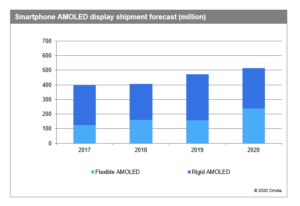

Despite a projected double-digit decline in smartphone shipments due to the coronavirus pandemic, the global market for active-matrix organic light-emitting diode (AMOLED) smartphone displays is expected to rise by 9 percent in 2020, according to Omdia.

Shipments of AMOLED panels used in smartphones are set to soar to 513 million units this year, up from 471 million in 2019, as reported by the Omdia OLED Display Market Tracker. In contrast, worldwide smartphone shipments are expected to plunge by 13 percent in 2020 as the coronavirus impacts both consumer demand and supply-chain availability. This indicates that the penetration of AMOLED panels is rising sharply this year.

“Smartphone brands across the world increasingly are migrating their product lines to AMOLED display technology—even amidst the catastrophic market conditions spurred by the coronavirus pandemic,” said Brian Huh, principal analyst, small/medium displays, for Omdia. “Apple is expected to expand its AMOLED iPhone line-up to three models in 2020, up from two in 2019. Meanwhile, Chinese smartphone OEMs are expected to increase the number of high-end smartphones integrating AMOLED panels this year.”

This growth is entirely driven by demand for flexible AMOLEDs, whose shipments are expected to increase by 50 percent in 2020. Demand for foldable smartphones is helping fuel sales growth for flexible AMOLEDs.

In contrast, the rigid AMOLED market is forecast to decline by 12 percent in 2020 due to the coronavirus pandemic and the fierce competition with the alternative display technology: low-temperature polysilicon (LTPS) TFT LCD.

Strong growth in 2019

In 2019, AMOLED panel shipments for smartphones increased to 471 million units, up 16 percent from 2018. As a result, the AMOLED penetration rate for the total smartphone display market rose 4 percentage points to reach 30 percent last year.

Shipments of rigid AMOLED panels increased to 313 million, up 26 percent from 2018. A shipment increase among Chinese smartphone OEMs was a major driver of the rise in shipments.

However, shipments of flexible AMOLED panels slightly decreased last year, declining to 158 million units, down 1 percent from 2018. Demand for Apple and Samsung smartphones using flexible AMOLED displays fell short of expectations last year. Furthermore, Chinese smartphone OEMS did not expand their AMOLED smartphone lineups during the year.

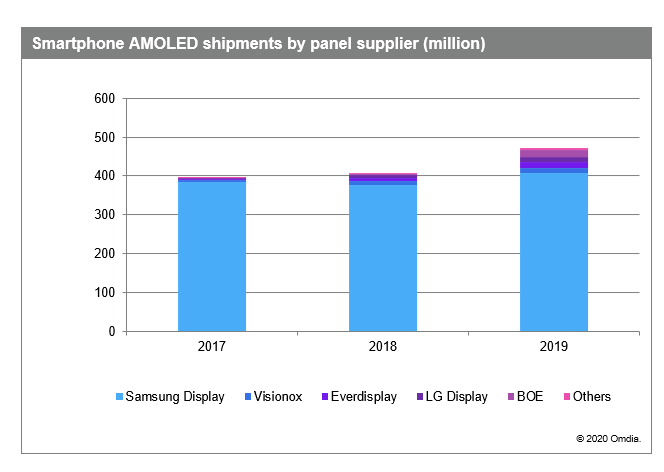

Samsung Display leads the AMOLED race

In terms of panel suppliers, Samsung Display shipped 407 million smartphone AMOLED panels in 2019, up 8 percent from 2018. This gave the company a dominant position in the market, with an 86 percent share of unit shipments for the year.

However, Samsung Display’s shipment share of total AMOLED panel shipment continued to decline. In parallel, other panel makers such as BOE, Everdisplay and Visionox increased their panel shipments. Excluding Samsung Display, total panel shipments increased by 113 percent to reach 64 million units in 2019.

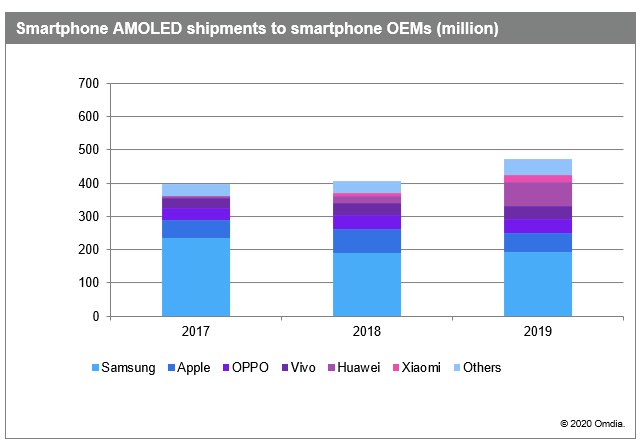

Samsung buys up AMOLEDs, while Apple’s purchasing falls in 2019

In terms of AMOLED panel shipments to smartphone OEMs, shipments to Samsung increased by 3 percent to reach 194 million units in 2019 thanks to an increase in rigid AMOLED shipments. However, panel shipments to Apple decreased by 24 percent to 56 million units.

At the same time, panel shipments to Chinese OEMs increased dramatically. Panel shipments to Huawei and Xiaomi increased by 287 percent and 120 percent respectively to reach 73 million and 20 million units. Both companies in 2019 increased their adoption of AMOLEDs in place of TFT-LCDs in their mid- to high-end smartphone line-ups.