 | 76.6 | 78.2 | 26.6 |

| iOS | 74.5 | 51.0 | 19.7 | 17.5 | 46.1 |

| Windows Phone | 10.7 | 8.8 | 2.8 | 3 | 21.6 |

| Blackberry | 1.4 | 1.7 | 0.4 | 0.6 | -17.6 |

| Others | 1.8 | 2.3 | 0.5 | 0.8 | -21.7 |

| Total | 377.5 | 292.2 | 100 | 100 | 29.2 |

| Source: IDC | |||||