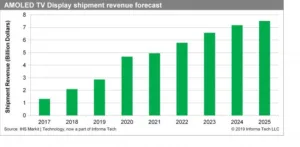

Driven by falling prices and rising consumer demand for thinner, lighter and more colourful television sets, market revenue for active matrix organic light-emitting-diode (AMOLED) displays used in TVs is expected to nearly triple during the next six years, according to IHS Markit | Technology, now a part of Informa Tech.

Global revenue for AMOLED TV displays will expand to $7.5 billion in 2025, up from $2.9 billion in 2019, as reported by the IHS Markit | Technology AMOLED & Flexible Display Intelligence Service. Although AMOLED TVs have only been on the market since 2013, they are rapidly gaining share, with these types of sets expected to account for 20.6 percent of the $36 billion TV display market in 2025, up from just 8.6 percent in 2019.

“Despite carrying a much higher average selling price (ASP) than LCD TVs, AMOLED TVs are extremely appealing to consumers because of their slim form factor, light weight and wide color gamut,” said Jerry Kang, associate director at IHS Markit | Technology. “Starting in 2020, AMOLED TV ASPs are expected to begin to decline due to increases in manufacturing capacity spurred by the adoption of a more advanced production process. This will pave the way for much more widespread adoption of AMOLED TVs.”

Thinner prices for thin displays

The AMOLED TV ASP currently is about four times more than the LCD TV ASP, based on a comparison of 65-inch panels with a 3840 by 2160 resolution. Because of this, TV brands are eager to reduce AMOLED prices to make them more attractive to consumers.

One development expected to result in major price declines is the use of multi-model glass (MMG) substrates in Gen 8 display manufacturing fabs. With its capability to support multiple display sizes on a single substrate, MMG can improve the efficiency of manufacturing, reduce product costs and help diversify product line-ups.

LG Display recently ramped-up a new Gen 8 MMG factory in Guangzhou, China. This represents the company’s second Gen 8 facility after its factory in Paju, South Korea established in 2013. As a result of its extensive investments in cutting-edge display facilities with MMG, LG Display is expected to expand its lead in the AMOLED TV display market.

Other display suppliers are aiming to compete with LG Display’s advanced white OLED technology. These firms are offering alternative technologies that soon could also be leveraged for manufacturing AMOLED TV displays, including ink-jet printing, RGB OLED and quantum dot color-converting OLED.

AMOLED & Flexible Display Intelligence Service

The IHS Markit | Technology AMOLED & Flexible Display Intelligence Service presents the latest market trends and forecasts of the AMOLED display market, including sub-industries like shadow mask and polyimide substrate. The services also provides market intelligence on technology, capacity and panel suppliers’ business strategies by region.